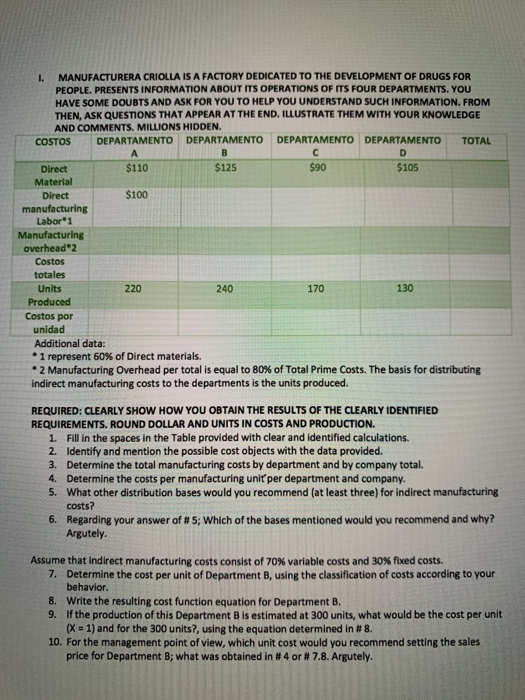

1. MANUFACTURERA CRIOLLA IS A FACTORY DEDICATED TO THE DEVELOPMENT OF DRUGS FOR PEOPLE. PRESENTS INFORMATION ABOUT ITS OPERATIONS OF ITS FOUR DEPARTMENTS. YOU HAVE SOME DOUBTS AND ASK FOR YOU TO HELP YOU UNDERSTAND SUCH INFORMATION. FROM THEN, ASK QUESTIONS THAT APPEAR AT THE END. ILLUSTRATE THEM WITH YOUR KNOWLEDGE AND COMMENTS. MILLIONS HIDDEN. COSTOS DEPARTAMENTO DEPARTAMENTO DEPARTAMENTO DEPARTAMENTO TOTAL Direct $110 $125 $90 $105 Direct $100 manufacturing Labor1 Manufacturing overhead2 Costos totales Units 220 170 130 Produced Costos por unidad Additional data: 1 represent 60% of Direct materials. * 2 Manufacturing Overhead per total is equal to 80% of Total Prime Costs. The basis for distributing indirect manufacturing costs to the departments is the units produced. 240 REQUIRED: CLEARLY SHOW HOW YOU OBTAIN THE RESULTS OF THE CLEARLY IDENTIFIED REQUIREMENTS. ROUND DOLLAR AND UNITS IN COSTS AND PRODUCTION. 1. Fill in the spaces in the Table provided with clear and identified calculations. 2. Identify and mention the possible cost objects with the data provided. 3. Determine the total manufacturing costs by department and by company total. 4. Determine the costs per manufacturing unit per department and company. 5. What other distribution bases would you recommend (at least three) for indirect manufacturing costs? 6. Regarding your answer of # 5; Which of the bases mentioned would you recommend and why? Argutely. Assume that indirect manufacturing costs consist of 70% variable costs and 30% fixed costs. 7. Determine the cost per unit of Department B, using the classification of costs according to your behavior. 8. Write the resulting cost function equation for Department B. 9. If the production of this Department B is estimated at 300 units, what would be the cost per unit (X = 1) and for the 300 units?, using the equation determined in # 8. 10. For the management point of view, which unit cost would you recommend setting the sales price for Department B; what was obtained in #4 or # 7.8. Argutely. 1. MANUFACTURERA CRIOLLA IS A FACTORY DEDICATED TO THE DEVELOPMENT OF DRUGS FOR PEOPLE. PRESENTS INFORMATION ABOUT ITS OPERATIONS OF ITS FOUR DEPARTMENTS. YOU HAVE SOME DOUBTS AND ASK FOR YOU TO HELP YOU UNDERSTAND SUCH INFORMATION. FROM THEN, ASK QUESTIONS THAT APPEAR AT THE END. ILLUSTRATE THEM WITH YOUR KNOWLEDGE AND COMMENTS. MILLIONS HIDDEN. COSTOS DEPARTAMENTO DEPARTAMENTO DEPARTAMENTO DEPARTAMENTO TOTAL Direct $110 $125 $90 $105 Direct $100 manufacturing Labor1 Manufacturing overhead2 Costos totales Units 220 170 130 Produced Costos por unidad Additional data: 1 represent 60% of Direct materials. * 2 Manufacturing Overhead per total is equal to 80% of Total Prime Costs. The basis for distributing indirect manufacturing costs to the departments is the units produced. 240 REQUIRED: CLEARLY SHOW HOW YOU OBTAIN THE RESULTS OF THE CLEARLY IDENTIFIED REQUIREMENTS. ROUND DOLLAR AND UNITS IN COSTS AND PRODUCTION. 1. Fill in the spaces in the Table provided with clear and identified calculations. 2. Identify and mention the possible cost objects with the data provided. 3. Determine the total manufacturing costs by department and by company total. 4. Determine the costs per manufacturing unit per department and company. 5. What other distribution bases would you recommend (at least three) for indirect manufacturing costs? 6. Regarding your answer of # 5; Which of the bases mentioned would you recommend and why? Argutely. Assume that indirect manufacturing costs consist of 70% variable costs and 30% fixed costs. 7. Determine the cost per unit of Department B, using the classification of costs according to your behavior. 8. Write the resulting cost function equation for Department B. 9. If the production of this Department B is estimated at 300 units, what would be the cost per unit (X = 1) and for the 300 units?, using the equation determined in # 8. 10. For the management point of view, which unit cost would you recommend setting the sales price for Department B; what was obtained in #4 or # 7.8. Argutely