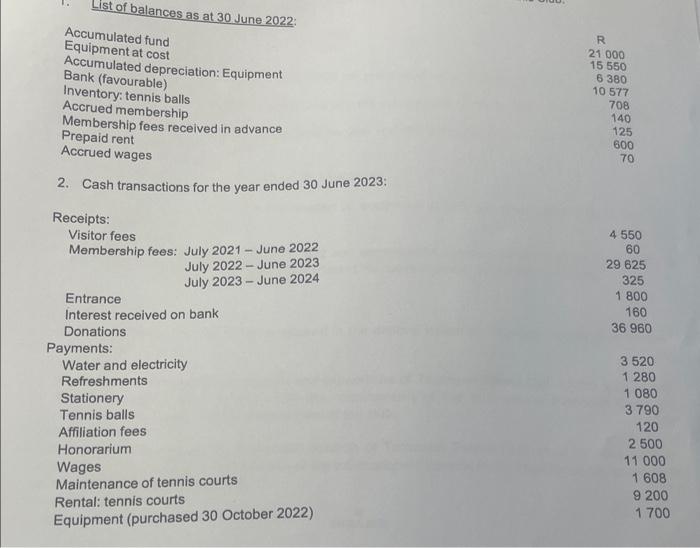

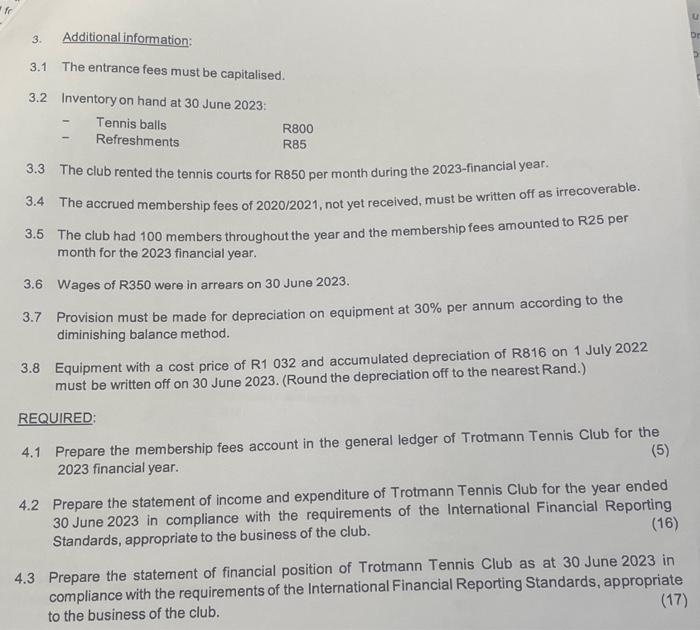

1. List of balances as at 30 June 2022: Accumulated fund Equipment at cost Accumulated depreciation: Equipment Bank (favourable) Inventory: tennis balls Accrued membership Membership fees received in advance Prepaid rent Accrued wages R R 21000 15550 6380 10577 708 140 125 600 70 2. Cash transactions for the year ended 30 June 2023: Receipts: Visitor fees Membership fees: July 2021 - June 2022 July 2022 - June 2023 July 2023 - June 2024 Entrance Interest received on bank Donations Payments: Water and electricity Refreshments Stationery Tennis balls Affiliation fees Honorarium Wages Maintenance of tennis courts Rental: tennis courts Equipment (purchased 30 October 2022) 4550 60 29625 325 1800 160 36960 3520 1280 1080 3790 120 2500 11000 1608 9200 1700 3.1 The entrance fees must be capitalised. 3.2 Inventory on hand at 30 June 2023 : - Tennis balls - Refreshments R800 R85 3.3 The club rented the tennis courts for R850 per month during the 2023 -financial year. 3.4 The accrued membership fees of 2020/2021, not yet received, must be written off as irrecoverable. 3.5 The club had 100 members throughout the year and the membership fees amounted to R25 per month for the 2023 financial year. 3.6 Wages of R350 were in arrears on 30 June 2023. 3.7 Provision must be made for depreciation on equipment at 30% per annum according to the diminishing balance method. 3.8 Equipment with a cost price of R1 032 and accumulated depreciation of R816 on 1 July 2022 must be written off on 30 June 2023. (Round the depreciation off to the nearest Rand.) REQUIRED: 4.1 Prepare the membership fees account in the general ledger of Trotmann Tennis Club for the (5) 2023 financial year. 4.2 Prepare the statement of income and expenditure of Trotmann Tennis Club for the year ended 30 June 2023 in compliance with the requirements of the International Financial Reporting Standards, appropriate to the business of the club. (16) 4.3 Prepare the statement of financial position of Trotmann Tennis Club as at 30 June 2023 in compliance with the requirements of the International Financial Reporting Standards, appropriate to the business of the club. (17) 1. List of balances as at 30 June 2022: Accumulated fund Equipment at cost Accumulated depreciation: Equipment Bank (favourable) Inventory: tennis balls Accrued membership Membership fees received in advance Prepaid rent Accrued wages R R 21000 15550 6380 10577 708 140 125 600 70 2. Cash transactions for the year ended 30 June 2023: Receipts: Visitor fees Membership fees: July 2021 - June 2022 July 2022 - June 2023 July 2023 - June 2024 Entrance Interest received on bank Donations Payments: Water and electricity Refreshments Stationery Tennis balls Affiliation fees Honorarium Wages Maintenance of tennis courts Rental: tennis courts Equipment (purchased 30 October 2022) 4550 60 29625 325 1800 160 36960 3520 1280 1080 3790 120 2500 11000 1608 9200 1700 3.1 The entrance fees must be capitalised. 3.2 Inventory on hand at 30 June 2023 : - Tennis balls - Refreshments R800 R85 3.3 The club rented the tennis courts for R850 per month during the 2023 -financial year. 3.4 The accrued membership fees of 2020/2021, not yet received, must be written off as irrecoverable. 3.5 The club had 100 members throughout the year and the membership fees amounted to R25 per month for the 2023 financial year. 3.6 Wages of R350 were in arrears on 30 June 2023. 3.7 Provision must be made for depreciation on equipment at 30% per annum according to the diminishing balance method. 3.8 Equipment with a cost price of R1 032 and accumulated depreciation of R816 on 1 July 2022 must be written off on 30 June 2023. (Round the depreciation off to the nearest Rand.) REQUIRED: 4.1 Prepare the membership fees account in the general ledger of Trotmann Tennis Club for the (5) 2023 financial year. 4.2 Prepare the statement of income and expenditure of Trotmann Tennis Club for the year ended 30 June 2023 in compliance with the requirements of the International Financial Reporting Standards, appropriate to the business of the club. (16) 4.3 Prepare the statement of financial position of Trotmann Tennis Club as at 30 June 2023 in compliance with the requirements of the International Financial Reporting Standards, appropriate to the business of the club. (17)