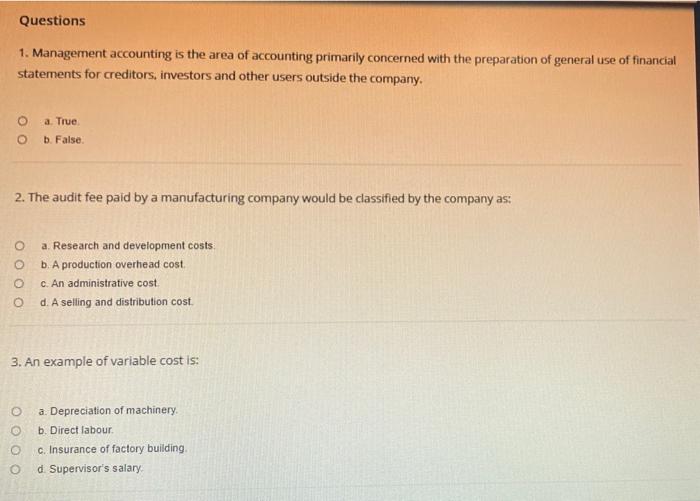

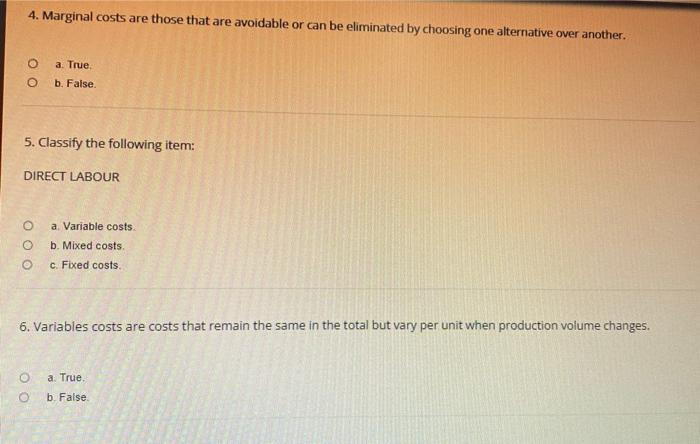

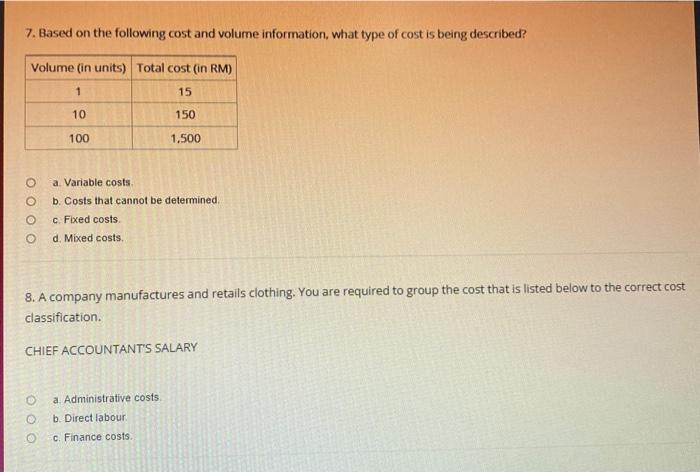

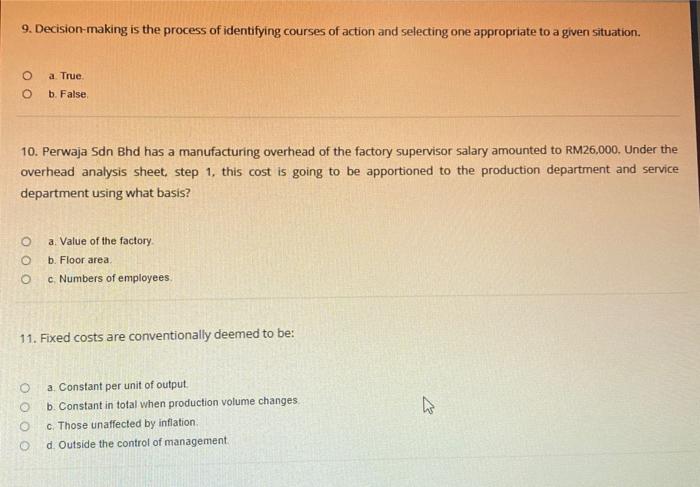

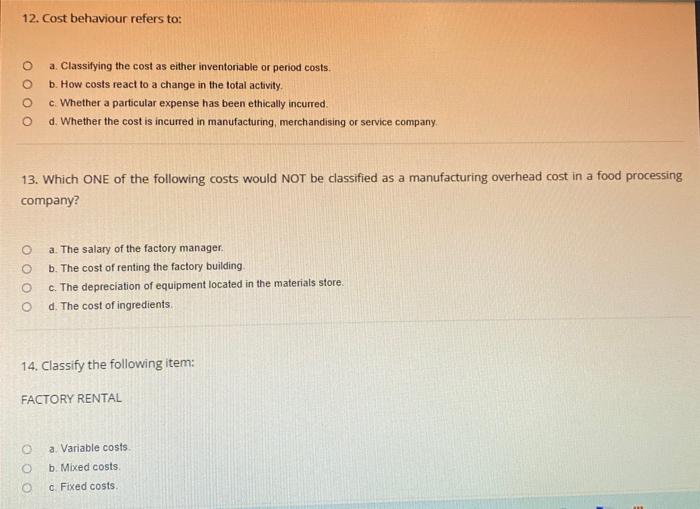

1. Management accounting is the area of accounting primarily concerned with the preparation of general use of financial statements for creditors, investors and other users outside the company. a. True. b. False. 2. The audit fee paid by a manufacturing company would be classified by the company as: a. Research and development costs b. A production overhead cost c. An administrative cost d. A selling and distribution cost. 3. An example of variable cost is: a. Depreciation of machinery. b. Direct labour. c. Insurance of factory building. d. Supervisor's salary. 4. Marginal costs are those that are avoidable or can be eliminated by choosing one alternative over another. a. True, b. Faise. 5. Classify the following item: DIRECT LABOUR a. Variable costs. b. Mixed costs. c. Fixed costs. 6. Variables costs are costs that remain the same in the total but vary per unit when production volume changes. a. True. b. Faise. 7. Based on the following cost and volume information, what type of cost is being described? a. Variable costs. b. Costs that cannot be determined. c. Fixed costs. d. Mixed costs. 8. A company manufactures and retails clothing. You are required to group the cost that is listed below to the correct cost classification. CHIEF ACCOUNTANT'S SALARY a. Administrative costs b. Direct labour. c. Finance costs. 9. Decision-making is the process of identifying courses of action and selecting one appropriate to a given situation. a. True. b. False. 10. Perwaja Sdn Bhd has a manufacturing overhead of the factory supervisor salary amounted to RM26,000, Under the overhead analysis sheet, step 1, this cost is going to be apportioned to the production department and service department using what basis? a. Value of the factory. b. Floor area. c. Numbers of employees. 11. Fixed costs are conventionally deemed to be: a. Constant per unit of output. b. Constant in total when production volume changes c. Those unaffected by inflation. d. Outside the control of management. 12. Cost behaviour refers to: a. Classifying the cost as either inventoriable or period costs. b. How costs react to a change in the total activity. c. Whether a particular expense has been ethically incurred. d. Whether the cost is incurred in manufacturing, merchandising or service company. 13. Which ONE of the following costs would NOT be classified as a manufacturing overhead cost in a food processing company? a. The salary of the factory manager. b. The cost of renting the factory building c. The depreciation of equipment located in the materials store. d. The cost of ingredients. 14. Classify the following item: FACTORY RENTAL a. Variable costs. b. Mixed costs. c. Fixed costs. 15. Production costs are costs incurred in the factory or plant and typically consist of prime costs, manufacturing overhead and period expenses. a. True. b. False