Answered step by step

Verified Expert Solution

Question

1 Approved Answer

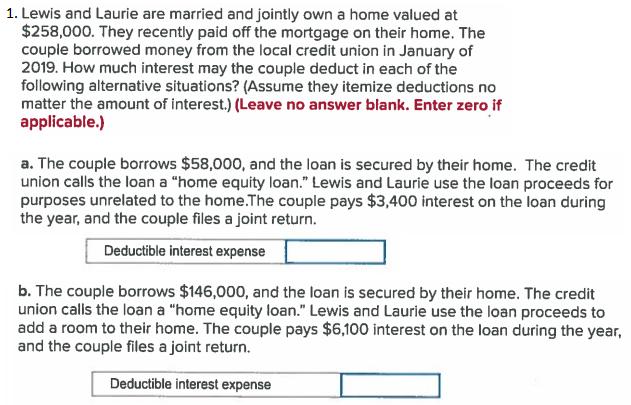

1. Lewis and Laurie are married and jointly own a home valued at $258,000. They recently paid off the mortgage on their home. The

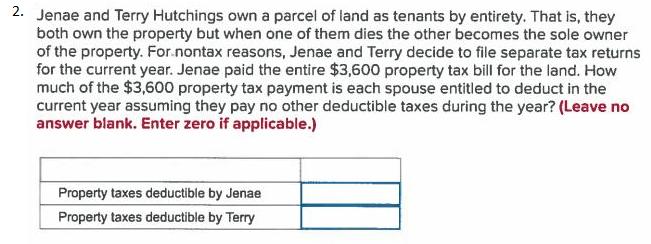

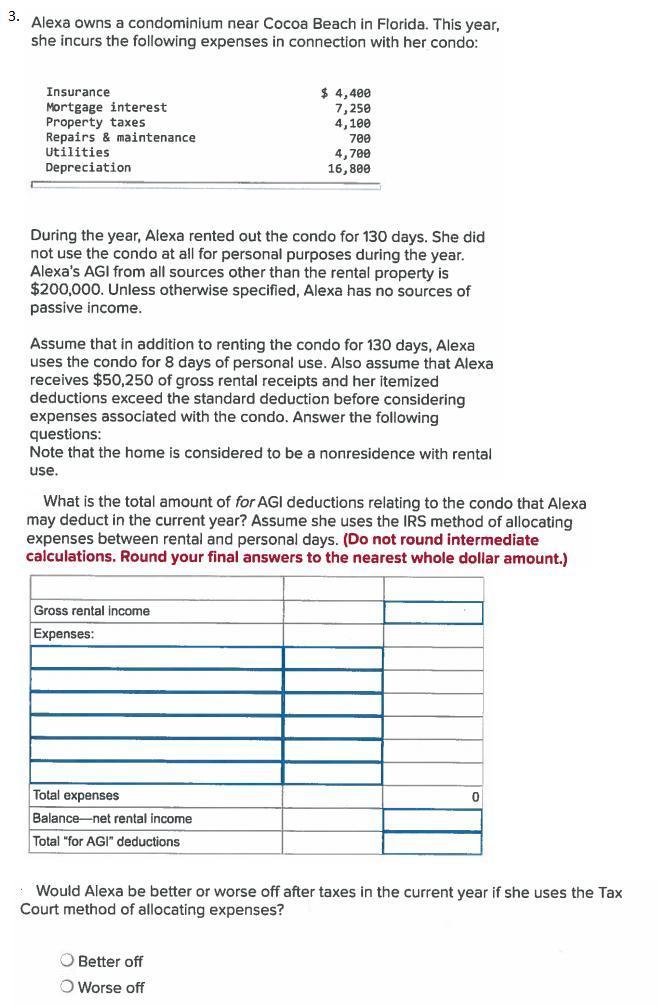

1. Lewis and Laurie are married and jointly own a home valued at $258,000. They recently paid off the mortgage on their home. The couple borrowed money from the local credit union in January of 2019. How much interest may the couple deduct in each of the following alternative situations? (Assume they itemize deductions no matter the amount of interest.) (Leave no answer blank. Enter zero if applicable.) a. The couple borrows $58,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds for purposes unrelated to the home.The couple pays $3,400 interest on the loan during the year, and the couple files a joint return. Deductible interest expense b. The couple borrows $146,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds to add a room to their home. The couple pays $6,100 interest on the loan during the year, and the couple files a joint return. Deductible interest expense 2. Jenae and Terry Hutchings own a parcel of land as tenants by entirety. That is, they both own the property but when one of them dies the other becomes the sole owner of the property. For.nontax reasons, Jenae and Terry decide to file separate tax returns for the current year. Jenae paid the entire $3,600 property tax bill for the land. How much of the $3,600 property tax payment is each spouse entitled to deduct in the current year assuming they pay no other deductible taxes during the year? (Leave no answer blank. Enter zero if applicable.) Property taxes deductible by Jenae Property taxes deductible by Terry 3. Alexa owns a condominium near Cocoa Beach in Florida. This year, she incurs the following expenses in connection with her condo: Insurance Mortgage interest Property taxes Repairs & maintenance Utilities $ 4,400 7,250 4,100 700 4,700 16,800 Depreciation During the year, Alexa rented out the condo for 130 days. She did not use the condo at all for personal purposes during the year. Alexa's AGI from all sources other than the rental property is $200,000. Unless otherwise specified, Alexa has no sources of passive income. Assume that in addition to renting the condo for 130 days, Alexa uses the condo for 8 days of personal use. Also assume that Alexa receives $50,250 of gross rental receipts and her itemized deductions exceed the standard deduction before considering expenses associated with the condo. Answer the following questions: Note that the home is considered to be a nonresidence with rental use. What is the total amount of for AGI deductions relating to the condo that Alexa may deduct in the current year? Assume she uses the IRS method of allocating expenses between rental and personal days. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Gross rental income Expenses: Total expenses Balance-net rental income Total "for AGI" deductions Would Alexa be better or worse off after taxes in the current year if she uses the Tax Court method of allocating expenses? O Btter off O Worse off

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 a 0 Beginning in 2018 the interest on home equity debt is no longer deductible unless it was used ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

605b2f997477c_72569.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started