Question

1. Liquidity ratios and OFN management a) Compute the three liquidity ratios for the years 2022 and 2021. Interpret your results. b) Compute the OFN

1. Liquidity ratios and OFN management

a) Compute the three liquidity ratios for the years 2022 and 2021. Interpret your results.

b) Compute the OFN for each year and explain how its increase from one year to another was financed.

c) Relate your two previous answers with the financing of the operational cycle and cash cycle.

2. Activity/Efficiency ratios and operational and cash cycle

a) Calculate the necessary ratios to obtain the operational and cash cycle for each year. Interpret your results.

b) How efficient was the management of assets in both years? Explain.

3. Calculate the long-term solvency ratios to evaluate the leverage degree of the company, and its capacity to meet its financial liabilities.

4. Evaluate how the stockholder's return changed from one year to another. Additionally, use the DuPont approach to answer the following questions:

a) Did the level in leverage influence the change in ROE?

b) How efficient was the management of assets?

c) Was there an improvement in the profitability of the business?

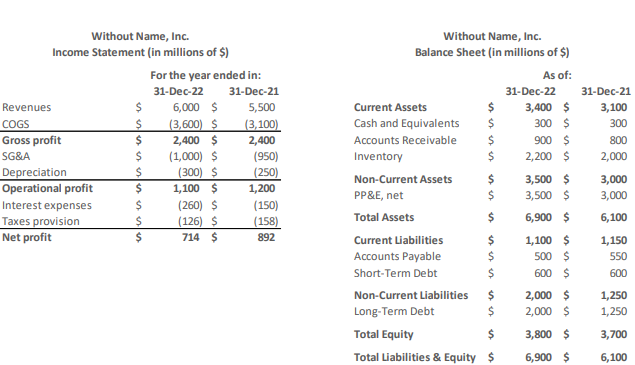

Without Name, Inc. Income Statement (in millions of \$) Without Name, Inc. Balance Sheet (in millions of \$)

Without Name, Inc. Income Statement (in millions of \$) Without Name, Inc. Balance Sheet (in millions of \$) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started