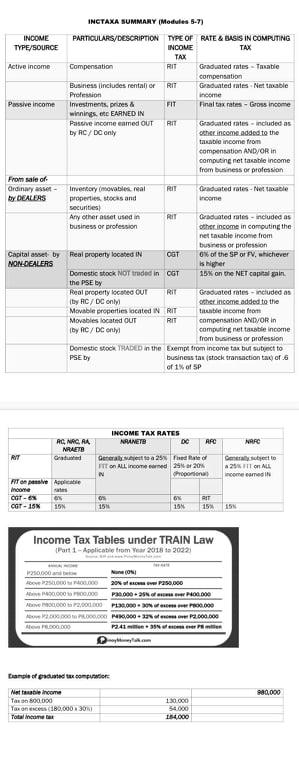

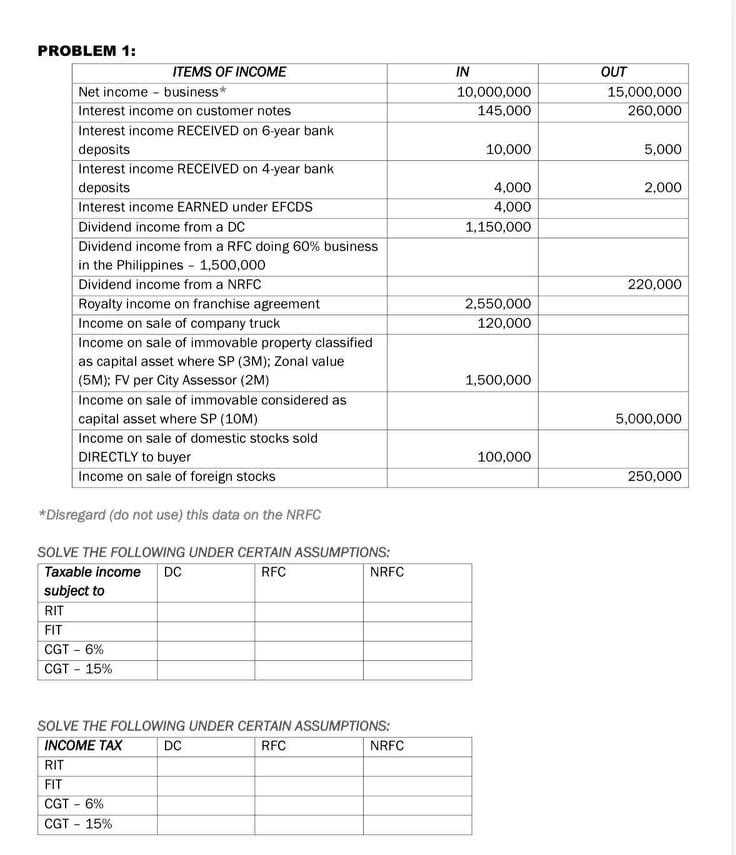

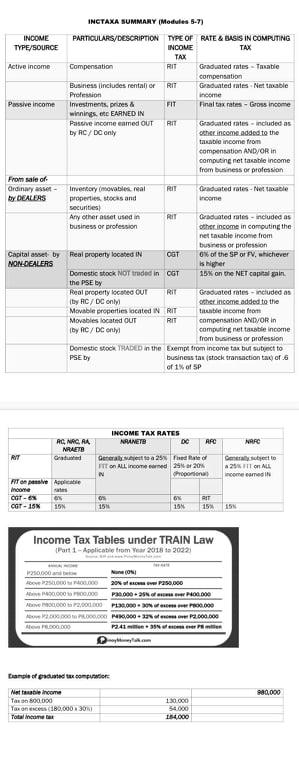

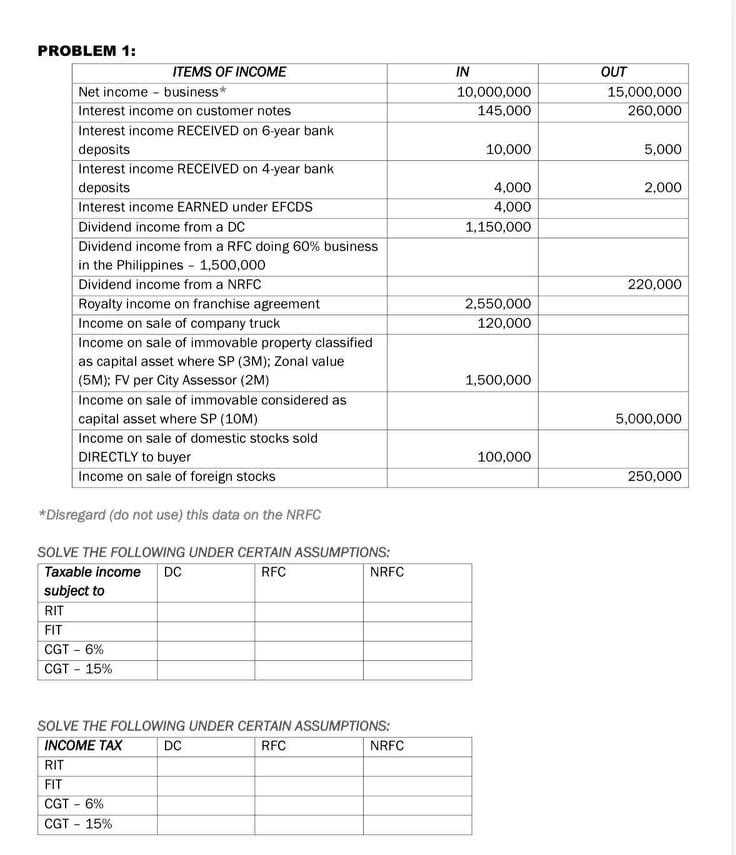

1. Meaning of Terminologies: (RIT) Regular Income Tax (FIT) Final Income Tax (CGT) Capital Gains Tax (RC) Resident Citizen (NRC) Non Resident Citizen (RA) Resident Alien (NRAETB) Non Resident Alien Engaged in Trade or Business (NRANETB) Non Resident Alien Not Engaged in Trade or Business 1st pic-Basis 2nd pic-prob

INCTAXA SUMMARY Modules 5-7) INCOME PARTICULARS/DESCRIPTION TYPE OF RATE & BASIS IN COMPUTING TYPE/SOURCE INCOME TAX TAX Active income Compensation RIT Graduated rates - Table compensation Business includes rental of RIT Graduatedrales Nettable Profession income Passive income Investments, prises & FIT Final tax rates - Gross income winnings, etc EARNED IN Passive income eamed OUT RIT Graduated rates included as by RC/DC only other income added to the taxable income from compensation AND/OR in computing netta atle income from business or profession From sale of Ordinary asset Inventory movable real RII Graduated rotes - Nettable W DEALERS properties Mocks and income securities Any other asset used in RIT Graduatedrales - included as business or profession other income in computing the net table income from business or profession Capital asset by Real property located IN 6% of the SP or FV, whichever NON-DEALERS is higher Domestic stock NOT truded in CGT 15x on the NET capital gain the PSE by Real property located our Rit Graduated rates included as by RC / DC only other income added to the Movable properties located N RIT tible income from Movables located OUT RIT compensation ANDVOR in by AC/DC only computing nettauable income from business or profession Domestic Stock THADED in the Exempt from income tax bus sutect to PSE by business tax (stock transaction of of 1 of 5P GOT NARC AC, NR. AA NRETS Grau RIT INCOME TAX RATES NRANETO DC AFC Generala 25 de on ALL income one 29 20% N Chroportion Gatto a 25 llon ALL income RT ve Aplicable noorte cor- ON CGT-1515N os 15 OW 15 RIT 15 15 Income Tax Tables under TRAIN Law Part 1 - Apolicable trom Year 2018 - 202 12 NONI 200 201 of P250,000 200.000.000 P2.000 200.000 000 POOPM00N PROC.000 2. P. M.000-2.000.000 C.000 72.41 3. Pse trample of Prostate computer Nettabile Income Tasso 800.000 Yoxanences 6,000 3001 Total income tax 280,000 130.000 54.000 14.000 IN 10,000,000 145,000 OUT 15,000,000 260,000 10,000 5,000 2,000 4,000 4.000 1,150,000 PROBLEM 1: ITEMS OF INCOME Net income - business Interest income on customer notes Interest income RECEIVED on 6-year bank deposits Interest income RECEIVED on 4-year bank deposits Interest income EARNED under EFCDS Dividend income from a DC Dividend income from a RFC doing 60% business in the Philippines - 1,500,000 Dividend income from a NRFC Royalty income on franchise agreement Income on sale of company truck Income on sale of immovable property classified as capital asset where SP (3M); Zonal value (5M): FV per City Assessor (2M) Income on sale of immovable considered as capital asset where SP (10M) Income on sale of domestic stocks sold DIRECTLY to buyer Income on sale of foreign stocks 220,000 2,550,000 120,000 1,500,000 5,000,000 100.000 250,000 *Disregard (do not use this data on the NRFC DC SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: Taxable income RFC NRFC subject to RIT FIT CGT - 6% CGT -15% SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: INCOME TAX DC RFC NRFC RIT FIT CGT - 6% CGT -15% INCTAXA SUMMARY Modules 5-7) INCOME PARTICULARS/DESCRIPTION TYPE OF RATE & BASIS IN COMPUTING TYPE/SOURCE INCOME TAX TAX Active income Compensation RIT Graduated rates - Table compensation Business includes rental of RIT Graduatedrales Nettable Profession income Passive income Investments, prises & FIT Final tax rates - Gross income winnings, etc EARNED IN Passive income eamed OUT RIT Graduated rates included as by RC/DC only other income added to the taxable income from compensation AND/OR in computing netta atle income from business or profession From sale of Ordinary asset Inventory movable real RII Graduated rotes - Nettable W DEALERS properties Mocks and income securities Any other asset used in RIT Graduatedrales - included as business or profession other income in computing the net table income from business or profession Capital asset by Real property located IN 6% of the SP or FV, whichever NON-DEALERS is higher Domestic stock NOT truded in CGT 15x on the NET capital gain the PSE by Real property located our Rit Graduated rates included as by RC / DC only other income added to the Movable properties located N RIT tible income from Movables located OUT RIT compensation ANDVOR in by AC/DC only computing nettauable income from business or profession Domestic Stock THADED in the Exempt from income tax bus sutect to PSE by business tax (stock transaction of of 1 of 5P GOT NARC AC, NR. AA NRETS Grau RIT INCOME TAX RATES NRANETO DC AFC Generala 25 de on ALL income one 29 20% N Chroportion Gatto a 25 llon ALL income RT ve Aplicable noorte cor- ON CGT-1515N os 15 OW 15 RIT 15 15 Income Tax Tables under TRAIN Law Part 1 - Apolicable trom Year 2018 - 202 12 NONI 200 201 of P250,000 200.000.000 P2.000 200.000 000 POOPM00N PROC.000 2. P. M.000-2.000.000 C.000 72.41 3. Pse trample of Prostate computer Nettabile Income Tasso 800.000 Yoxanences 6,000 3001 Total income tax 280,000 130.000 54.000 14.000 IN 10,000,000 145,000 OUT 15,000,000 260,000 10,000 5,000 2,000 4,000 4.000 1,150,000 PROBLEM 1: ITEMS OF INCOME Net income - business Interest income on customer notes Interest income RECEIVED on 6-year bank deposits Interest income RECEIVED on 4-year bank deposits Interest income EARNED under EFCDS Dividend income from a DC Dividend income from a RFC doing 60% business in the Philippines - 1,500,000 Dividend income from a NRFC Royalty income on franchise agreement Income on sale of company truck Income on sale of immovable property classified as capital asset where SP (3M); Zonal value (5M): FV per City Assessor (2M) Income on sale of immovable considered as capital asset where SP (10M) Income on sale of domestic stocks sold DIRECTLY to buyer Income on sale of foreign stocks 220,000 2,550,000 120,000 1,500,000 5,000,000 100.000 250,000 *Disregard (do not use this data on the NRFC DC SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: Taxable income RFC NRFC subject to RIT FIT CGT - 6% CGT -15% SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: INCOME TAX DC RFC NRFC RIT FIT CGT - 6% CGT -15%