Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. LO.5 Which of the following individuals are required to file a tax return for 2023 ? Should any of these individuals file a return

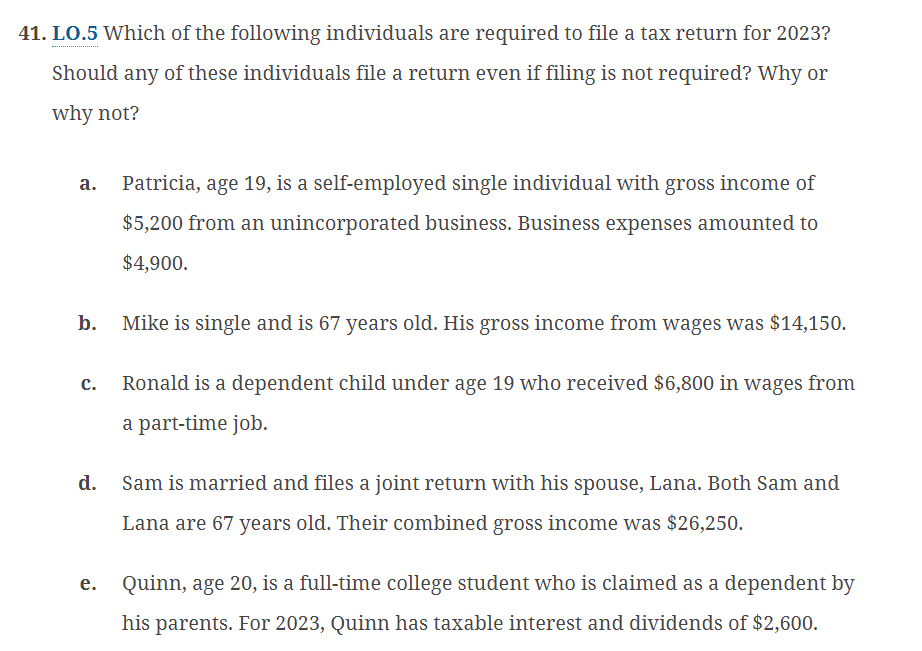

1. LO.5 Which of the following individuals are required to file a tax return for 2023 ? Should any of these individuals file a return even if filing is not required? Why or why not? a. Patricia, age 19, is a self-employed single individual with gross income of $5,200 from an unincorporated business. Business expenses amounted to $4,900. b. Mike is single and is 67 years old. His gross income from wages was $14,150. c. Ronald is a dependent child under age 19 who received $6,800 in wages from a part-time job. d. Sam is married and files a joint return with his spouse, Lana. Both Sam and Lana are 67 years old. Their combined gross income was $26,250. e. Quinn, age 20, is a full-time college student who is claimed as a dependent by his parents. For 2023, Quinn has taxable interest and dividends of $2,600

1. LO.5 Which of the following individuals are required to file a tax return for 2023 ? Should any of these individuals file a return even if filing is not required? Why or why not? a. Patricia, age 19, is a self-employed single individual with gross income of $5,200 from an unincorporated business. Business expenses amounted to $4,900. b. Mike is single and is 67 years old. His gross income from wages was $14,150. c. Ronald is a dependent child under age 19 who received $6,800 in wages from a part-time job. d. Sam is married and files a joint return with his spouse, Lana. Both Sam and Lana are 67 years old. Their combined gross income was $26,250. e. Quinn, age 20, is a full-time college student who is claimed as a dependent by his parents. For 2023, Quinn has taxable interest and dividends of $2,600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started