Question: 1. make sure the answer is in 2 decimals. Read question carefully 2. Make sure the final answer is in 2 decimals. Please read the

1. make sure the answer is in 2 decimals. Read question carefully

2. Make sure the final answer is in 2 decimals. Please read the question carefully

3.

3.

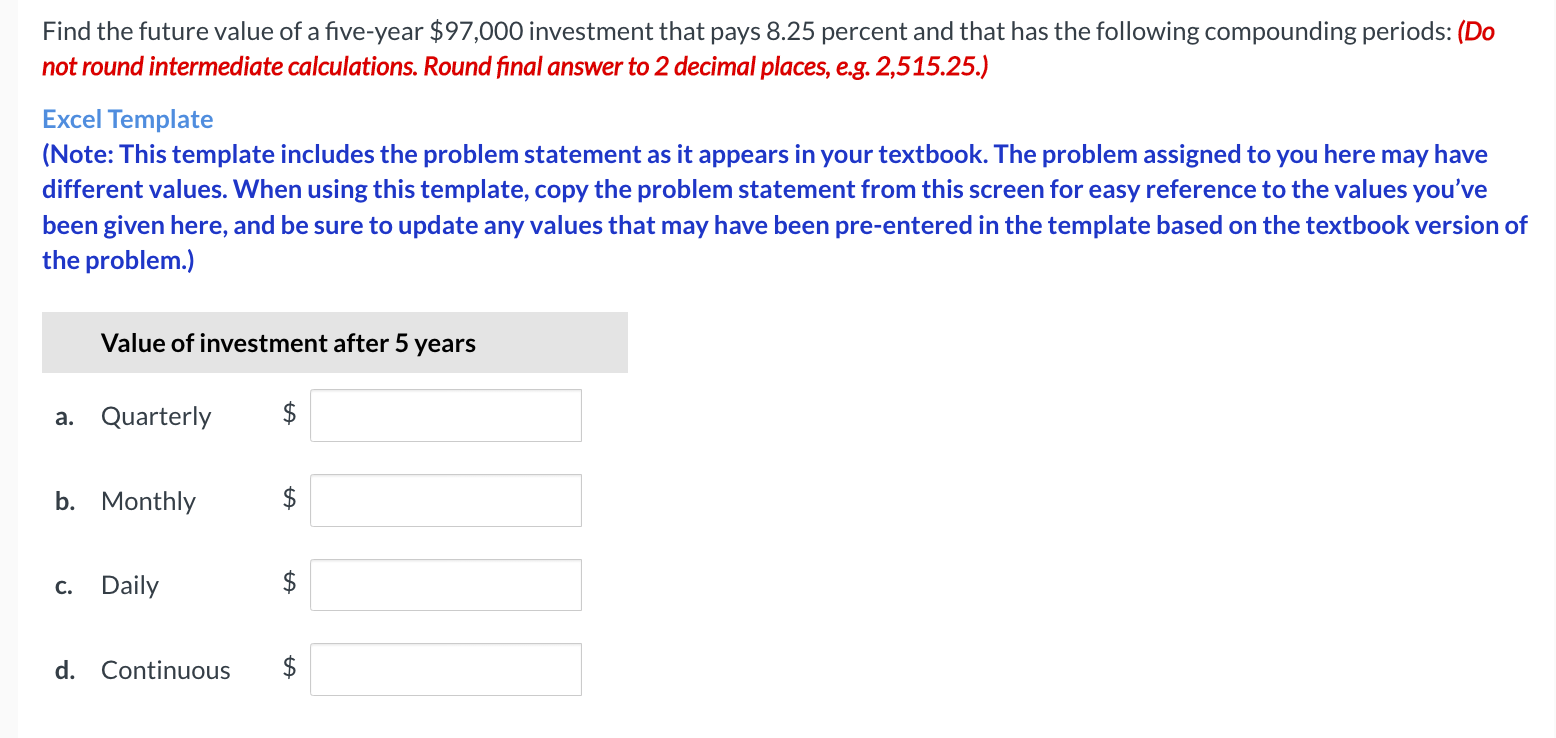

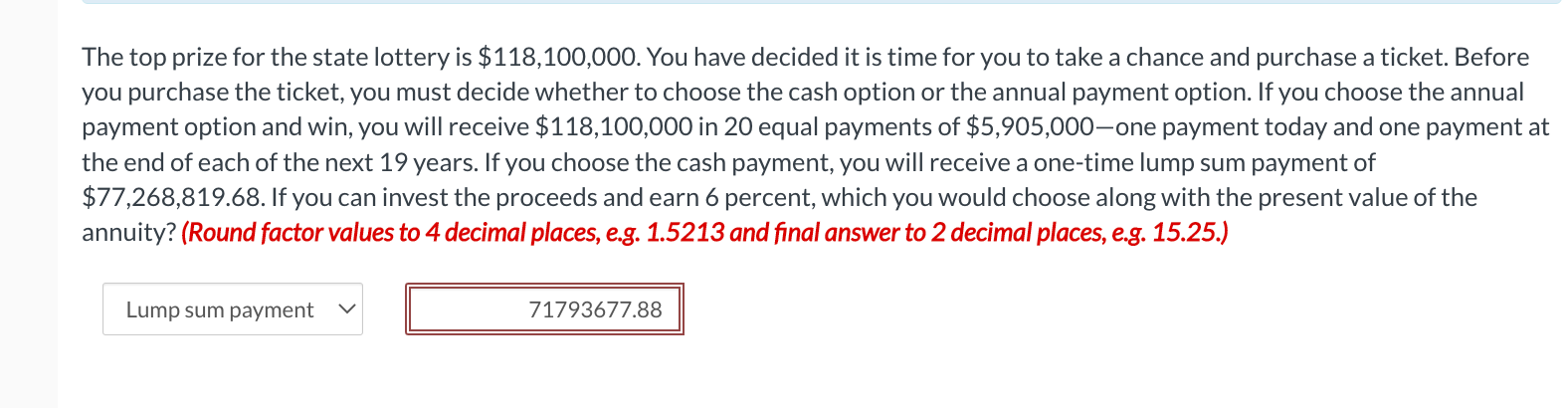

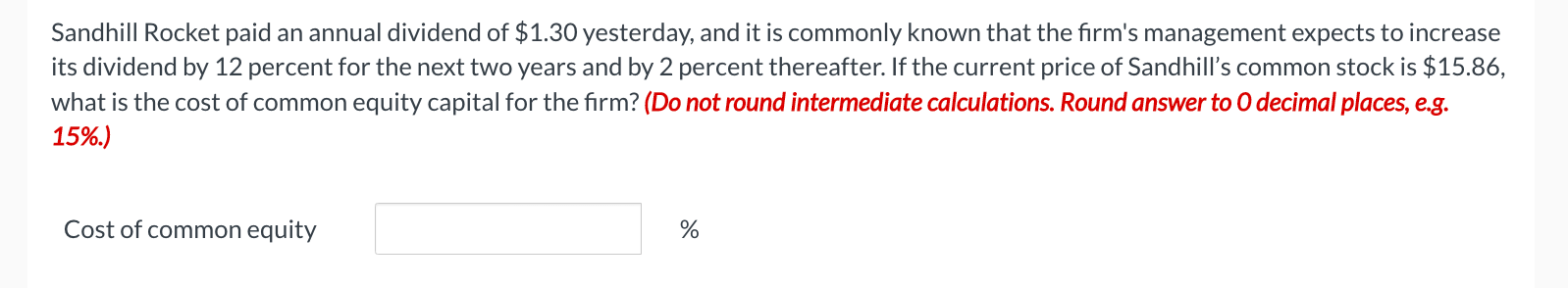

Find the future value of a five-year $97,000 investment that pays 8.25 percent and that has the following compounding periods: (Do not round intermediate calculations. Round final answer to 2 decimal places, e.g. 2,515.25.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version c the problem.) The top prize for the state lottery is $118,100,000. You have decided it is time for you to take a chance and purchase a ticket. Before you purchase the ticket, you must decide whether to choose the cash option or the annual payment option. If you choose the annual payment option and win, you will receive $118,100,000 in 20 equal payments of $5,905,000-one payment today and one payment at the end of each of the next 19 years. If you choose the cash payment, you will receive a one-time lump sum payment of $77,268,819.68. If you can invest the proceeds and earn 6 percent, which you would choose along with the present value of the annuity? (Round factor values to 4 decimal places, e.g. 1.5213 and final answer to 2 decimal places, e.g. 15.25.) Sandhill Rocket paid an annual dividend of $1.30 yesterday, and it is commonly known that the firm's management expects to increase its dividend by 12 percent for the next two years and by 2 percent thereafter. If the current price of Sandhill's common stock is $15.86, what is the cost of common equity capital for the firm? (Do not round intermediate calculations. Round answer to 0 decimal places, e.g. 15\%.) Cost of common equity %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts