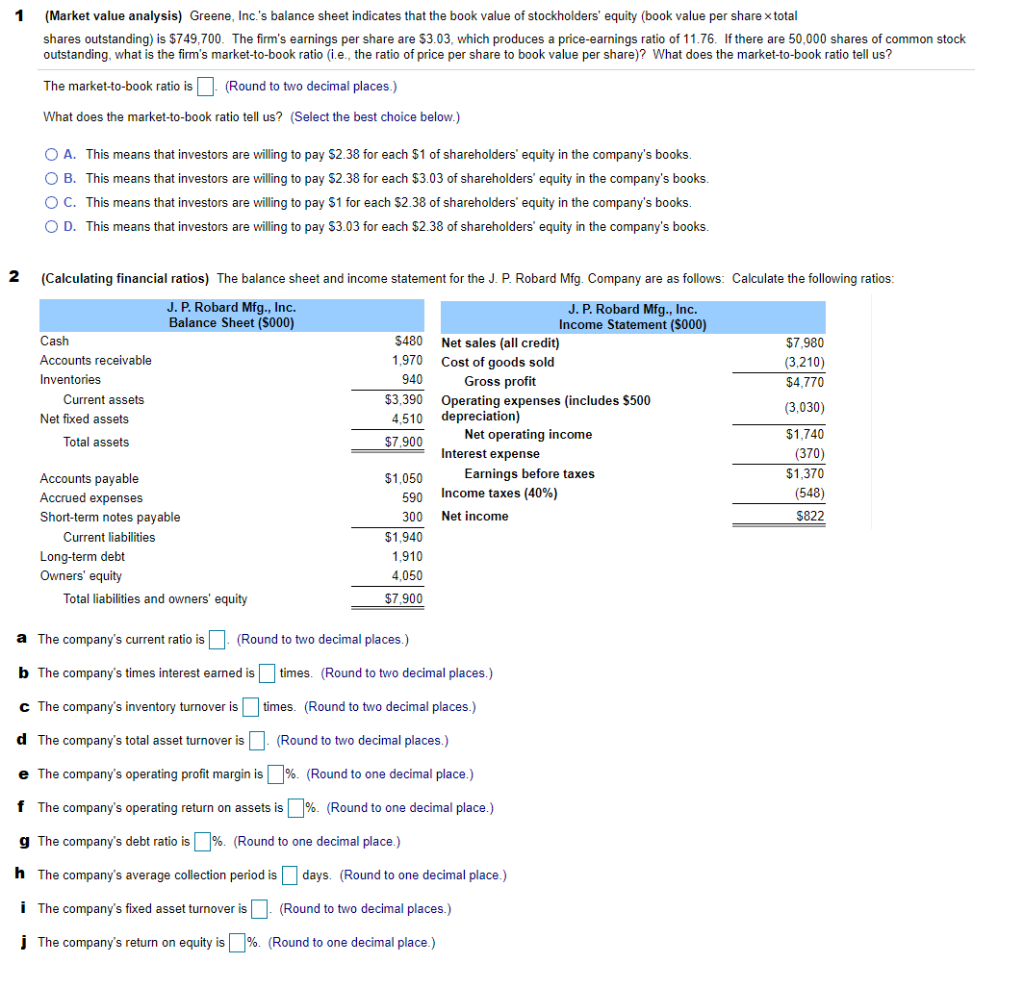

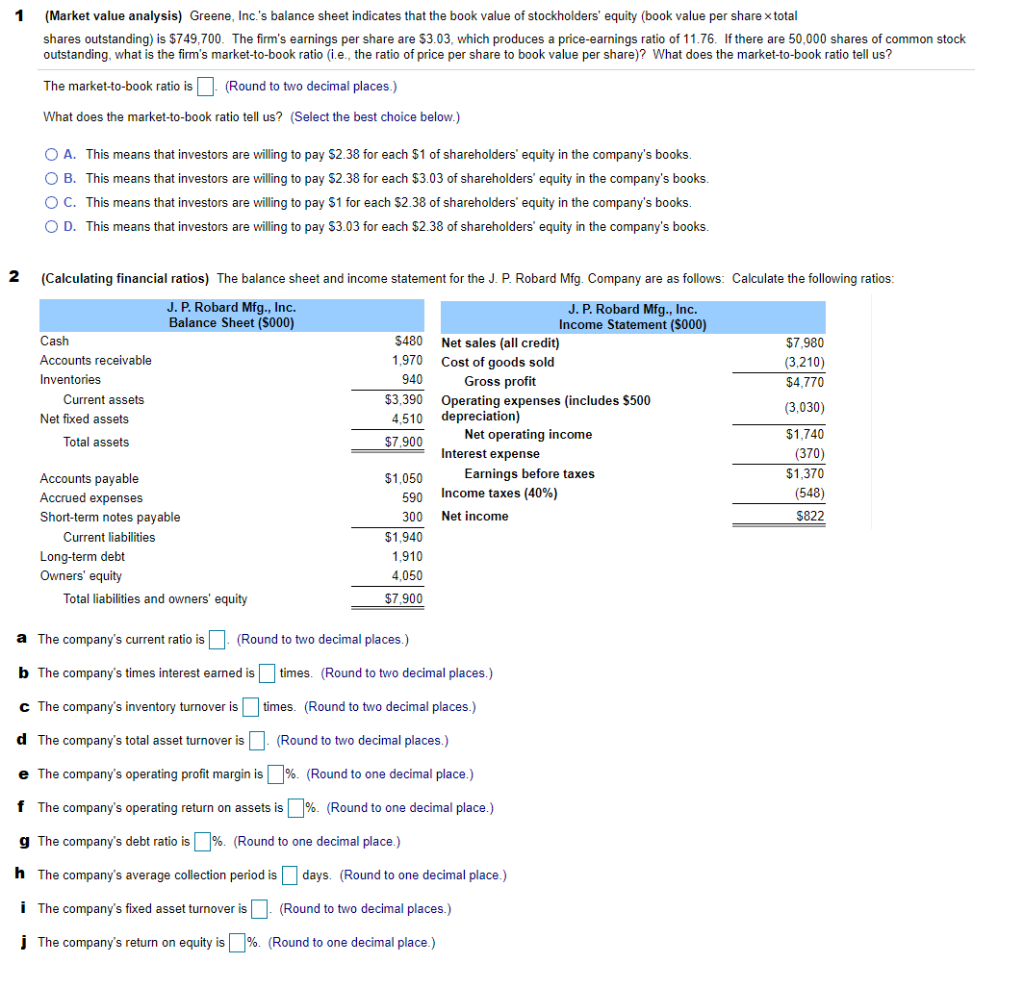

1 (Market value analysis) Greene, Inc.'s balance sheet indicates that the book value of stockholders' equity (book value per share x total shares outstanding) is $749,700. The firm's earnings per share are $3.03, which produces a price-earnings ratio of 11.76. If there are 50,000 shares of common stock outstanding, what is the firm's market-to-book ratio (i.e., the ratio of price per share to book value per share)? What does the market-to-book ratio tell us? The market-to-book ratio is (Round to two decimal places.) What does the market-to-book ratio tell us? (Select the best choice below.) O A. This means that investors are willing to pay $2.38 for each $1 of shareholders' equity in the company's books. OB. This means that investors are willing to pay $2.38 for each $3.03 of shareholders' equity in the company's books O C. This means that investors are willing to pay $1 for each $2.38 of shareholders' equity in the company's books. OD. This means that investors are willing to pay $3.03 for each $2.38 of shareholders' equity in the company's books 2 (Calculating financial ratios) The balance sheet and income statement for the J.P. Robard Mfg. Company are as follows: Calculate the following ratios: J. P. Robard Mfg., Inc. Balance Sheet (5000) Cash $7.980 (3,210) Accounts receivable Inventories $4.770 Current assets J. P. Robard Mfg., Inc. Income Statement (5000) $480 Net sales (all credit) 1,970 Cost of goods sold 940 Gross profit $3,390 Operating expenses (includes $500 4,510 depreciation) $7.900 Net operating income Interest expense $1,050 Earnings before taxes 590 Income taxes (40%) (3,030) Net fixed assets Total assets $1.740 (370) $1.370 (548) 300 Net income $822 Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $1.940 1,910 4,050 $7.900 a The company's current ratio is (Round to two decimal places) b The company's times interest earned is times. (Round to two decimal places.) c The company's inventory turnover is times. (Round to two decimal places.) d The company's total asset turnover is (Round to two decimal places.) e The company's operating profit margin is%. (Round to one decimal place.) f The company's operating return on assets is %. (Round to one decimal place.) g The company's debt ratio is % (Round to one decimal place.) h The company's average collection period is days. (Round to one decimal place.) The company's fixed asset turnover is (Round to two decimal places.) The company's return on equity is % (Round to one decimal place.)