Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Merchandise inventory worth $50,000 is acquired at a cost of $42.000 from a company going out conceptual ect entries. of business. The following entry

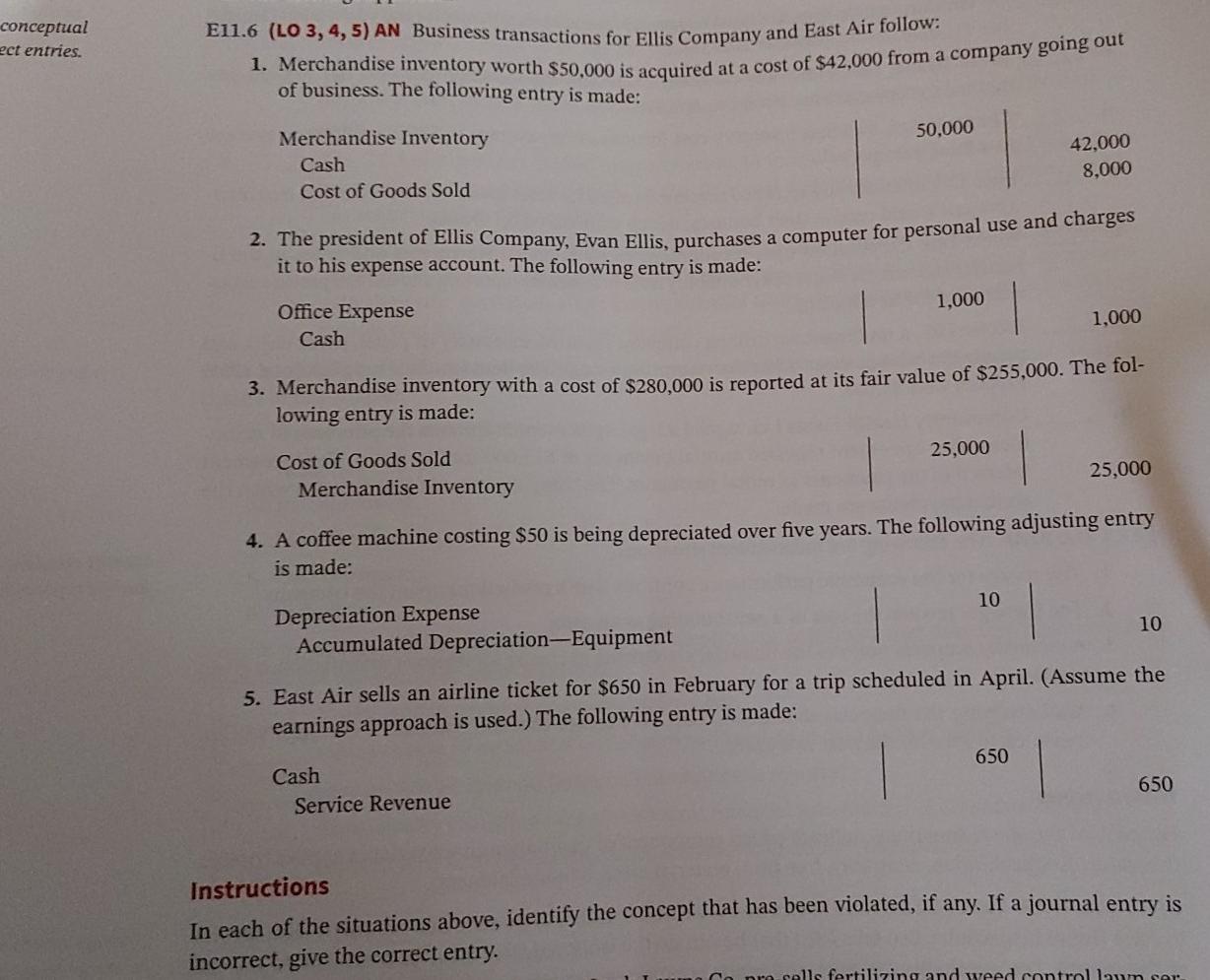

1. Merchandise inventory worth $50,000 is acquired at a cost of $42.000 from a company going out conceptual ect entries. of business. The following entry is made: E11.6 (LO 3, 4, 5) AN Business transactions for Ellis Company and East Air follow: 50.000 Merchandise Inventory Cash Cost of Goods Sold 42,000 8.000 2. The president of Ellis Company, Evan Ellis, purchases a computer for personal use and charges it to his expense account. The following entry is made: Office Expense 1,000 Cash 1,000 3. Merchandise inventory with a cost of $280,000 is reported at its fair value of $255,000. The fol- lowing entry is made: 25,000 Cost of Goods Sold Merchandise Inventory 25,000 4. A coffee machine costing $50 is being depreciated over five years. The following adjusting entry is made: 10 10 Depreciation Expense Accumulated Depreciation--Equipment 5. East Air sells an airline ticket for $650 in February for a trip scheduled in April. (Assume the earnings approach is used.) The following entry is made: 650 Cash Service Revenue 650 Instructions In each of the situations above, identify the concept that has been violated, if any. If a journal entry is incorrect, give the correct entry. olls fertilizing and weed controllaum ser

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started