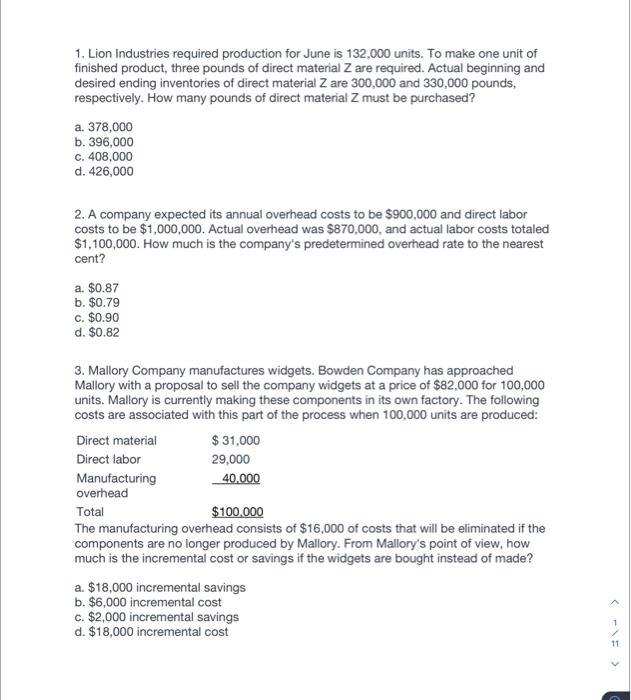

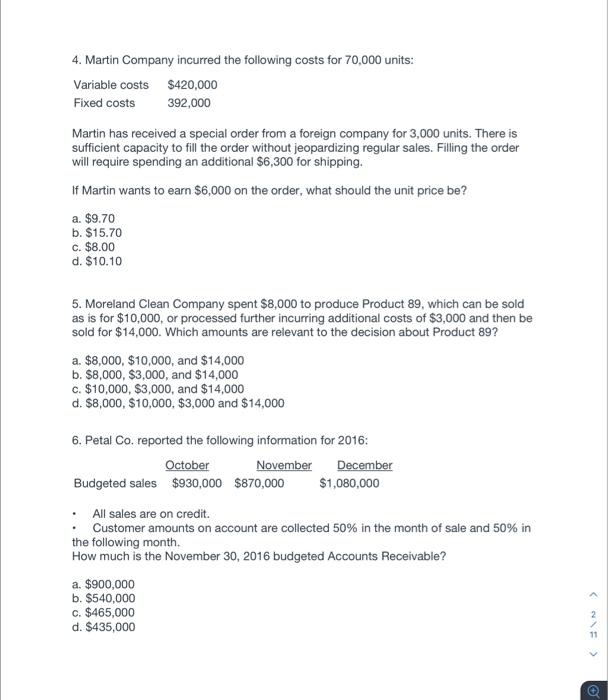

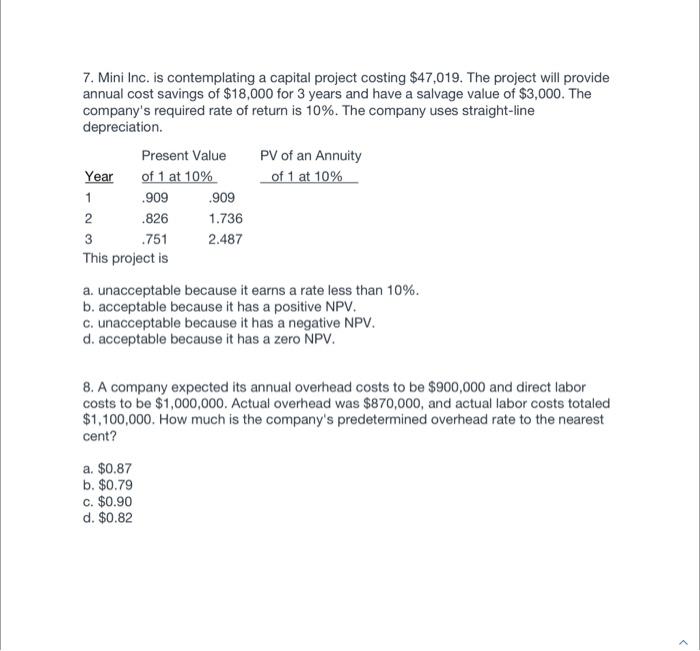

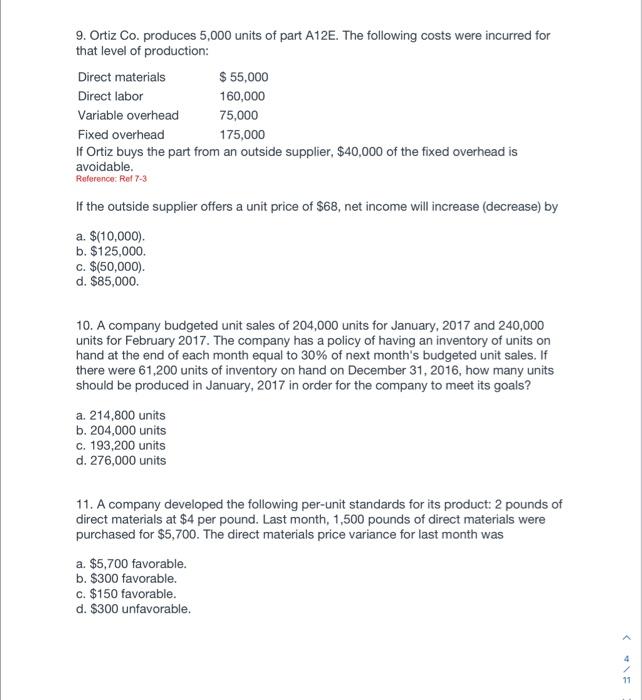

1. Lion Industries required production for June is 132,000 units. To make one unit of finished product, three pounds of direct material Z are required. Actual beginning and desired ending inventories of direct material Z are 300,000 and 330,000 pounds, respectively. How many pounds of direct material Z must be purchased? a. 378,000 b. 396,000 c. 408,000 d. 426,000 2. A company expected its annual overhead costs to be $900,000 and direct labor costs to be $1,000,000. Actual overhead was $870,000, and actual labor costs totaled $1,100,000. How much is the company's predetermined overhead rate to the nearest cent? a. $0.87 b. $0.79 c. $0.90 d. $0.82 3. Mallory Company manufactures widgets. Bowden Company has approached Mallory with a proposal to sell the company widgets at a price of $82,000 for 100,000 units. Mallory is currently making these components in its own factory. The following costs are associated with this part of the process when 100,000 units are produced: The manufacturing overhead consists of $16,000 of costs that will be eliminated if the components are no longer produced by Mallory. From Mallory's point of view, how much is the incremental cost or savings if the widgets are bought instead of made? a. $18,000 incremental savings b. $6,000 incremental cost c. $2,000 incremental savings d. $18,000 incremental cost 4. Martin Company incurred the following costs for 70,000 units: Martin has received a special order from a foreign company for 3,000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $6,300 for shipping. If Martin wants to earn $6,000 on the order, what should the unit price be? a. $9.70 b. $15.70 c. $8.00 d. $10.10 5. Moreland Clean Company spent $8,000 to produce Product 89 , which can be sold as is for $10,000, or processed further incurring additional costs of $3,000 and then be sold for $14,000. Which amounts are relevant to the decision about Product 89 ? a. $8,000,$10,000, and $14,000 b. $8,000,$3,000, and $14,000 c. $10,000,$3,000, and $14,000 d. $8,000,$10,000,$3,000 and $14,000 6. Petal Co. reported the following information for 2016 : - All sales are on credit. - Customer amounts on account are collected 50% in the month of sale and 50% in the following month. How much is the November 30,2016 budgeted Accounts Receivable? a. $900,000 b. $540,000 c. $465,000 d. $435,000 7. Mini Inc. is contemplating a capital project costing $47,019. The project will provide annual cost savings of $18,000 for 3 years and have a salvage value of $3,000. The company's required rate of return is 10%. The company uses straight-line depreciation. a. unacceptable because it earns a rate less than 10%. b. acceptable because it has a positive NPV. c. unacceptable because it has a negative NPV. d. acceptable because it has a zero NPV. 8. A company expected its annual overhead costs to be $900,000 and direct labor costs to be $1,000,000. Actual overhead was $870,000, and actual labor costs totaled $1,100,000. How much is the company's predetermined overhead rate to the nearest cent? a. $0.87 b. $0.79 c. $0.90 d. $0.82 9. Ortiz Co. produces 5,000 units of part A12E. The following costs were incurred for that level of production: If Ortiz buys the part from an outside supplier, $40,000 of the fixed overhead is avoidable. Relerence: Ret 73 If the outside supplier offers a unit price of $68, net income will increase (decrease) by a. $(10,000) b. $125,000. c. $(50,000). d. $85,000. 10. A company budgeted unit sales of 204,000 units for January, 2017 and 240,000 units for February 2017. The company has a policy of having an inventory of units on hand at the end of each month equal to 30% of next month's budgeted unit sales. If there were 61,200 units of inventory on hand on December 31,2016 , how many units should be produced in January, 2017 in order for the company to meet its goals? a. 214,800 units b. 204,000 units c. 193,200 units d. 276,000 units 11. A company developed the following per-unit standards for its product: 2 pounds of direct materials at $4 per pound. Last month, 1,500 pounds of direct materials were purchased for $5,700. The direct materials price variance for last month was a. $5,700 favorable. b. $300 favorable. c. $150 favorable. d. $300 unfavorable