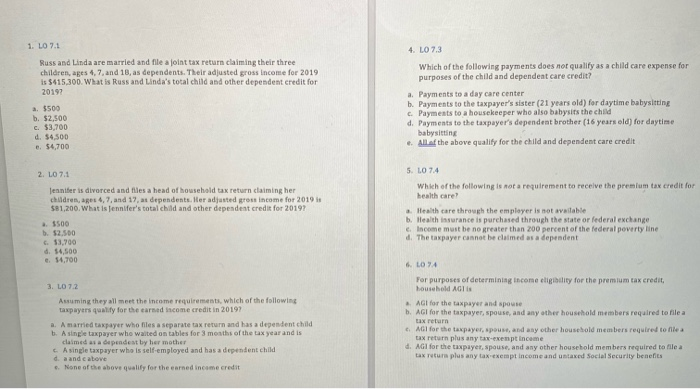

1. LO 7.1 4. LO 7.3 Russ and Linda are married and file a joint tax return claiming their three children, ages 4,7, and 18, as dependents. Their adjusted gross income for 2019 is $415300 What is Russ and Linda's total child and other dependent credit for 20197 Which of the following payments does not qualify as a child care expense for purposes of the child and dependent care credit? a. $500 b. $2,500 c. $3.700 d. 54,500 . 54,700 a. Payments to a day care center b. Payments to the taxpayer's sister (21 years old) for daytime babysitting c. Payments to a housekeeper who also babysits the child d. Payments to the taxpayer's dependent brother (16 years old) for daytime babysitting e. All of the above qualify for the child and dependent care credit 2. LO 7.1 5. LO 7.4 Which of the following is not a requirement to receive the premium tax credit for health care? Jennifer is divorced and files ahead of household tax return claiming her children ages 4,7, and 17, as dependents. Her adjusted gross income for 2019 $81,200. What is Jennifer's total child and other dependent credit for 20197 .. 1500 b. $2.500 $3.990 o $4.500 e. 54,700 .. Health care through the employer is not available b. Health insurance is purchased through the state or federal exchange & Income must be no greater than 200 percent of the federal poverty line d. The taxpayer cannot be claimed as a dependent 6. LO 74 For purposes of determining Income eligibility for the premium tax credit household AG 3. LO 7.2 Assuming they all meet the income requirements, which of the following taxpayers qualify for the credincome credit in 20197 a. A married taxpayer who files a separate tax return and has a dependent child b. A single taxpayer who waited on tables for 3 months of the tax year and is claimed as a dependent by her mother A single taxpayer who is self-employed and has a dependent child da and cateve . None of the above quality for the earned income credit AG for the taxpayer and spouse b. Al for the taxpayer, spouse, and any other household members required to file a tax return AGI for the taxpayer, spoust, and any other household members required to lea tax return plus any tax-exempt income d. Al for the taxpayer, spouse, and any other household members required to file a tax return plus any tax exempt income and untaxed Social Security benefits