Answered step by step

Verified Expert Solution

Question

1 Approved Answer

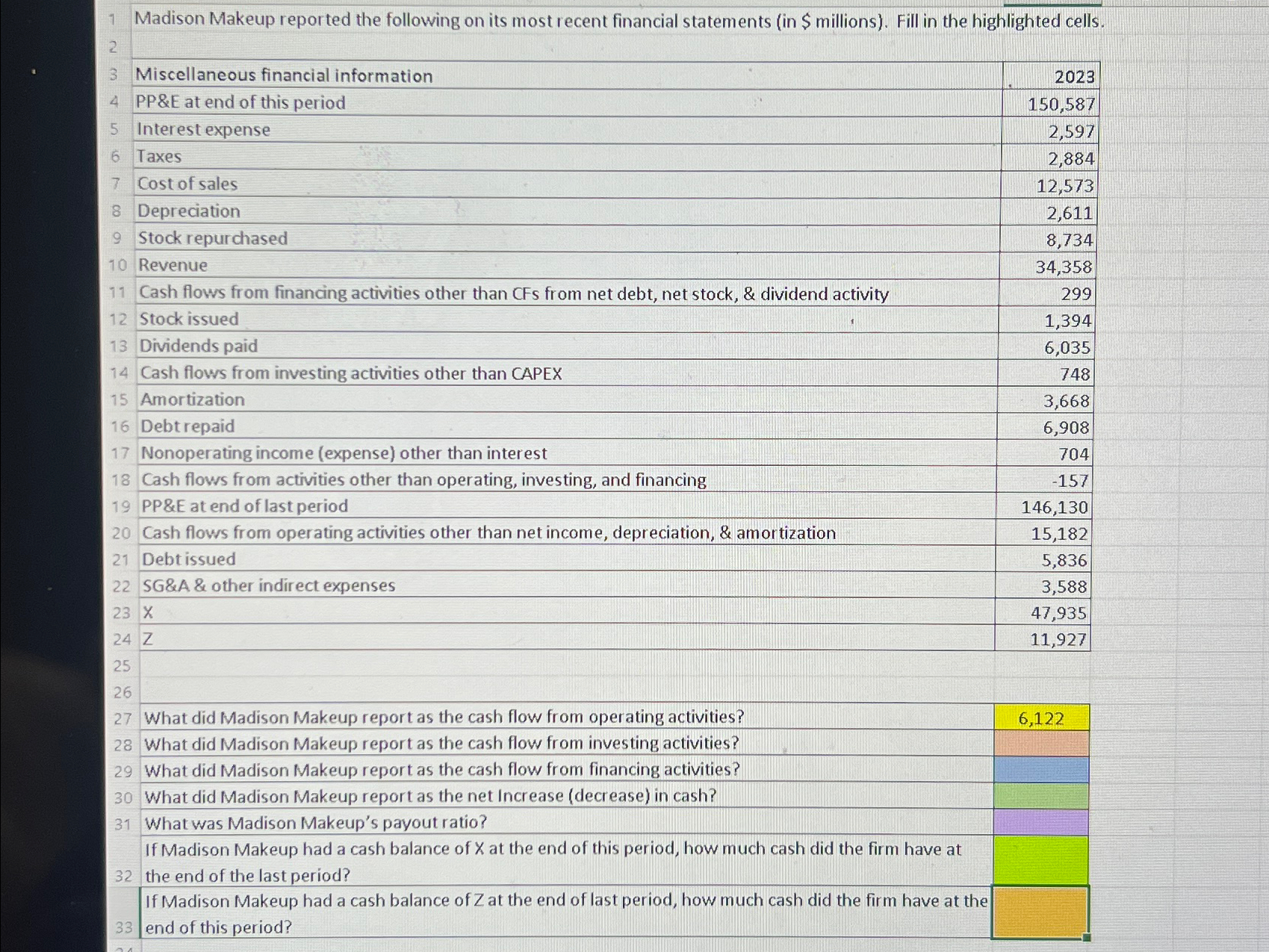

1 Madison Makeup reported the following on its most recent financial statements ( in $ millions ) . Fill in the highlighted cells. table

Madison Makeup reported the following on its most recent financial statements in $ millions Fill in the highlighted cells.

tableMiscellaneous financial information,PP&E at end of this period,Interest expense,TaxesCost of sales,DepreciationStock repurchased,RevenueCash flows from financing activities other than CFs from net debt, net stock, & dividend activity,Stock issued,Dividends paid,Cash flows from investing activities other than CAPEX,AmortizationDebt repaid,Nonoperating income expense other than interest,Cash flows fr om activities other than operating, investing, and financing,PP&E at end of last period,Cash flows from operating activities other than net income, depreciation, & amortization,Debt issued,SG&A & other indirect expenses,

tableWhat did Madison Makeup report as the cash flow from operating activities?,What did Madison Makeup report as the cash flow from investing activities?,What did Madison Makeup report as the cash flow from financing activities?,What did Madison Makeup report as the net Increase decrease in cash?,What was Madison Makeup's payout ratio?,tableIf Madison Makeup had a cash balance of at the end of this period, how much cash did the firm have atthe end of the last period?tableIf Madison Makeup had a cash balance of at the end of last period, how much cash did the firm have at theend of this period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started