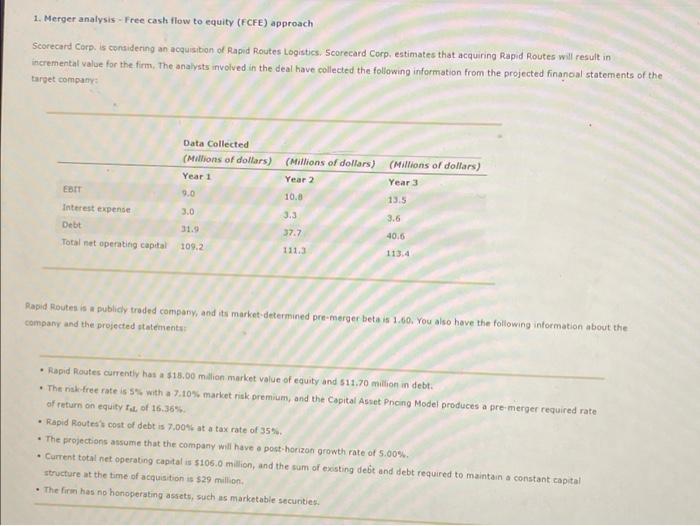

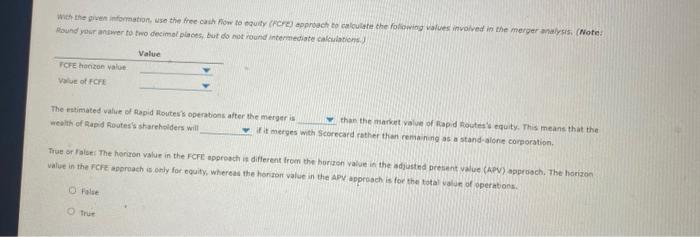

1. Merger analysis - Free cash flow to equity (FCFE) approach Scorecard Corp. is considering an acquisition of Rapid Routes Logistics. Scorecard Corp. estimates that acquiring Rapid Routes will result in incremental value for the firm, The analysts involved in the deal have collected the following information from the projected financal statements of the target company Data Collected (Millions of dollars) Year 1 (Millions of dollars) Year 2 (Millions of dollars) Year 3 13.5 EBIT 9.0 10.8 Interest expense 3.0 3.3 3.6 Debt 31.9 40.6 Total net operating capital 109.2 37.7 1113 113.4 Rapid Routes is a publidy traded company, and its market determined pre-merger beta is 1.60. You also have the following information about the company and the projected statements Rapid Routes currently has a $15.00 million market value of equity and 511.70 million in debt. The niske tree rate is with a 7.10% market risk premium, and the Capital Asset Pncing Model produces a pre-merger required rate of return on equity of 16.35% Rapid Routes cost of debt is 7.00 at a tax rate of 35% The projections assume that the company will have post-horizon growth rate of 5.00% Current total net operating capital is $105.0 million, and the sum of existing debt and debt required to maintain a constant capital structure at the time of acquisition is $29 million The firm has no honoperating assets, such as marketable securities with the given information, use the free cail How to muity crore) proach to calculate the following values involved in the merger analysis. (Note: Round your answer to two decimal places, but do not round intermediate calculation Value TOFE on value of FORE The estimated value of Rapid Route's operations after the mergeris than the market value of apd Roseguity. This means that the wealth of Rapid Route's shareholders will Fit merges with Scorecard rather than remaining as a stand-alone corporation True or Fals: The horion value in the FCFE pproach is different from the horizon valuti the adjusted present Value (APV) approach. The horizon value in the FCE approach only for couity, where the horizont value in the APV approach is for the total of operations. Pole True