Answered step by step

Verified Expert Solution

Question

1 Approved Answer

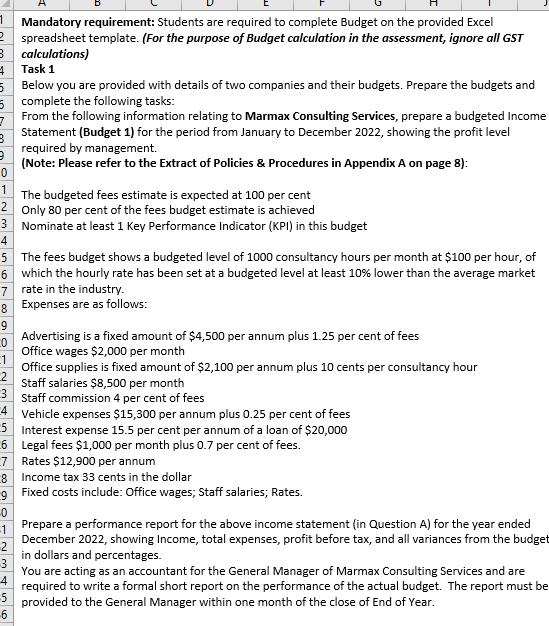

1 Mandatory requirement: Students are required to complete Budget on the provided Excel 2 3 4 5 5 B spreadsheet template. (For the purpose

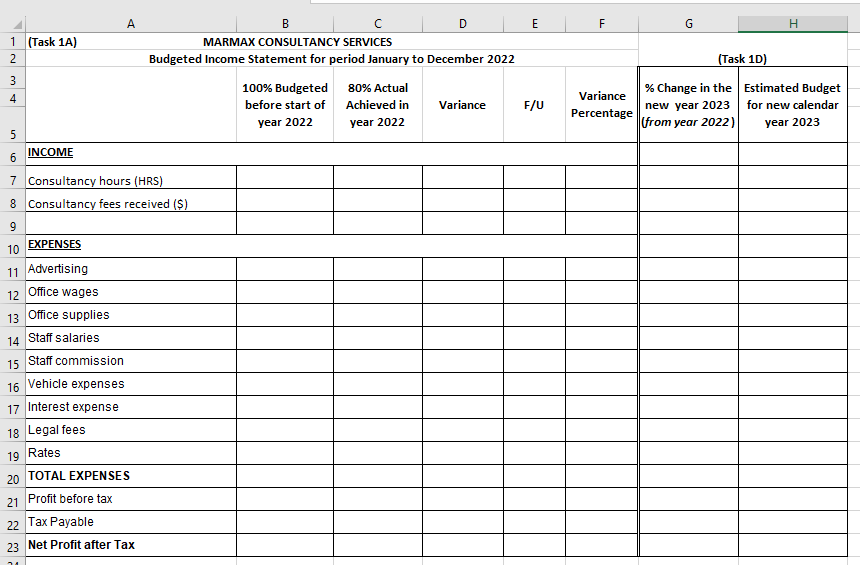

1 Mandatory requirement: Students are required to complete Budget on the provided Excel 2 3 4 5 5 B spreadsheet template. (For the purpose of Budget calculation in the assessment, ignore all GST calculations) Task 1 Below you are provided with details of two companies and their budgets. Prepare the budgets and complete the following tasks: From the following information relating to Marmax Consulting Services, prepare a budgeted Income Statement (Budget 1) for the period from January to December 2022, showing the profit level required by management. 0 9 (Note: Please refer to the Extract of Policies & Procedures in Appendix A on page 8): The budgeted fees estimate is expected at 100 per cent Only 80 per cent of the fees budget estimate is achieved 1 2 3 Nominate at least 1 Key Performance Indicator (KPI) in this budget 4 5 The fees budget shows a budgeted level of 1000 consultancy hours per month at $100 per hour, of 6 which the hourly rate has been set at a budgeted level at least 10% lower than the average market rate in the industry. 7 8 Expenses are as follows: Advertising is a fixed amount of $4,500 per annum plus 1.25 per cent of fees 9 10 Office wages $2,000 per month 1 2 Office supplies is fixed amount of $2,100 per annum plus 10 cents per consultancy hour Staff salaries $8,500 per month 3 Staff commission 4 per cent of fees 4 Vehicle expenses $15,300 per annum plus 0.25 per cent of fees 5 Interest expense 15.5 per cent per annum of a loan of $20,000 6 Legal fees $1,000 per month plus 0.7 per cent of fees. 7 Rates $12,900 per annum. 8 Income tax 33 cents in the dollar Prepare a performance report for the above income statement (in Question A) for the year ended December 2022, showing Income, total expenses, profit before tax, and all variances from the budget in dollars and percentages. 9 Fixed costs include: Office wages; Staff salaries; Rates. 0 -1 2 3 4 5 6 You are acting as an accountant for the General Manager of Marmax Consulting Services and are required to write a formal short report on the performance of the actual budget. The report must be provided to the General Manager within one month of the close of End of Year. 1 234 A (Task 1A) 5 INCOME 6 B C D E F G MARMAX CONSULTANCY SERVICES Budgeted Income Statement for period January to December 2022 7 Consultancy hours (HRS) 8 Consultancy fees received ($) 9 EXPENSES 10 11 Advertising 12 Office wages 13 Office supplies 14 Staff salaries 15 Staff commission 16 Vehicle expenses 17 Interest expense 18 Legal fees 19 Rates 20 TOTAL EXPENSES 21 Profit before tax 22 Tax Payable 23 Net Profit after Tax H (Task 1D) Estimated Budget for new calendar year 2023 100% Budgeted before start of year 2022 80% Actual Achieved in year 2022 Variance F/U Variance Percentage % Change in the new year 2023 (from year 2022)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started