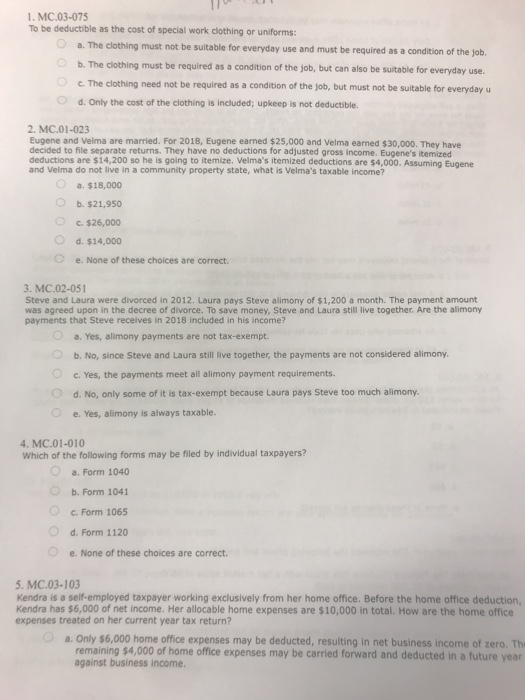

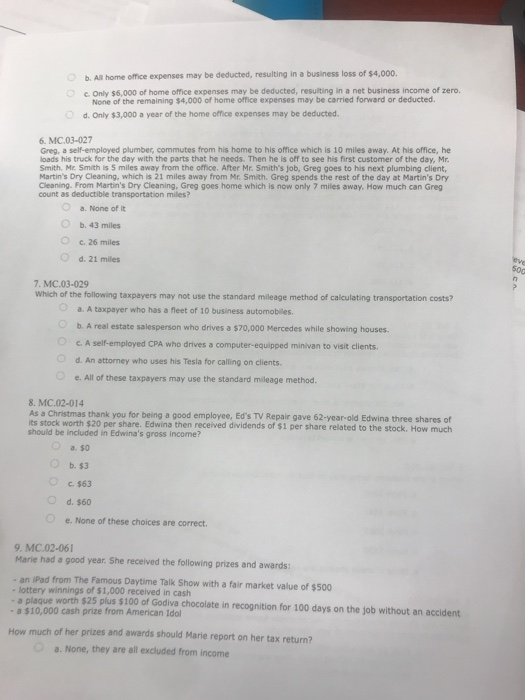

1. MC.03-075 To be deductible as the cost of special work clothing or uniforms: a. The clothing must not be suitable for everyday use and must be required as a condition of the job b. The clothing must be required as a condition of the job, but can also be suitable for everyday use. c. The clothing need not be required as a condition of the job, but must not be suitable for everyday u d. Only the cost of the clothing is included; upkeep is not deductible. 2. MC.01-023 Eugene and Velma are married. For 2018, Eugene earned $25,000 and Velma eaned $30,000. They have decided to file separate returns. They have no deductions for adjusted gross income. Eugene's itemized deductions are $14,200 so he is going to itemize. Velma's itemized deductions are $4,000. Assuming Eugene and Velma do not live in a community property state, what is Velma's taxable income? a. $18,000 b. $21,950 c. $26,000 Od. $14,000 O e. None of these choices are correct. 3. MC.02-051 Steve and Laura were divorced in 2012. Laura pays Steve alimony of $1,200 a month. The payment amount was agreed upon in the decree of divorce. To save money, Steve and Laura still live together. Are the alimony payments that Steve receives in 2018 included in his income? a. Yes, alimony payments are not tax-exempt. b. No, since Steve and Laura still live together, the payments are not considered alimony. c. Yes, the payments meet all alimony payment requirements. d. No, only some of it is tax-exempt because Laura pays Steve too much almony. e. Yes, alimony is always taxable. 4. MC.01-010 Which of the following forms may be filed by individual taxpayers? a. Form 1040 b. Form 1041 Oc. Form 1065 d. Form 1120 e. None of these choices are correct 5. MC.03-103 Kendra is a self-employed taxpayer working exclusively from her home office. Before the home office deduction, Kendra has $6,000 of net income. Her allocable home expenses are $10,000 in total. How are the home office expenses treated on her current year tax return? O a. Only $6,000 home office expenses may be deducted, resulting in net business income of zero. Th remaining $4,000 of home office expenses may be carried forward and deducted in a future year against business income. b. All home office expenses may be deducted, resulting in a business loss of $4,000. e Only $6,000 of home office expenses may be deducted, resulting in a net business income of zero. None of the remaining $4,000 of home office expenses may be carried forward or deducted. d. Only $3,000 a year of the home office expenses may be deducted. O 6. MC.03-027 Greg, a self-employed plumber, commutes from his home to his office which is 10 miles away. At his office, he loads his truck for the day with the parts that he needs. Then he is off to see his first customer of the day, Mr. Smith. Mr. Smith is 5 miles away from the office. After Mr. Smith's job, Greg goes to his next plumbing client, Martin's Dry Cleaning, which is 21 miles away from Mr. Smith. Greg spends the rest of the day at Martin's Dry Cleaning. From Martin's Dry Cleaning, Greg goes home which is now only 7 miles away. How much can Greg count as deductible transportation miles? Oa. None of it O b. 43 miles O c. 26 miles O d. 21 miles 7. MC.03-029 Which of the following taxpayers may not use the standard mileage method of calculating transportation costs? a. A taxpayer who has a fleet of 10 business automobiles. b. A real estate salesperson who drives a $70,000 Mercedes while showing houses C. A self-employed CPA who drives a computer-equipped minivan to visit clients d. An attorney who uses his Tesla for calling on cients Oe. All of these taxpayers may use the standard mileage methood 8. MC.02-014 As a Christmas thank you for being a good employee, Ed's TV Repair gave 62-year-old Edwina three shares of its stock worth $20 per share. Edwina then received dividends of $1 per share related to the stock. How should be included in Edwina's gross income? a, $0 . $63 d. $60 OeNone of these choices are correct 9. MC.02-061 Marie had a good year. She received the following prizes and awards: - an iPad from The Famous Daytime Talk Show with a fair market value of $500 lottery winnings of $1,000 received in cash - a plaque worth $25 plus $100 of Godiva chocolate in recognition for 100 days on the job without an accident a $10,000 cash prize from American Ido How much of her prizes and awards should Marie report on her tax return? . None, they are all excluded from income