Question

1. Merton Enterprises has bonds on the market making annual payments, with 18 years to maturity, and selling for $960. At this price, the bonds

1. Merton Enterprises has bonds on the market making annual payments, with 18 years to maturity, and selling for $960. At this price, the bonds yield 8.7 percent. What must the coupon rate be on Mertons bonds

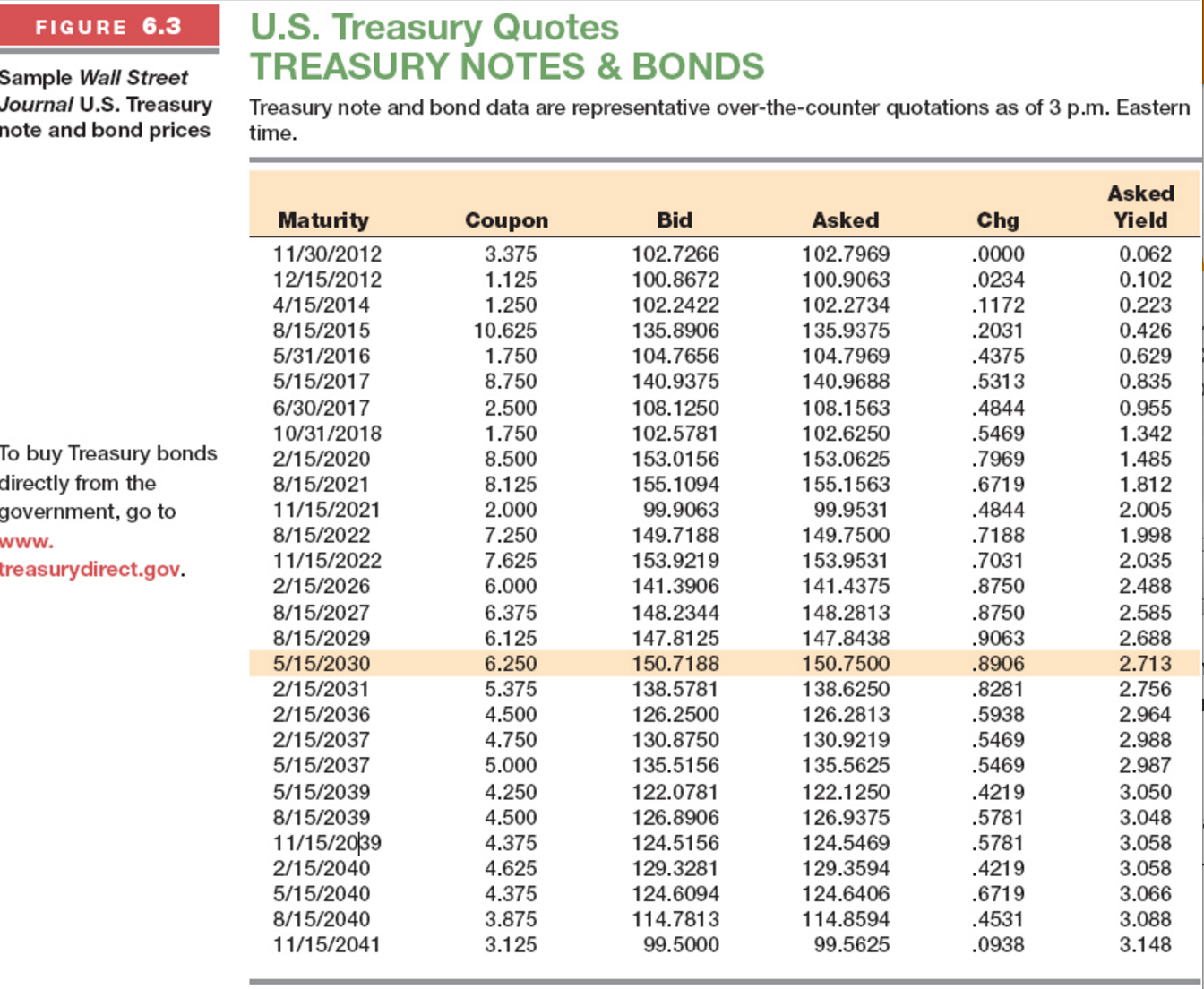

| 2. Crossfade Co. issued 17-year bonds two years ago at a coupon rate of 10.1 percent. The bonds make semiannual payments. If these bonds currently sell for 97 percent of par value, what is the YTM? 3. Locate the Treasury bond in Figure 6.3 maturing February 2026. Assume a $1,000 par value. 3a. Is this a premium or a discount bond? 3b. What is its current yield? 3c. What is its yield to maturity? 3d. What is the bid-ask spread in dollars?

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started