Answered step by step

Verified Expert Solution

Question

1 Approved Answer

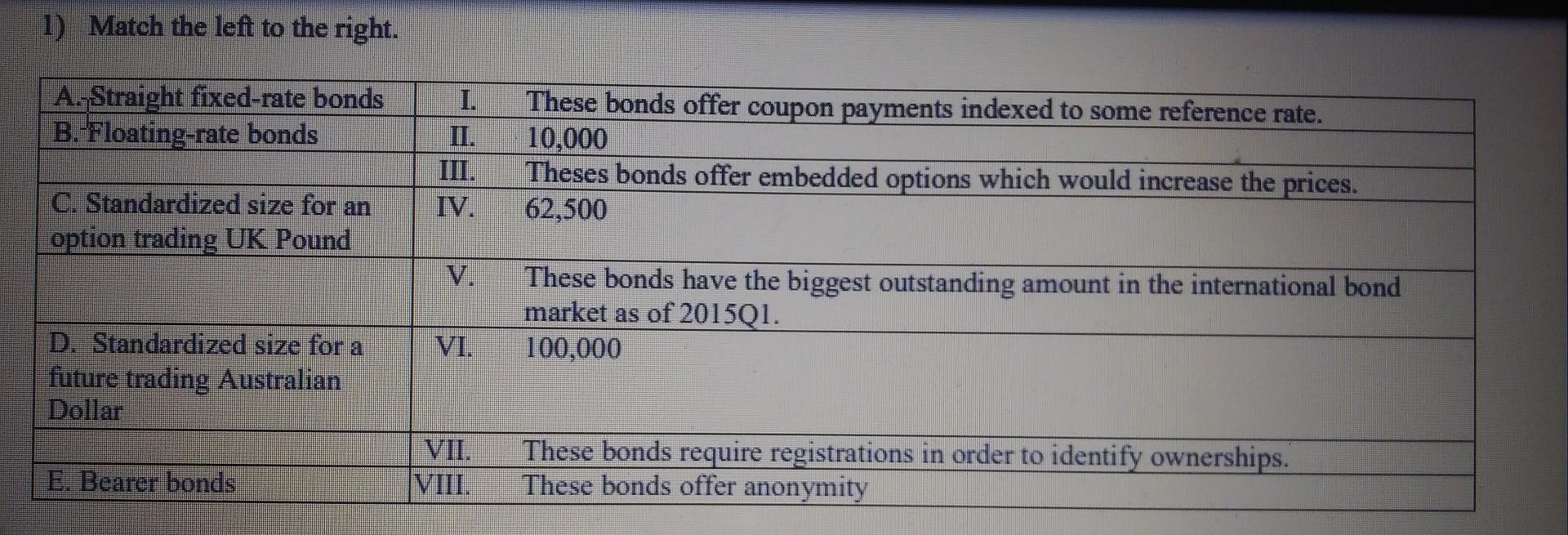

1) Match the left to the right. A., Straight fixed-rate bonds B. Floating-rate bonds These bonds offer coupon payments indexed to some reference rate. 10,000

1) Match the left to the right. A., Straight fixed-rate bonds B. Floating-rate bonds These bonds offer coupon payments indexed to some reference rate. 10,000 Theses bonds offer embedded options which would increase the prices. 62,500 IV. C. Standardized size for an option trading UK Pound V. These bonds have the biggest outstanding amount in the international bond market as of 201501. 100,000 VI. D. Standardized size for a future trading Australian Dollar VII. VIII. These bonds require registrations in order to identify ownerships. These bonds offer anonymity E. Bearer bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started