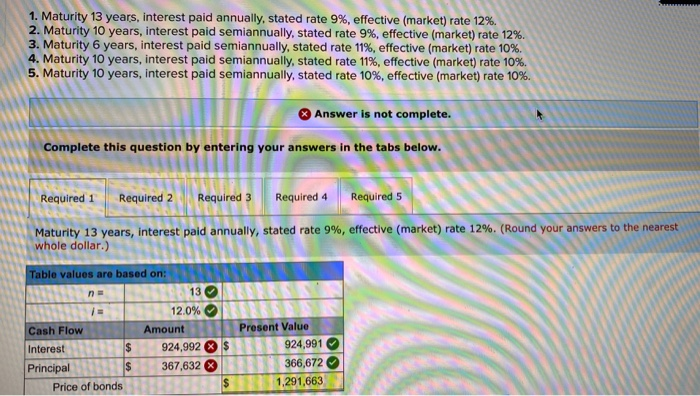

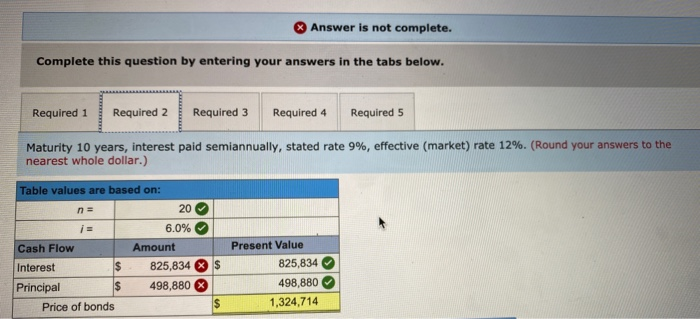

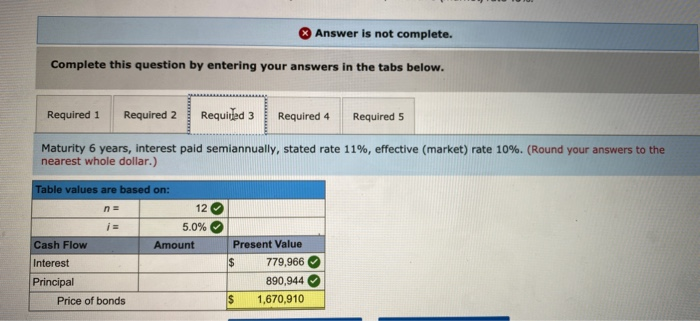

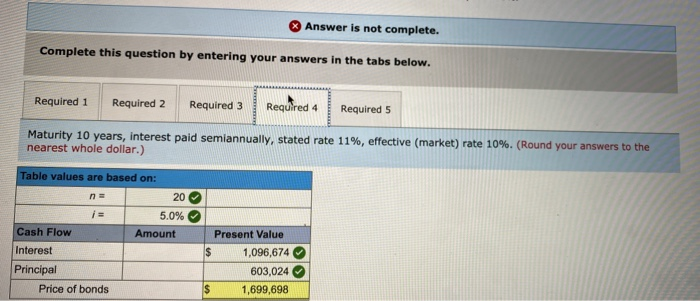

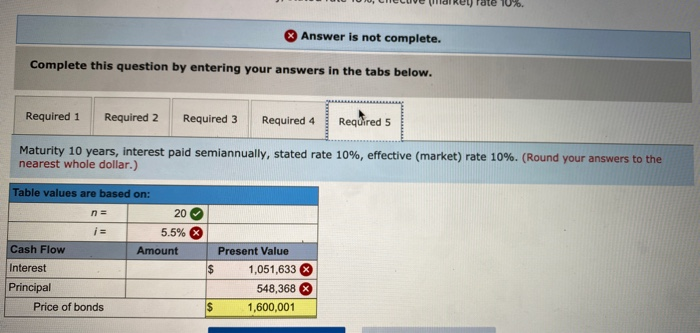

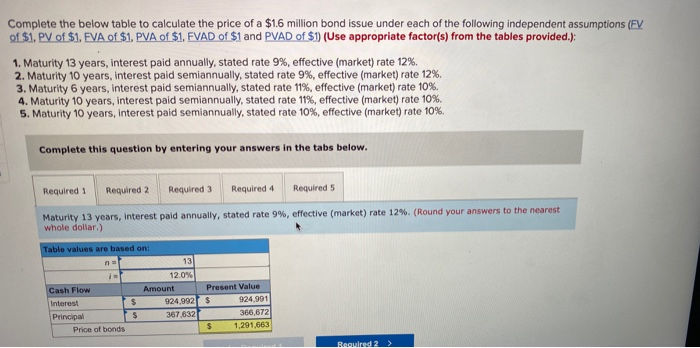

1. Maturity 13 years, interest paid annually, stated rate 9%, effective market) rate 12%. 2. Maturity 10 years, interest paid semiannually, stated rate 9%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 11%, effective (market) rate 10%. 4. Maturity 10 years, interest paid semiannually, stated rate 11%, effective market) rate 10%. 5. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 13 years, interest paid annually, stated rate 9%, effective (market) rate 12%. (Round your answers to the nearest whole dollar.) Table values are based on: 13 12.0% Cash Flow Amount Present Value Interest $ 924,992 $ 924,991 Principal $ 367,632 366,672 Price of bonds $ 1,291,663 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 10 years, interest paid semiannually, stated rate 9%, effective market) rate 12%. (Round your answers to the nearest whole dollar.) Table values are based on: n = 20 > i = Cash Flow 6.0% Amount 825,834 498,880 Present Value 825,834 $ Interest $ Principal $ Price of bonds 498,880 1,324,714 $ Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Requided 3 Required 4 Required 5 Maturity 6 years, interest paid semiannually, stated rate 11%, effective (market) rate 10%. (Round your answers to the nearest whole dollar.) Table values are based on: 12 5.0% Cash Flow Amount Interest Principal Price of bonds Present Value $ 779,966 890,944 $ 1,670,910 Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 10 years, interest paid semiannually, stated rate 11%, effective (market) rate 10%. (Round your answers to the nearest whole dollar.) Table values are based on: 20 5.0% Amount n = i = Cash Flow Interest Principal Price of bonds $ Present Value 1,096,674 603,024 1,699,698 $ rate 10%. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 10 years, interest paid semiannually, stated rate 10%, effective market) rate 10%. (Round your answers to the nearest whole dollar.) Table values are based on: n = 20 5.5% Amount Cash Flow $ Interest Principal Price of bonds Present Value 1,051,633 X 548,368 $ 1,600,001 Complete the below table to calculate the price of a $1.6 million bond issue under each of the following independent assumptions (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.): 1. Maturity 13 years, interest paid annually, stated rate 9%, effective (market) rate 12%. 2. Maturity 10 years, interest paid semiannually, stated rate 9%, effective market) rate 12% 3. Maturity 6 years, interest paid semiannually, stated rate 11%, effective (market) rate 10% 4. Maturity 10 years, interest paid semiannually, stated rate 11%, effective market) rate 10%. 5. Maturity 10 years, interest paid semiannually, stated rate 10%, effective market) rate 10% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Maturity 13 years, interest paid annually, stated rate 9%, effective market) rate 12%. (Round your answers to the nearest whole dollar) Table values are based on: n 13 Cash Flow Interest Principal Price of bonds 12.0% Amount 924,992 367,632 $ $ Present Value $ 924.991 366,672 $ 1.291.663 Ragwed