Answered step by step

Verified Expert Solution

Question

1 Approved Answer

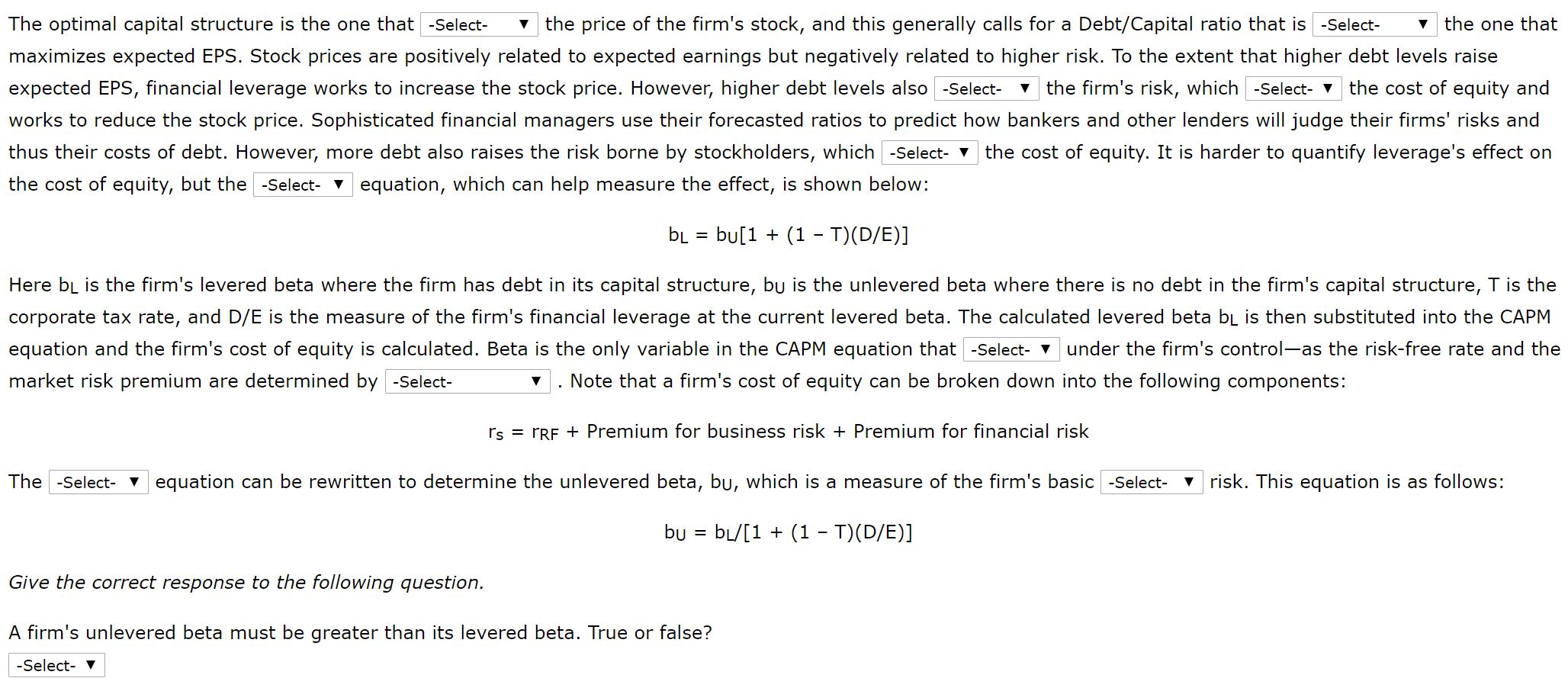

1) minimize/maximize 2) equal to/ lower than/ higher than 3) increase/ decrease 4) lowers/ raises 5) lowers/ raises 6) Gordon/ CAPM/ Hamada 7) is/ isn't

1) minimize/maximize

2) equal to/ lower than/ higher than

3) increase/ decrease

4) lowers/ raises

5) lowers/ raises

6) Gordon/ CAPM/ Hamada

7) is/ isn't

8) company actions/ market forces/ investor actions

9) Gordon/ CAPM/ Hamada

10) financial/ business/ market

11) true/ false

The optimal capital structure is the one that -Select the price of the firm's stock, and this generally calls for a Debt/Capital ratio that is -Select the one that maximizes expected EPS. Stock prices are positively related to expected earnings but negatively related to higher risk. To the extent that higher debt levels raise expected EPS, financial leverage works to increase the stock price. However, higher debt levels also -Select- v the firm's risk, which -Select- v the cost of equity and works to reduce the stock price. Sophisticated financial managers use their forecasted ratios to predict how bankers and other lenders will judge their firms' risks and thus their costs of debt. However, more debt also raises the risk borne by stockholders, which -Select- v the cost of equity. It is harder to quantify leverage's effect on the cost of equity, but the -Select- y equation, which can help measure the effect, is shown below: bL = bu[1 + (1 - T)(D/E)] Here bl is the firm's levered beta where the firm has debt in its capital structure, bu is the unlevered beta where there is no debt in the firm's capital structure, T is the corporate tax rate, and D/E is the measure of the firm's financial leverage at the current levered beta. The calculated levered beta bl is then substituted into the CAPM equation and the firm's cost of equity is calculated. Beta is the only variable in the CAPM equation that -Select- v under the firm's control-as the risk-free rate and the market risk premium are determined by -Select- v . Note that a firm's cost of equity can be broken down into the following components: rs = rRF + Premium for business risk + Premium for financial risk The -Select- y equation can be rewritten to determine the unlevered beta, bu, which is a measure of the firm's basic -Select- v risk. This equation is as follows: bu = b[/[1 + (1 - 1)(D/E)] Give the correct response to the following question. A firm's unlevered beta must be greater than its levered beta. True or false? -Select- vStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started