Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. manufacturing account 2. statement of profit and loss TUTORIAL IN CLASS The waist of b es 31 July 2019 are eated from the books

1. manufacturing account 2. statement of profit and loss

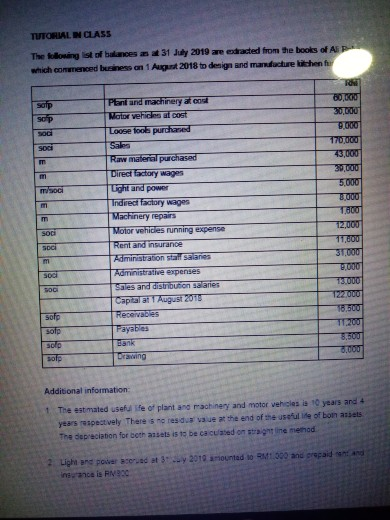

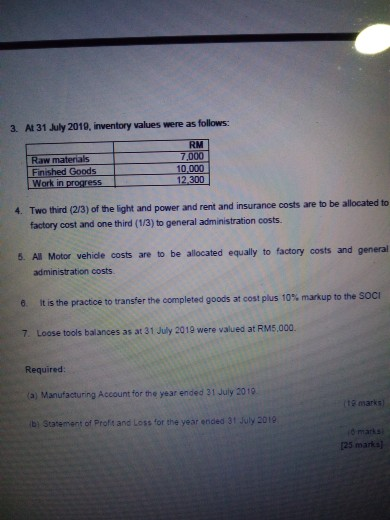

TUTORIAL IN CLASS The waist of b es 31 July 2019 are eated from the books of Alp which commenced business on 1 August 2018 to design and manufactureichen Plant and machinery & Co Motor vehicles al cost Loose to purchand 80,00 20.000 43,000 22.600 5.000 3.000 TO Raw material purchased Dired bdary ages ght and power Indredactory wages Machinery repairs Motor vehicles running expense Rent and insurance ministration stal salanes Administrative expenses Sales and distribution salaries Capital August 2015 eceivades Fayabes Bank wing 12.000 11 31.000 000 73000 12200 R sorp solp 300 solp 8333 o Additional information The estimated useful fe of plant and machinery and motor vehicles is 10 years and 4 years respectvely There is no read the end of the of bon assets The depreciation for both assets is to be a cated on straight line menad e red at 3 -- 2018 amounted to RM1.300 and prepaid Light and pow insurance is RMC 3. At 31 July 2018, inventory values were as follows: Raw materials Finished Goods Work in progress RM 7.000 10.000 12.300 4. Two third (2/3) of the light and power and rent and insurance costs are to be allocated to factory cost and one third (1/3) to general administration costs. 5. Al Motor vehicle costs are to be allocated equally to factory costs and general administration costs 6. It is the practice to transfer the completed goods at cost plus 10% markup to the SOCI 7. Loose tools balances as at 31 July 2012 were valued at RM5,000. Required: (a) Manufacturing Account for the year ended 31 July 2010 (1 marks by Statement of Profit and Loss for the year ended 31 July 2019 [25 marks) TUTORIAL IN CLASS The waist of b es 31 July 2019 are eated from the books of Alp which commenced business on 1 August 2018 to design and manufactureichen Plant and machinery & Co Motor vehicles al cost Loose to purchand 80,00 20.000 43,000 22.600 5.000 3.000 TO Raw material purchased Dired bdary ages ght and power Indredactory wages Machinery repairs Motor vehicles running expense Rent and insurance ministration stal salanes Administrative expenses Sales and distribution salaries Capital August 2015 eceivades Fayabes Bank wing 12.000 11 31.000 000 73000 12200 R sorp solp 300 solp 8333 o Additional information The estimated useful fe of plant and machinery and motor vehicles is 10 years and 4 years respectvely There is no read the end of the of bon assets The depreciation for both assets is to be a cated on straight line menad e red at 3 -- 2018 amounted to RM1.300 and prepaid Light and pow insurance is RMC 3. At 31 July 2018, inventory values were as follows: Raw materials Finished Goods Work in progress RM 7.000 10.000 12.300 4. Two third (2/3) of the light and power and rent and insurance costs are to be allocated to factory cost and one third (1/3) to general administration costs. 5. Al Motor vehicle costs are to be allocated equally to factory costs and general administration costs 6. It is the practice to transfer the completed goods at cost plus 10% markup to the SOCI 7. Loose tools balances as at 31 July 2012 were valued at RM5,000. Required: (a) Manufacturing Account for the year ended 31 July 2010 (1 marks by Statement of Profit and Loss for the year ended 31 July 2019 [25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started