Question

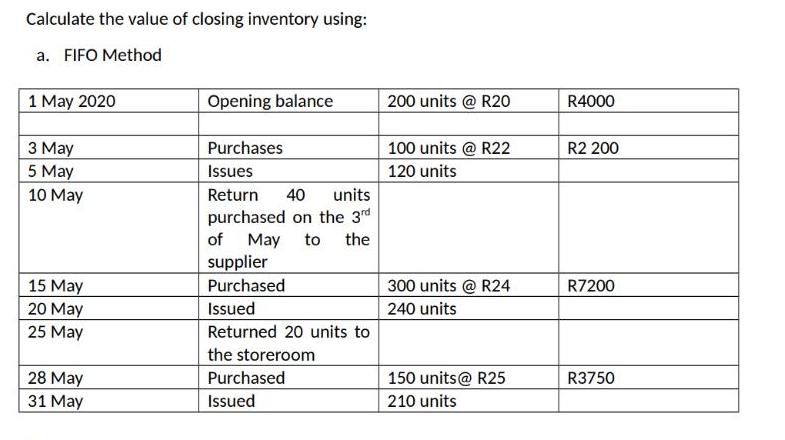

Calculate the value of closing inventory using: a. FIFO Method 1 May 2020 3 May 5 May 10 May 15 May 20 May 25

Calculate the value of closing inventory using: a. FIFO Method 1 May 2020 3 May 5 May 10 May 15 May 20 May 25 May 28 May 31 May Opening balance Purchases Issues Return 40 units purchased on the 3rd of May to the supplier Purchased Issued Returned 20 units to the storeroom Purchased Issued 200 units @ R20 100 units @ R22 120 units 300 units @ R24 240 units 150 units@ R25 210 units R4000 R2 200 R7200 R3750

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the closing inventory using the FIFO First In First Out method we need to track the uni...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App