Answered step by step

Verified Expert Solution

Question

1 Approved Answer

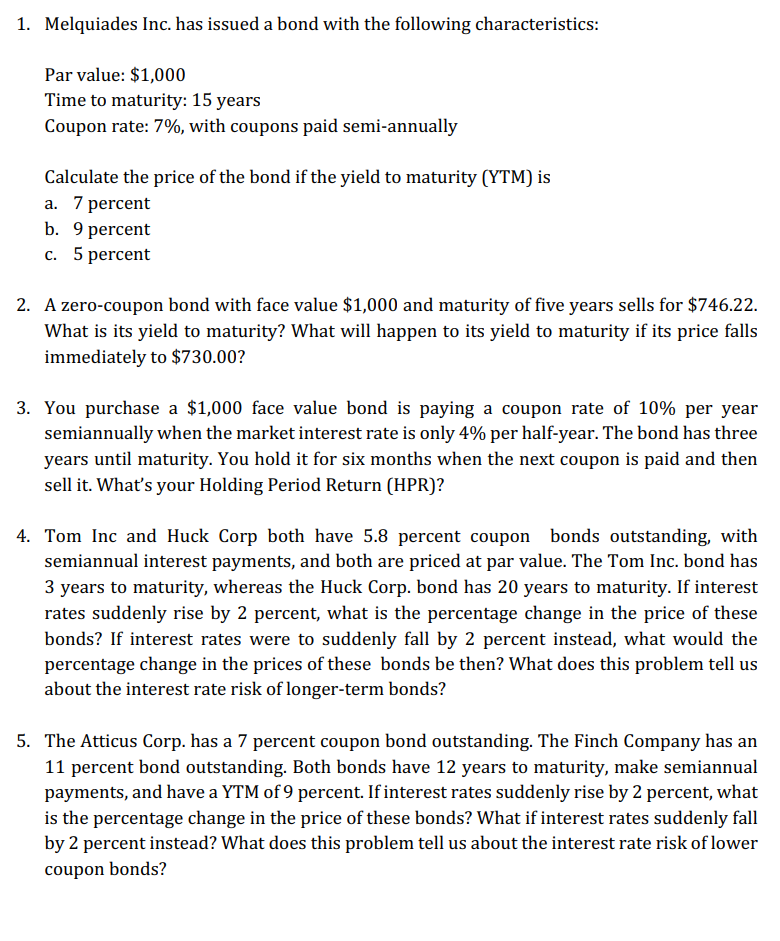

1. Melquiades Inc. has issued a bond with the following characteristics: Par value: $1,000 Time to maturity: 15 years Coupon rate: 7%, with coupons paid

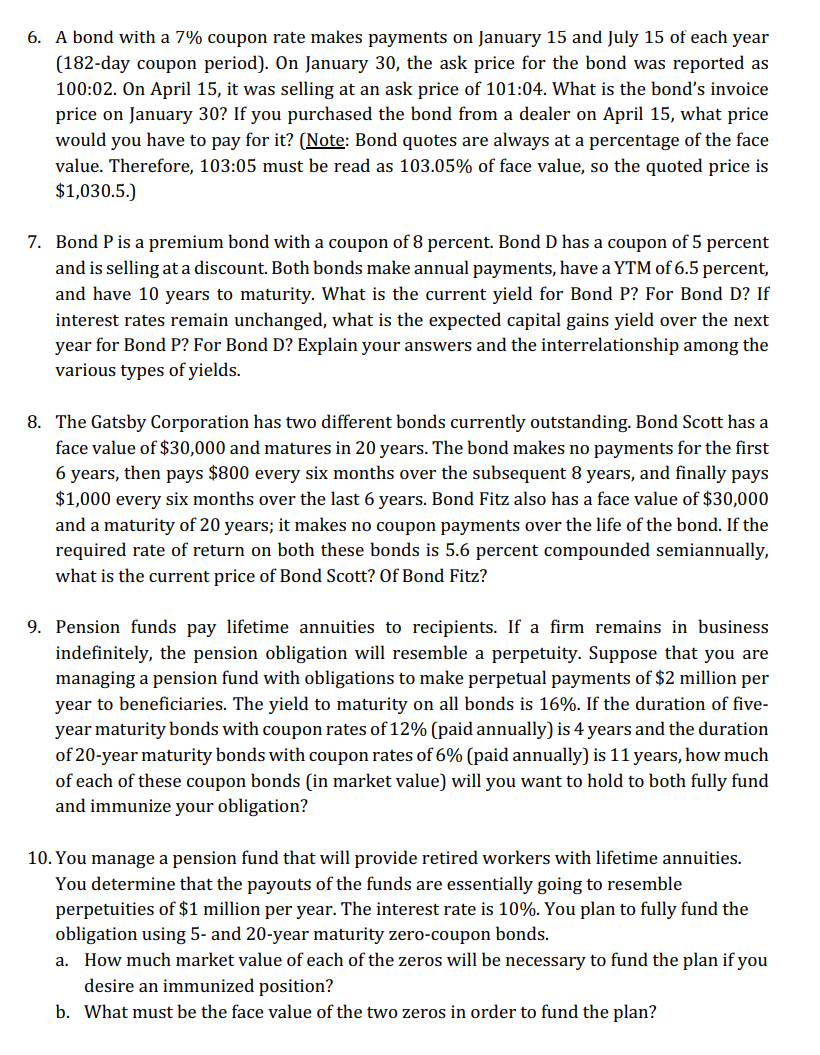

1. Melquiades Inc. has issued a bond with the following characteristics: Par value: $1,000 Time to maturity: 15 years Coupon rate: 7%, with coupons paid semi-annually Calculate the price of the bond if the yield to maturity (YTM) is a. 7 percent b. 9 percent c. 5 percent 2. A zero-coupon bond with face value $1,000 and maturity of five years sells for $746.22. What is its yield to maturity? What will happen to its yield to maturity if its price falls immediately to $730.00 ? 3. You purchase a $1,000 face value bond is paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. You hold it for six months when the next coupon is paid and then sell it. What's your Holding Period Return (HPR)? 4. Tom Inc and Huck Corp both have 5.8 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Tom Inc. bond has 3 years to maturity, whereas the Huck Corp. bond has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the prices of these bonds be then? What does this problem tell us about the interest rate risk of longer-term bonds? 5. The Atticus Corp. has a 7 percent coupon bond outstanding. The Finch Company has an 11 percent bond outstanding. Both bonds have 12 years to maturity, make semiannual payments, and have a YTM of 9 percent. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? What if interest rates suddenly fall by 2 percent instead? What does this problem tell us about the interest rate risk of lower coupon bonds? 6. A bond with a 7% coupon rate makes payments on January 15 and July 15 of each year (182-day coupon period). On January 30, the ask price for the bond was reported as 100:02. On April 15, it was selling at an ask price of 101:04. What is the bond's invoice price on January 30 ? If you purchased the bond from a dealer on April 15, what price would you have to pay for it? (Note: Bond quotes are always at a percentage of the face value. Therefore, 103:05 must be read as 103.05% of face value, so the quoted price is $1,030.5.) 7. Bond P is a premium bond with a coupon of 8 percent. Bond D has a coupon of 5 percent and is selling at a discount. Both bonds make annual payments, have a YTM of 6.5 percent, and have 10 years to maturity. What is the current yield for Bond P? For Bond D? If interest rates remain unchanged, what is the expected capital gains yield over the next year for Bond P? For Bond D? Explain your answers and the interrelationship among the various types of yields. 8. The Gatsby Corporation has two different bonds currently outstanding. Bond Scott has a face value of $30,000 and matures in 20 years. The bond makes no payments for the first 6 years, then pays $800 every six months over the subsequent 8 years, and finally pays $1,000 every six months over the last 6 years. Bond Fitz also has a face value of $30,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. If the required rate of return on both these bonds is 5.6 percent compounded semiannually, what is the current price of Bond Scott? Of Bond Fitz? 9. Pension funds pay lifetime annuities to recipients. If a firm remains in business indefinitely, the pension obligation will resemble a perpetuity. Suppose that you are managing a pension fund with obligations to make perpetual payments of $2 million per year to beneficiaries. The yield to maturity on all bonds is 16%. If the duration of fiveyear maturity bonds with coupon rates of 12% (paid annually) is 4 years and the duration of 20 -year maturity bonds with coupon rates of 6% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? 10. You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the funds are essentially going to resemble perpetuities of $1 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5- and 20-year maturity zero-coupon bonds. a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? b. What must be the face value of the two zeros in order to fund the plan

1. Melquiades Inc. has issued a bond with the following characteristics: Par value: $1,000 Time to maturity: 15 years Coupon rate: 7%, with coupons paid semi-annually Calculate the price of the bond if the yield to maturity (YTM) is a. 7 percent b. 9 percent c. 5 percent 2. A zero-coupon bond with face value $1,000 and maturity of five years sells for $746.22. What is its yield to maturity? What will happen to its yield to maturity if its price falls immediately to $730.00 ? 3. You purchase a $1,000 face value bond is paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. You hold it for six months when the next coupon is paid and then sell it. What's your Holding Period Return (HPR)? 4. Tom Inc and Huck Corp both have 5.8 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Tom Inc. bond has 3 years to maturity, whereas the Huck Corp. bond has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the prices of these bonds be then? What does this problem tell us about the interest rate risk of longer-term bonds? 5. The Atticus Corp. has a 7 percent coupon bond outstanding. The Finch Company has an 11 percent bond outstanding. Both bonds have 12 years to maturity, make semiannual payments, and have a YTM of 9 percent. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? What if interest rates suddenly fall by 2 percent instead? What does this problem tell us about the interest rate risk of lower coupon bonds? 6. A bond with a 7% coupon rate makes payments on January 15 and July 15 of each year (182-day coupon period). On January 30, the ask price for the bond was reported as 100:02. On April 15, it was selling at an ask price of 101:04. What is the bond's invoice price on January 30 ? If you purchased the bond from a dealer on April 15, what price would you have to pay for it? (Note: Bond quotes are always at a percentage of the face value. Therefore, 103:05 must be read as 103.05% of face value, so the quoted price is $1,030.5.) 7. Bond P is a premium bond with a coupon of 8 percent. Bond D has a coupon of 5 percent and is selling at a discount. Both bonds make annual payments, have a YTM of 6.5 percent, and have 10 years to maturity. What is the current yield for Bond P? For Bond D? If interest rates remain unchanged, what is the expected capital gains yield over the next year for Bond P? For Bond D? Explain your answers and the interrelationship among the various types of yields. 8. The Gatsby Corporation has two different bonds currently outstanding. Bond Scott has a face value of $30,000 and matures in 20 years. The bond makes no payments for the first 6 years, then pays $800 every six months over the subsequent 8 years, and finally pays $1,000 every six months over the last 6 years. Bond Fitz also has a face value of $30,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. If the required rate of return on both these bonds is 5.6 percent compounded semiannually, what is the current price of Bond Scott? Of Bond Fitz? 9. Pension funds pay lifetime annuities to recipients. If a firm remains in business indefinitely, the pension obligation will resemble a perpetuity. Suppose that you are managing a pension fund with obligations to make perpetual payments of $2 million per year to beneficiaries. The yield to maturity on all bonds is 16%. If the duration of fiveyear maturity bonds with coupon rates of 12% (paid annually) is 4 years and the duration of 20 -year maturity bonds with coupon rates of 6% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? 10. You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the funds are essentially going to resemble perpetuities of $1 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5- and 20-year maturity zero-coupon bonds. a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? b. What must be the face value of the two zeros in order to fund the plan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started