Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. List the advantages and disadvantages of over the counter market 2. List the three different trading styles that are normally used by option

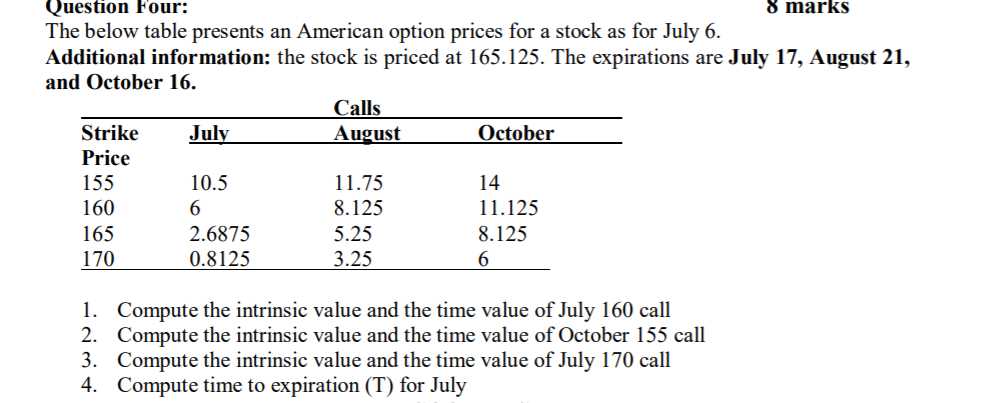

1. List the advantages and disadvantages of over the counter market 2. List the three different trading styles that are normally used by option traders 3. Differentiate between in the money call option and the in the money put option 4. Differentiate between out-of-money call option and out-of-money put option Question Four: 8 marks The below table presents an American option prices for a stock as for July 6. Additional information: the stock is priced at 165.125. The expirations are July 17, August 21, and October 16. Strike July Calls August October Price 155 10.5 11.75 14 160 6 8.125 11.125 165 2.6875 5.25 8.125 170 0.8125 3.25 6 1. Compute the intrinsic value and the time value of July 160 call 2. Compute the intrinsic value and the time value of October 155 call 3. Compute the intrinsic value and the time value of July 170 call 4. Compute time to expiration (T) for July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Advantages and Disadvantages of OverTheCounter OTC Market Advantages Flexibility OTC markets offer more flexibility in terms of contract terms pricing and negotiation compared to standardized exchan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started