Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required Prepare the statement of cash flow for the year ended 31 December 2019 in accordance with the IFRS and the requirements of the

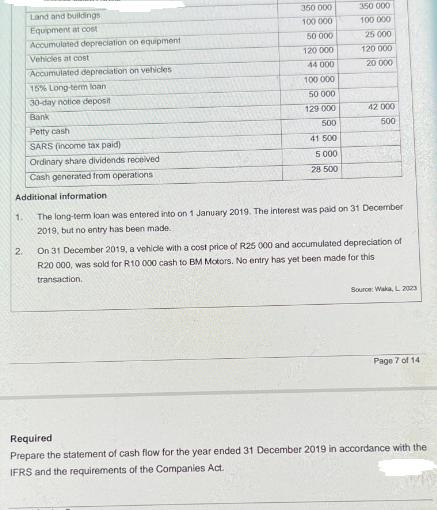

Required Prepare the statement of cash flow for the year ended 31 December 2019 in accordance with the IFRS and the requirements of the Companies Act. 1. Land and buildings Equipment at cost Accumulated depreciation on equipment 2. Vehicles at cost Accumulated depreciation on vehicles 15% Long-term loan 30-day notice deposit Bank Petty cash SARS (income tax paid) Ordinary share dividends received Cash generated from operations 350 000 100 000 50 000 120 000 44 000 100 000 50 000 129 000 500 41 500 5.000 28 500 350 000 100 000 25 000 120 000 20 000 Additional information The long-term loan was entered into on 1 January 2019. The interest was paid on 31 December 2019, but no entry has been made. 42 000 500 On 31 December 2019, a vehicle with a cost price of R25 000 and accumulated depreciation of R20 000, was sold for R10 000 cash to BM Motors. No entry has yet been made for this. transaction. Source: Waka, L 2023 Page 7 of 14 Required Prepare the statement of cash flow for the year ended 31 December 2019 in accordance with the IFRS and the requirements of the Companies Act.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows For the year ended 31 December 2019 Cash flows from operating activities Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started