1-

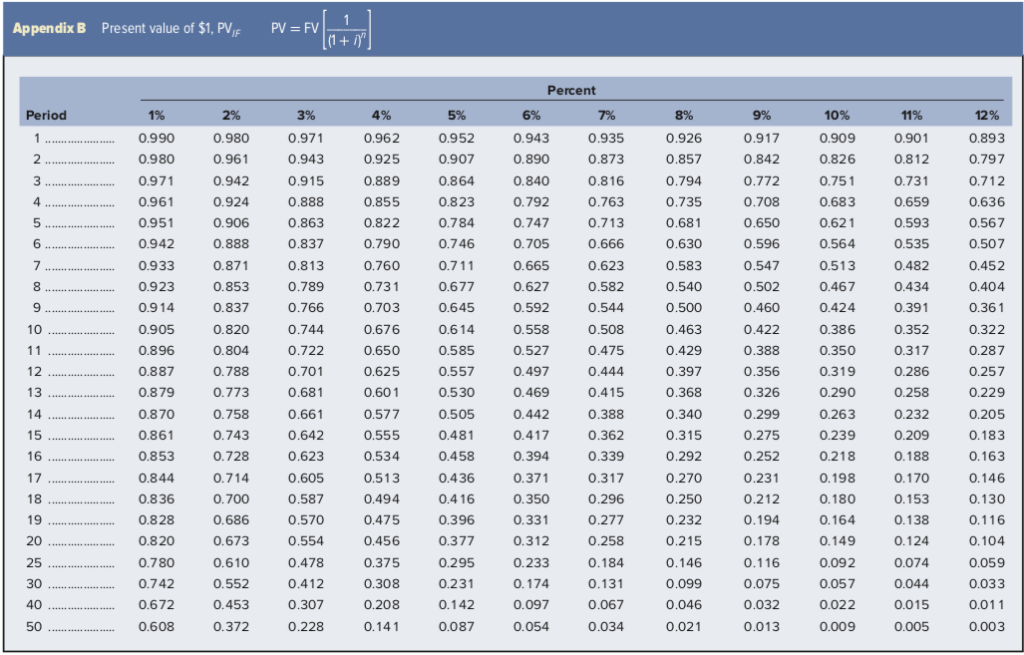

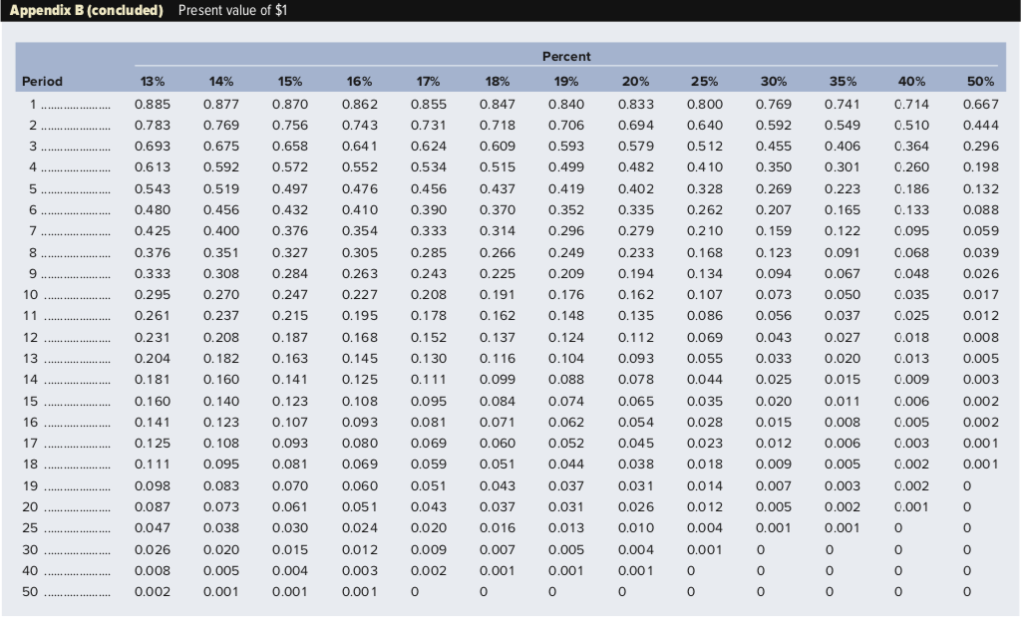

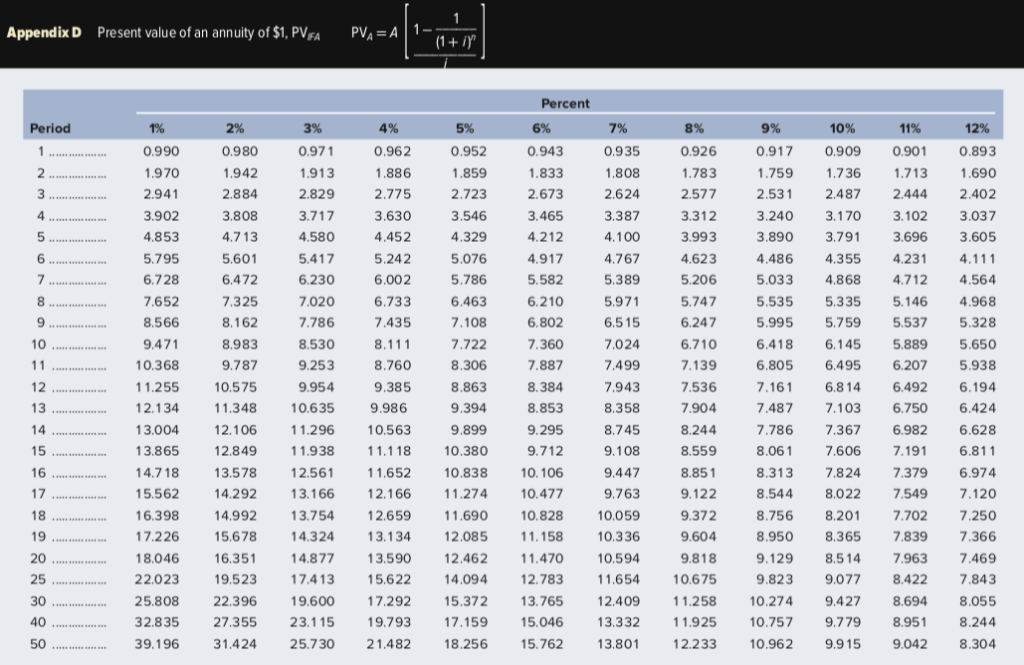

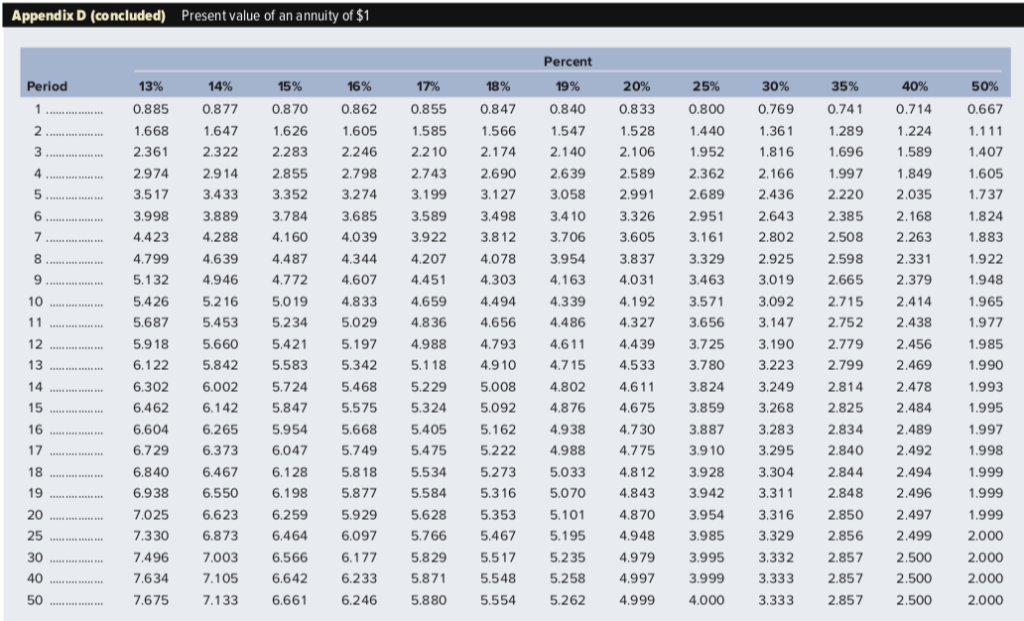

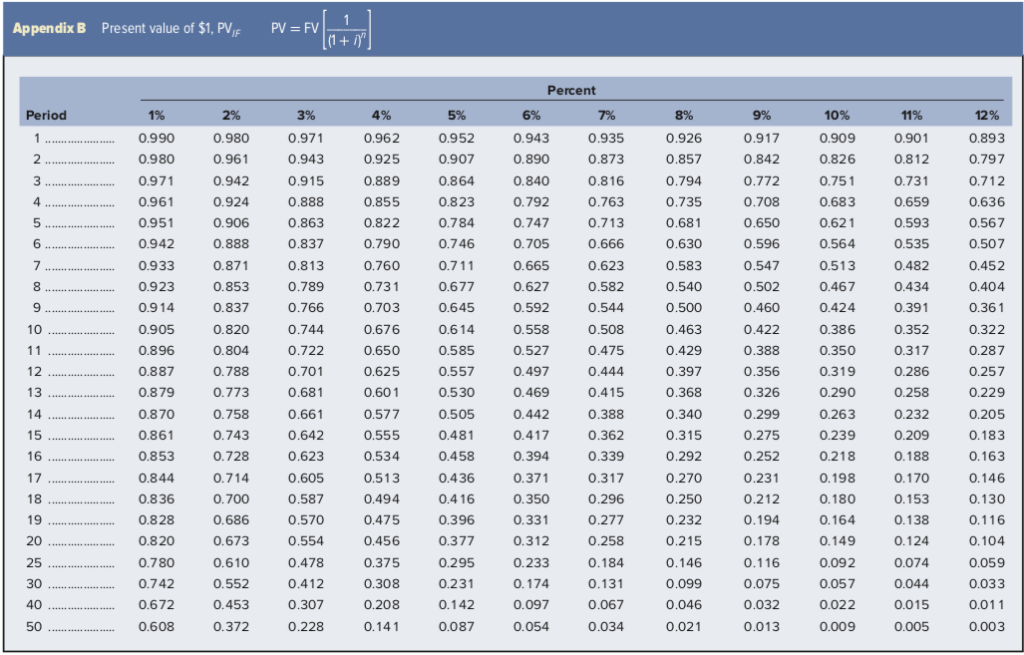

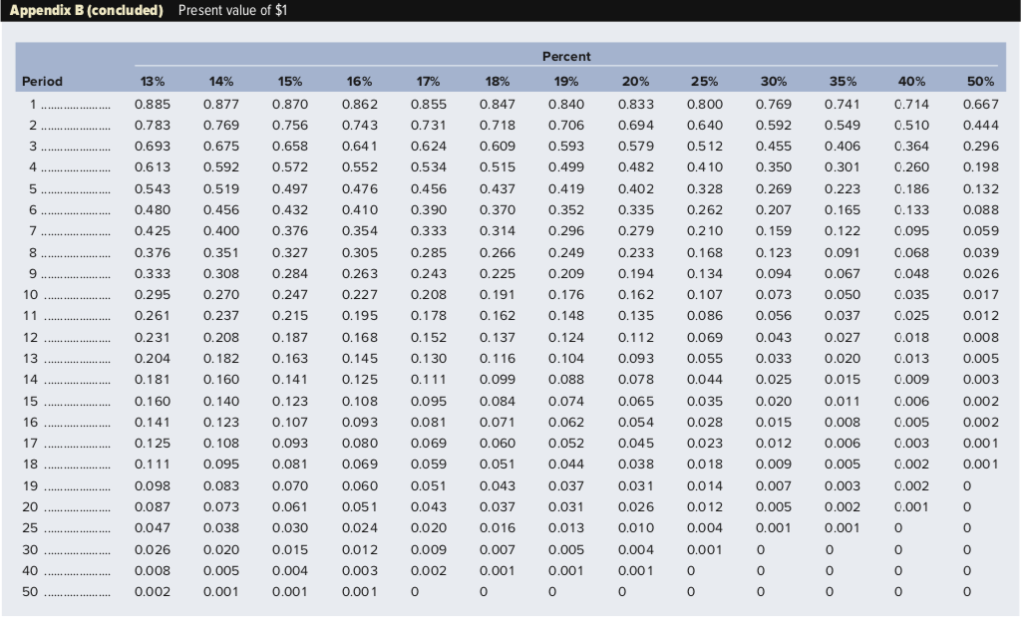

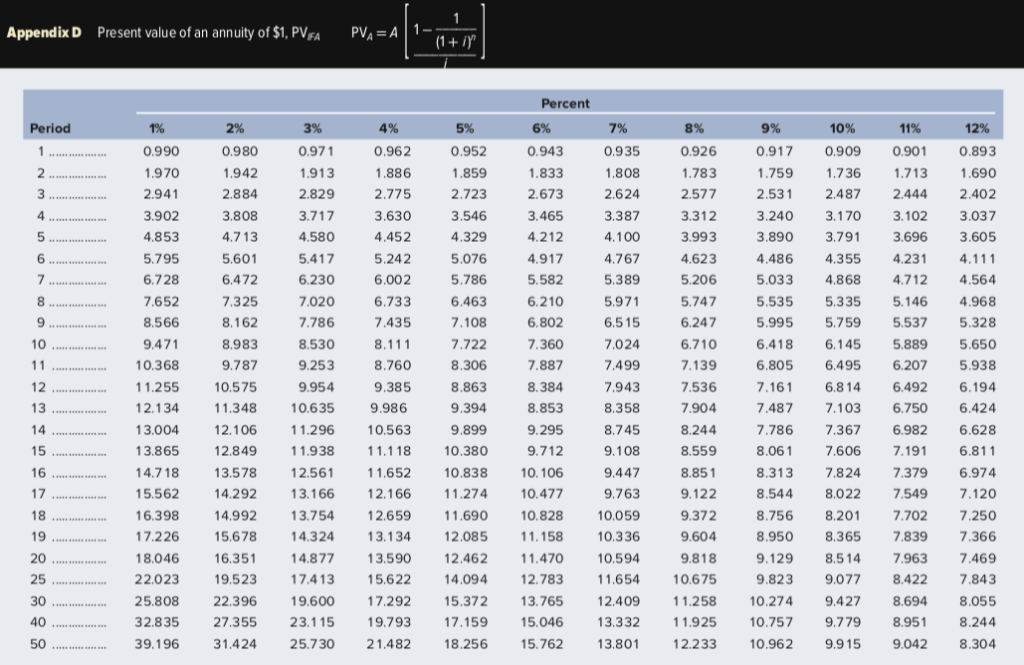

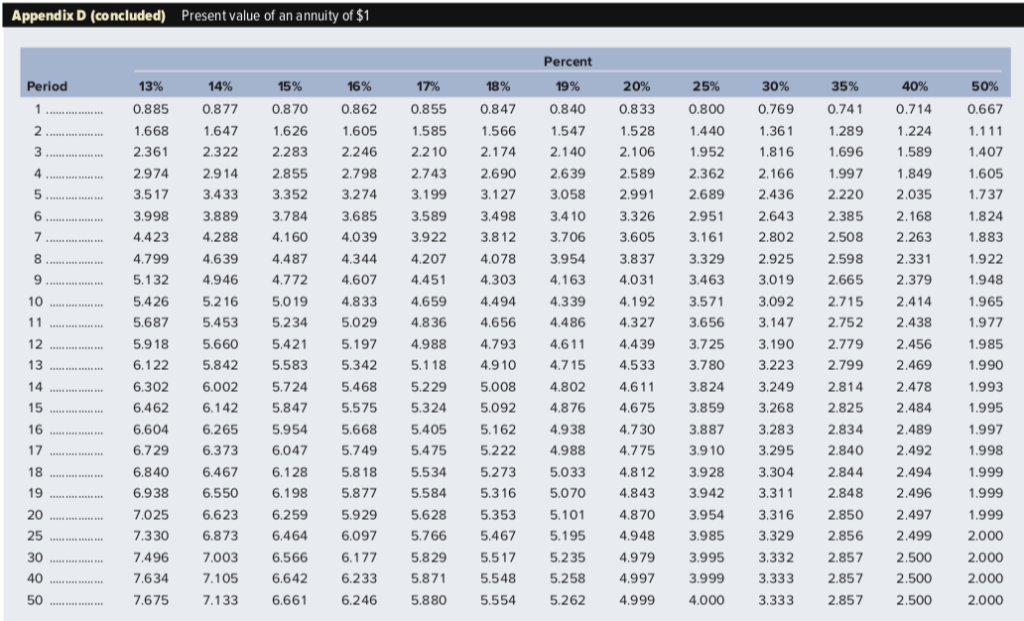

Mike Carlson will receive $18,000 a year from the end of the third year to the end of the 18th year (16 payments). The discount rate is 8%. The present value today of this deferred annuity is: Use Appendix B and Appendix D to calculate the answer.

-

$141,616

-

$117,812

-

$131,006

-

$136,536

2-

All of the following are advantages to the corporation of issuing convertibles EXCEPT:

-

Provides access for small companies to the debt market.

-

Provides a low-cost financing alternative for large, high-quality companies.

-

Is used when the corporation believes its stock is undervalued.

-

Generally is lower cost than straight debt.

1 Present value of $1, PV,E Appendix B PV = FV |(1+ iy Percent 2% 5% 6% Period 1% 3% 4% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 1 0.961 0.943 0,925 0.907 0.890 0.857 0.842 0.826 0.812 0.797 0.980 0.873 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.888 0.763 0.735 0.636 4 0.961 0.924 0.855 0.823 0.792 0.708 0.683 0.659 0.906 0.863 0.822 0.784 0.747 0.713 0.650 0.593 0.567 0.951 0.681 0.621 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.813 0.760 0.623 0.583 0.547 0.933 0.871 0.711 0.665 0.513 0.482 0.452 0.923 0.853 0.789 0.73 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.837 0.766 0.361 0.914 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 10 0.820 0.744 0.676 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.905 0.614 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 12 0.887 0.788 0.625 0.557 0.497 0.397 0.319 0.286 0.701 0.444 0.356 0.257 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.758 0.577 0.388 0.299 0.263 14 0.870 0.661 0.505 0.442 0.340 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.714 17 0.844 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.700 0.587 0.350 0.250 0.212 18 0.836 0.494 0.416 0.296 0.180 0.153 0.130 19 0.686 0.570 0.396 0.331 0.277 0.232 0.194 0.164 0.828 0.475 0.138 0.116 0.820 20 0.673 0.377 0.215 0.124 0.104 0.554 0.456 0.312 0.258 0.178 0.149 0.610 0.233 25 0.780 0.478 0.375 0.295 0.184 0.146 0.116 0.092 0.074 O.059 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 30 0.742 0.044 0.033 40 0.672 0.208 0.097 0.046 0.032 0.022 0.015 0.011 0.453 0.307 0.142 0.067 50 0.372 0.054 0.003 0.608 0.228 0.141 0.087 0.034 0.021 0.013 0.009 0,005 Present value of $1 Appendix B (concluded) Percent 30% 16% 40% Period 13% 14% 15% 17% 18% 19% 20% 25% 35% 50% 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.800 0.769 0.741 0.714 0.667 . 2. 0.769 0.756 0.694 0.549 0.510 0.783 0.743 0.731 0.718 0.706 0.640 0.592 0.444 0.675 0.579 3 0.693 0.658 0.64 0.624 0.609 0.593 0.512 0.455 0.406 0.364 0.296 0.572 0.515 0.482 0.613 0.592 0.552 0.534 0.499 0.410 0.350 0.301 0.260 0.198 0.519 0.497 0.476 0.437 0.419 0.402 0.328 0.269 0.186 0.132 5 0.543 0.456 0.223 6 0.335 0.165 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.262 0.207 0.133 0.088 7 0.425 0.400 0.376 0.314 0.279 0.210 0.122 0.354 0.333 0.296 0.159 0.095 0.059 8 . 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.168 0.091 0.068 0.039 0.123 0.048 0.284 0.194 0.067 0.333 0.308 0.263 0.243 0.225 0.209 0.134 0.094 0.026 10 0.295 0.270 0.247 0.191 0.162 0.107 0.035 0.227 0.208 0.176 0.073 0.050 0.017 11 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.086 0.056 0.037 0.025 0.012 0.231 0.124 0.069 0.043 12 0.208 0.187 0.112 0.027 0.018 0.008 0.168 0.152 0.137 13 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.055 0.033 O.020 0.013 0.005 14 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.044 0.025 0.015 0.009 0.003 0.020 0.006 0.160 0.140 0.084 0.074 0.002 15 0.123 0.108 0.095 0.065 0,035 0.011 16 0.141 0.123 0.107 O.093 0.081 0.071 0.062 0.054 0.028 0.015 0.008 0.005 0.002 17 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.023 O.012 0.006 0.003 0.001 18 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 0.070 19 0.098 0.083 0.060 0.051 0.043 0.037 0.031 0.014 0.007 0.003 0.002 0.061 0.037 0.026 0.012 0.001 20 0.087 0.073 0.05 0.043 0.031 0.005 0.002 C 25 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.004 0.001 0.001 0.015 0.007 0.004 0.001 30 0.026 0.020 0.012 0.009 0.005 40 0.008 0.005 0.004 0.001 0.001 0.001 0.003 0.002 C 0 O 50 0.002 0.001 0.001 O.001 C C C C C PVA=A 1- (1+i Appendix D Present value of an annuity of $1, PVFA Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.917 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.909 0.901 0.893 1.942 1.913 1.886 1,859 1.833 1,808 1.783 1.759 1.736 1.713 1.690 2.. 1.970 s. 2.577 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.53 2.487 2.444 2.402 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.102 3.037 4 3.240 3.170 5.... 4.853 4.713 4.580 4.452 4,329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 5.795 5.601 5.242 5.076 4.767 4.623 4.231 4.111 5.417 4.917 4.486 4.355 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 6.210 7.652 7.325 7.020 6.733 6.463 5.971 5.747 5.535 5.335 5.146 4.968 C 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 9.253 8.760 8.306 7.887 7.499 7.139 6.207 5.938 11 10.368 9,787 6.805 6,495 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 13 11.348 9.986 9.394 8.853 8.358 7.904 7.487 6.750 12.134 10.635 7.103 6.424 12.106 1.296 10.563 9.899 9.295 8.745 8.244 7.786 7,367 6.982 14 13.004 6.628 15 13.865 12.849 11.938 11.1 18 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 16 13.578 12.561 1 1.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 14.718 15.562 17 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 19 17.226 15.678 14.324 13.134 12.085 11.158 10,336 9.604 8.950 8.365 7.839 7.366 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7,469 17.413 25 22.023 19.523 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 22.396 19.600 17.292 15.372 1 1.258 10.274 8.055 30 25.808 13.765 12,409 9,427 8.694 40 32,835 27.355 23.115 19.793 17.159 15.046 13.332 1 1.925 10.757 9.779 8.951 8.244 50 39.196 31,424 25.730 18.256 12.233 10,962 9.042 8.304 21.482 15.762 13.801 9.915 Appendix D (concluded) Present value of an annuity of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 0.885 0.877 0.870 0.862 0.855 0.847 0.833 0.800 0.769 0.741 0.667 1 0.840 0.714 1.528 2 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.440 1.36 1.289 1.224 1.1 11 2.361 2.283 2.246 2.210 2.174 2.140 2.106 1.952 1.816 1.696 1.407 2.322 1.589 3. . 4 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.362 2.166 1,997 1.849 1.605 5 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.689 2.436 2.220 2.035 1.737 3.784 3.326 2.385 3.998 3.889 3.685 3.589 3.498 3.410 2.951 2.643 2.168 1.824 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.161 2.508 2.263 1.883 2.802 7 4.799 2.598 4.6.39 4.487 4.344 4.207 4.078 3.954 3.837 3.329 2.925 2.331 1.922 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.463 2.665 1.948 3.019 2.379 5.0 19 2.715 10 5,426 5.216 4.833 4.659 4.494 4.339 4.192 3.571 3.092 2.414 1.965 11 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 3.656 3.147 2.752 2.438 1.977 5.421 4.793 4.439 2.779 1.985 12 5.918 5.660 5.197 4.988 4.611 3.725 3.190 2.456 13 6.122 5.842 5.583 5.342 5.118 4.9 10 4.715 4.533 3.780 3.223 2.799 2.469 1,990 2.814 14 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 3.824 3.249 2.478 1.993 15 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 3.859 3.268 2.825 1.995 2.484 4.730 16 6.604 6.265 5.954 5.668 5.405 5.162 4.938 3.887 3.283 2.834 2,489 1.997 17 6.729 6.373 6.047 5.749 5.475 5.222 4.988 4.775 3.910 3.295 2.840 2.492 1.998 5.273 4,812 3.928 18 6.840 6.467 6.128 5.818 5.534 5.033 3.304 2.844 2.494 1.999 5.316 19 6.938 6.198 5.877 4.843 3.942 2.848 6.550 5.584 5.070 3.311 2.496 1.999 6.259 4.870 2.850 20 7.025 6.623 5.929 5.628 5.353 5.101 3.954 3.316 2.497 1.999 25 7.330 6.873 6,464 6.097 5.766 5.467 5.195 4,948 3.985 3.329 2.856 2.499 2.000 7,496 6.177 5.829 30 7.003 6.566 5.517 5.235 4.979 3.995 3.332 2.857 2.500 2.000 40 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4,997 3.999 3.333 2.857 2.500 2.000 50 7.675 7.133 6.661 5.880 5.262 4.999 4.000 3.333 2.857 2.000 6.246 5.554 2.500