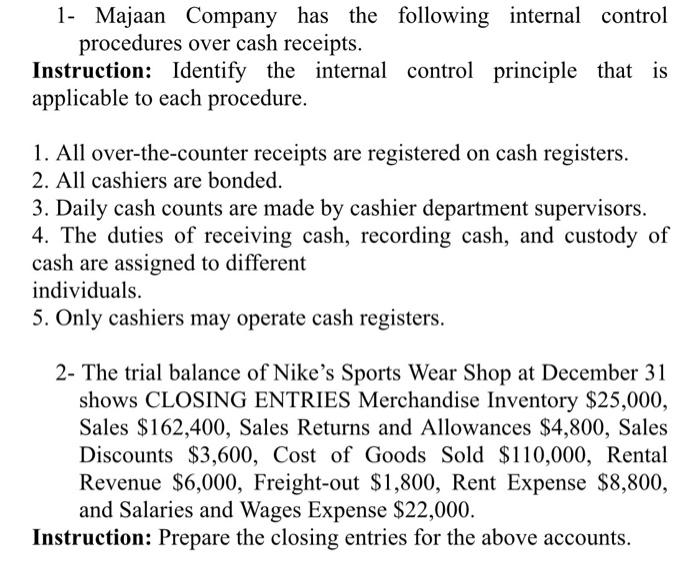

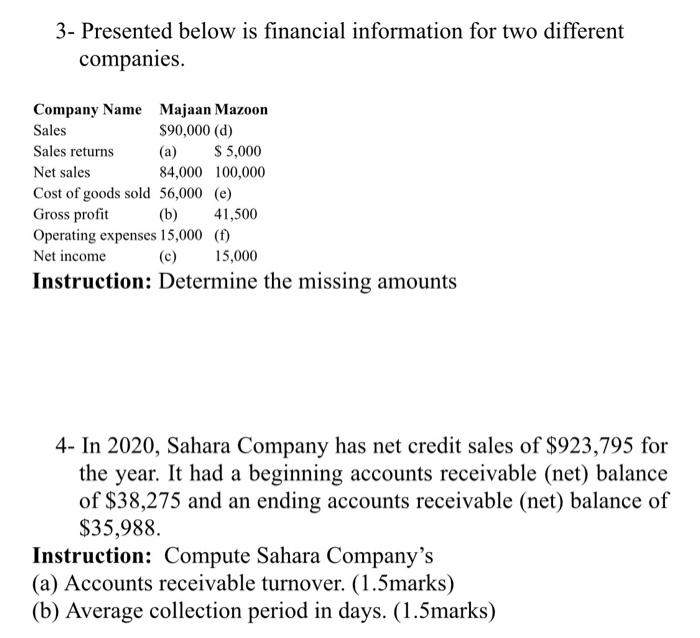

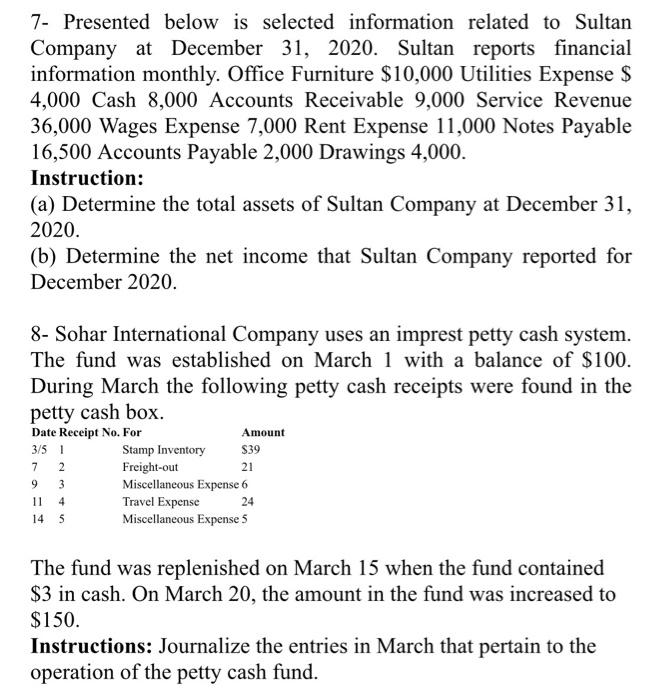

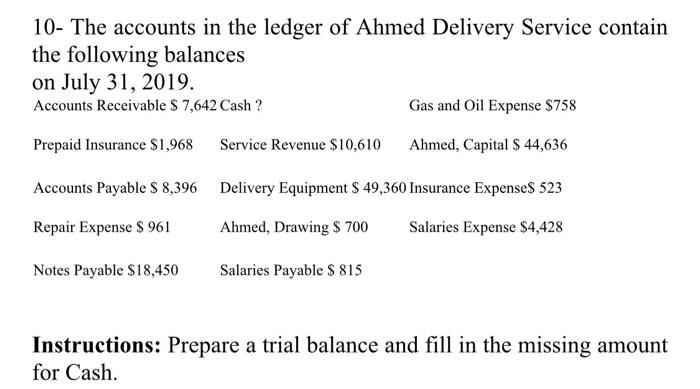

1- Majaan Company has the following internal control procedures over cash receipts. Instruction: Identify the internal control principle that is applicable to each procedure. 1. All over-the-counter receipts are registered on cash registers. 2. All cashiers are bonded. 3. Daily cash counts are made by cashier department supervisors. 4. The duties of receiving cash, recording cash, and custody of cash are assigned to different individuals. 5. Only cashiers may operate cash registers. 2- The trial balance of Nike's Sports Wear Shop at December 31 shows CLOSING ENTRIES Merchandise Inventory $25,000, Sales $162,400, Sales Returns and Allowances $4,800, Sales Discounts $3,600, Cost of Goods Sold $110,000, Rental Revenue $6,000, Freight-out $1,800, Rent Expense $8,800, and Salaries and Wages Expense $22,000. Instruction: Prepare the closing entries for the above accounts. 3- Presented below is financial information for two different companies. Company Name Majaan Mazoon Sales $90,000 (d) Sales returns (a) $ 5,000 Net sales 84,000 100,000 Cost of goods sold 56,000 (e) Gross profit (b) 41,500 Operating expenses 15,000 (f) Net income (c) 15,000 Instruction: Determine the missing amounts 4- In 2020, Sahara Company has net credit sales of $923,795 for the year. It had a beginning accounts receivable (net) balance of $38,275 and an ending accounts receivable (net) balance of $35,988. Instruction: Compute Sahara Company's (a) Accounts receivable turnover. (1.5marks) (b) Average collection period in days. (1.5marks) 7- Presented below is selected information related to Sultan Company at December 31, 2020. Sultan reports financial information monthly. Office Furniture $10,000 Utilities Expense $ 4,000 Cash 8,000 Accounts Receivable 9,000 Service Revenue 36,000 Wages Expense 7,000 Rent Expense 11,000 Notes Payable 16,500 Accounts Payable 2,000 Drawings 4,000. Instruction: (a) Determine the total assets of Sultan Company at December 31, 2020. (b) Determine the net income that Sultan Company reported for December 2020. 8- Sohar International Company uses an imprest petty cash system. The fund was established on March 1 with a balance of $100. During March the following petty cash receipts were found in the petty cash box. Date Receipt No. For Amount Stamp Inventory Freight-out 21 Miscellaneous Expense 6 Travel Expense 24 Miscellaneous Expenses S39 3/5 1 7 2 9 3 11 4 14 5 The fund was replenished on March 15 when the fund contained $3 in cash. On March 20, the amount in the fund was increased to $150. Instructions: Journalize the entries in March that pertain to the operation of the petty cash fund. 10- The accounts in the ledger of Ahmed Delivery Service contain the following balances on July 31, 2019. Accounts Receivable $ 7,642 Cash ? Gas and Oil Expense $758 Prepaid Insurance $1,968 Service Revenue $10,610 Ahmed, Capital $ 44,636 Accounts Payable $ 8,396 Delivery Equipment $ 49,360 Insurance Expenses 523 Repair Expense $ 961 Ahmed, Drawing $ 700 Salaries Expense $4,428 Notes Payable $18,450 Salaries Payable $ 815 Instructions: Prepare a trial balance and fill in the missing amount for Cash