Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company decided to make some changes to its operations based on the actual results and the variance analysis. The plan is to maintain

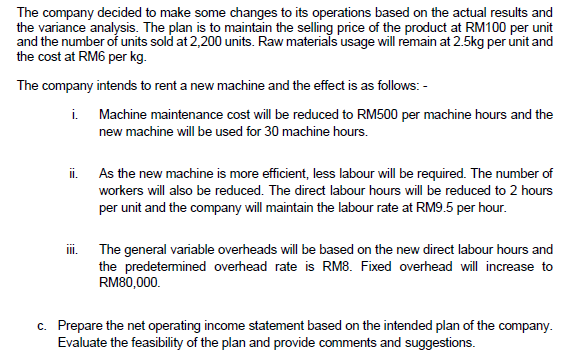

The company decided to make some changes to its operations based on the actual results and the variance analysis. The plan is to maintain the selling price of the product at RM100 per unit and the number of units sold at 2,200 units. Raw materials usage will remain at 2.5kg per unit and the cost at RM6 per kg. The company intends to rent a new machine and the effect is as follows:- i. Machine maintenance cost will be reduced to RM500 per machine hours and the new machine will be used for 30 machine hours. ii. As the new machine is more efficient, less labour will be required. The number of workers will also be reduced. The direct labour hours will be reduced to 2 hours per unit and the company will maintain the labour rate at RM9.5 per hour. iii. The general variable overheads will be based on the new direct labour hours and the predetermined overhead rate is RM8. Fixed overhead will increase to RM80,000. c. Prepare the net operating income statement based on the intended plan of the company. Evaluate the feasibility of the plan and provide comments and suggestions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started