Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Monica qualifies for which of the following credits? a. Child and Dependent Care Credit b. BothAandB c. Neither A nor B 2. What amount

1. Monica qualifies for which of the following credits? a. Child and Dependent Care Credit b. BothAandB c. Neither A nor B

2. What amount can Monica claim as an adjustment for the supplies she purchased out of pocket? ______________ ($450 is wrong)

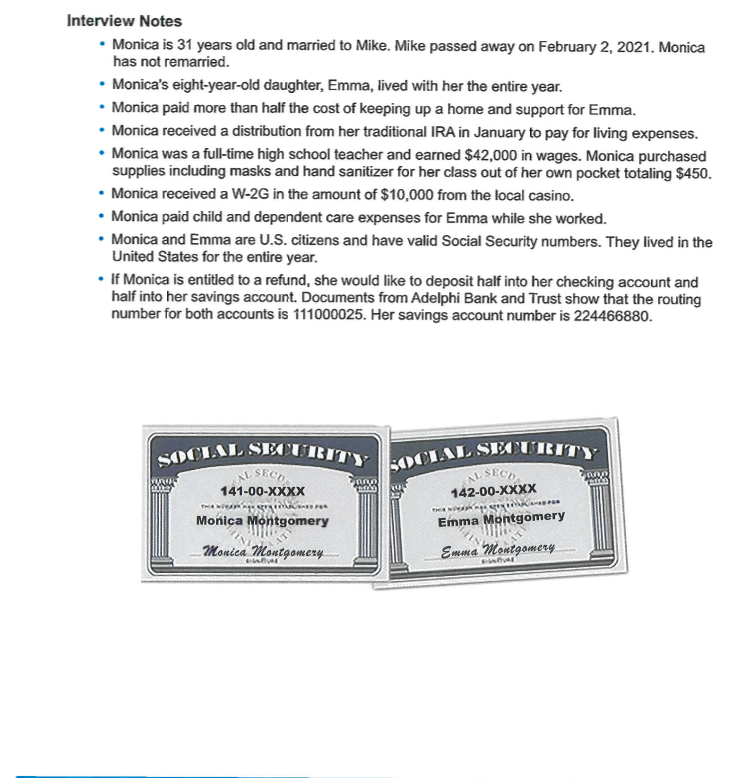

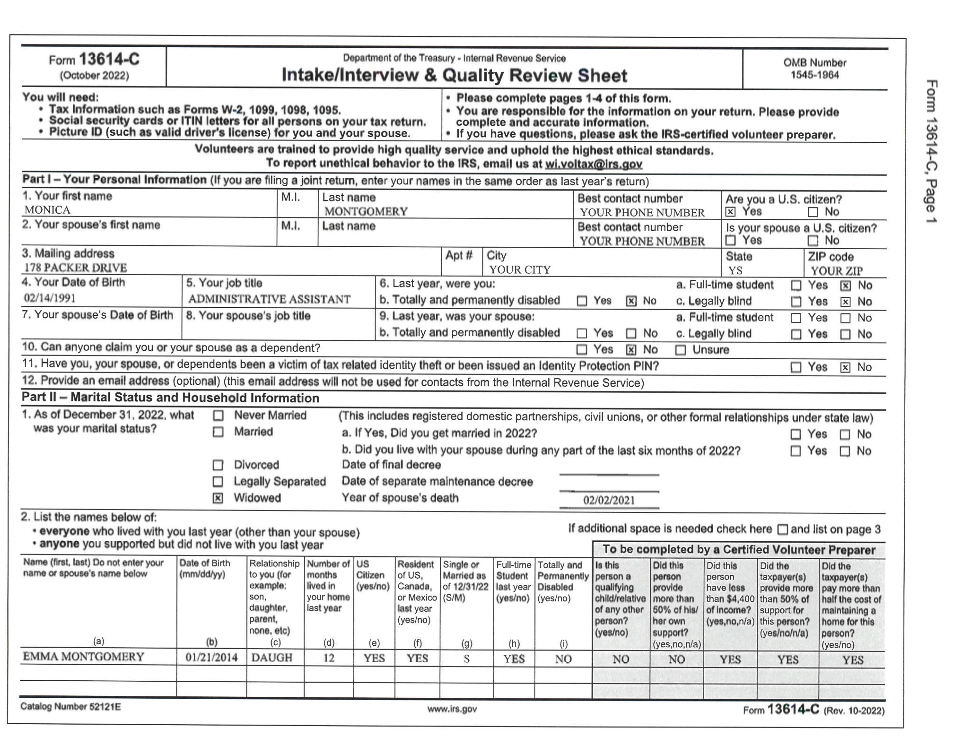

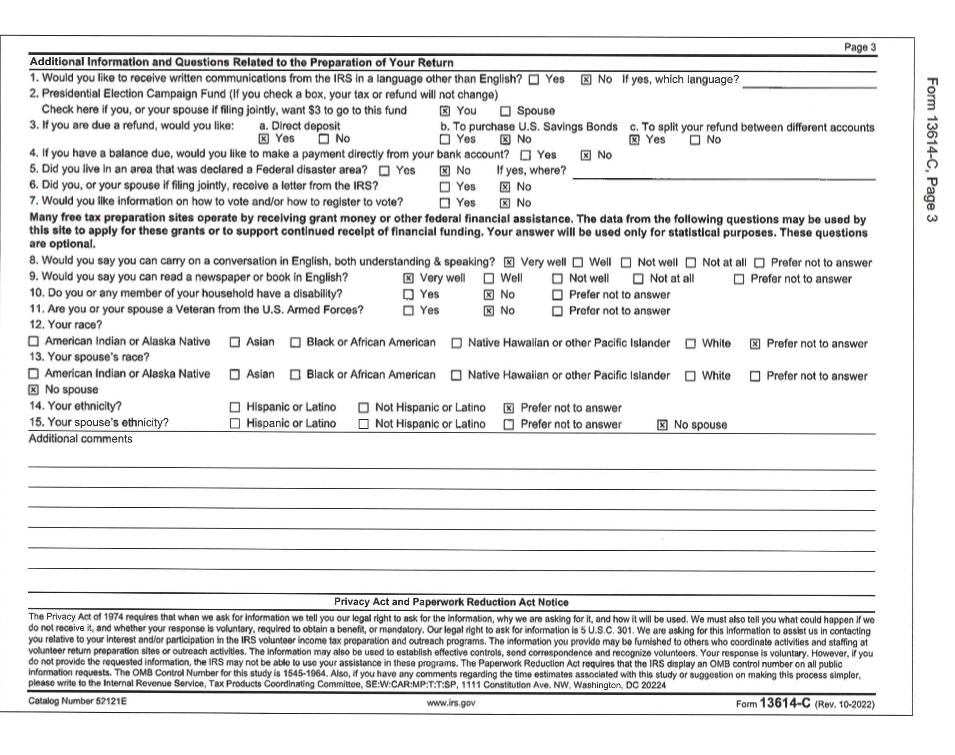

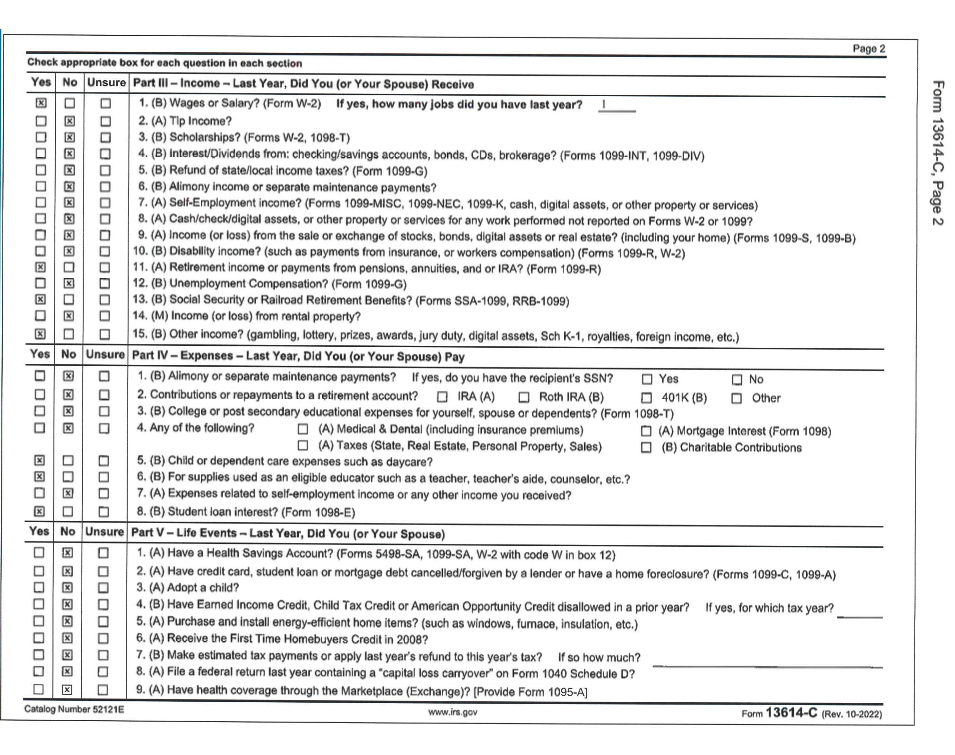

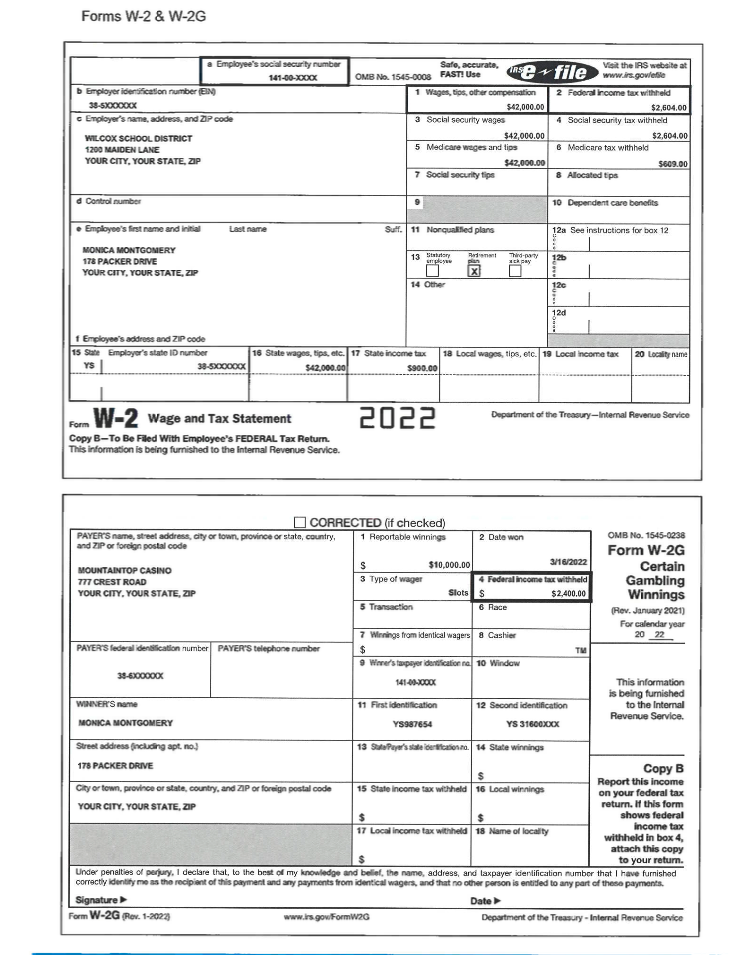

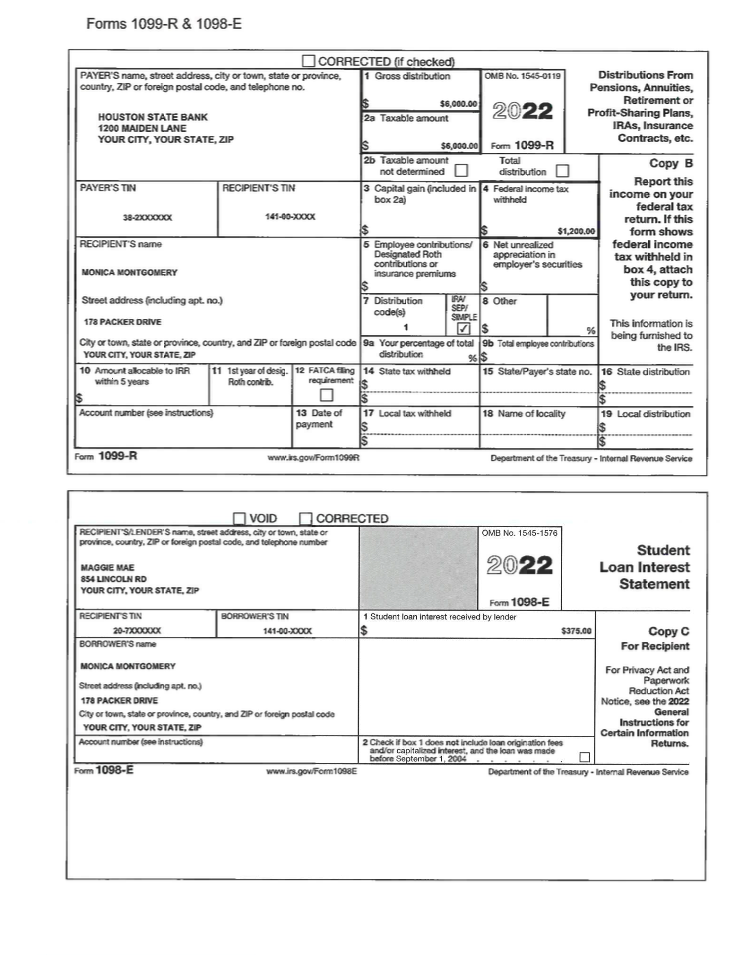

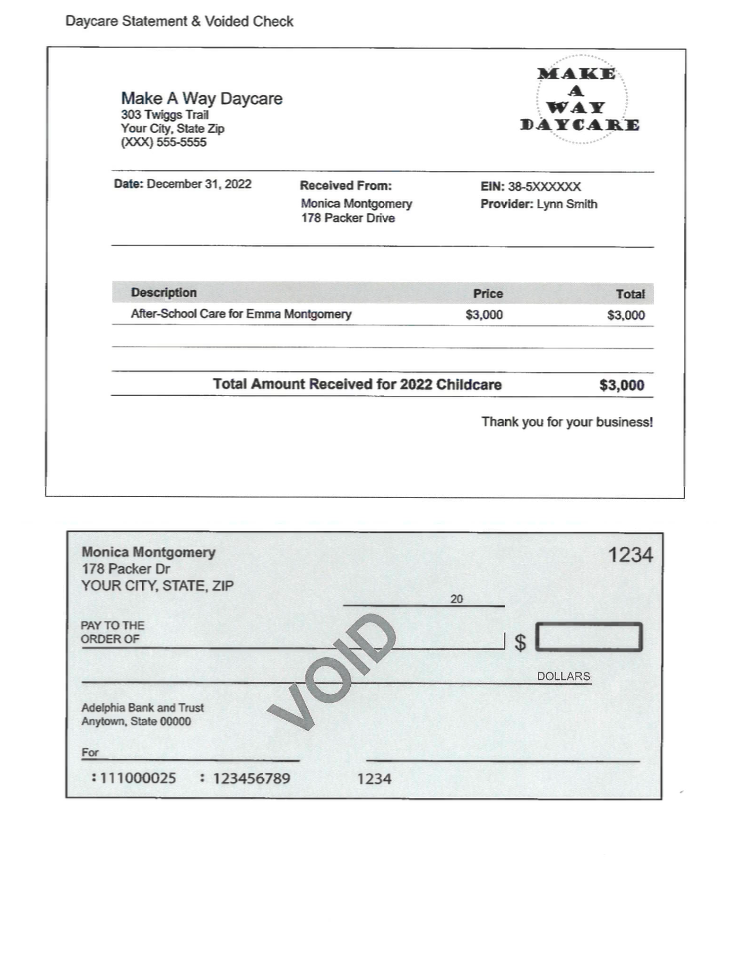

Interview Notes - Monica is 31 years old and married to Mike. Mike passed away on February 2, 2021. Monica has not remarried. - Monica's eight-year-old daughter, Emma, lived with her the entire year. - Monica paid more than half the cost of keeping up a home and support for Emma. - Monica received a distribution from her traditional IRA in January to pay for living expenses. - Monica was a full-time high school teacher and earned $42,000 in wages. Monica purchased supplies including masks and hand sanitizer for her class out of her own pocket totaling $450. - Monica received a W-2G in the amount of $10,000 from the local casino. - Monica paid child and dependent care expenses for Emma while she worked. - Monica and Emma are U.S. citizens and have valid Social Security numbers. They lived in the United States for the entire year. - If Monica is entitled to a refund, she would like to deposit half into her checking account and half into her savings account. Documents from Adelphi Bank and Trust show that the routing number for both accounts is 111000025 . Her savings account number is 224466880. 2. List the names below of: - everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 Additional Information and Questions Related to the Preparation of Your Return 1. Would you like to receive written communications from the IRS in a language other than English? Yes No If yes, which language? 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) Check here if you, or your spouse if filing jointly, want $3 to go to this fund 3. If you are due a refund, would you like: a. Direct deposit [ You Spouse No b. To purchase U.S. Savings Bonds c. To split your refund between different accounts 4. If you have a balance due, would you like to make a payment directly from your bank account? Yes No 5. Did you llve in an area that was declared a Federal disaster area? Yes No If yes, where? 6. Did you, or your spouse if filing jointly, recolve a letter from the IRS? Yes No 7. Would you like information on how to vote and/or how to register to vote? Yes No Many free tax preparation sites operate by recelving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued recelpt of financial funding. Your answer will be used only for statistical purposes. These questions are optional. 8. Would you say you can carry on a conversation in English, both understanding \& speaking? Very well Well Not well Not at all Prefer not to answer 9. Would you say you can read a newspaper or book in English? Prefer not to answer 10. Do you or any member of your household have a disability? 11. Are you or your spouse a Veteran from the U.S. Armed Forces? Yes Yo 12. Your race? American Indian or Alaska Native Asian Black or African American Native Hawalian or other Pacific Islander White Prefer not to answer 13. Your spouse's race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White Prefer not to answer No spouse 14. Your ethnicity? Hispanic or Latino Not Hispanic or Latino Prefer not to answer 15. Your spouse's ethnicity? Hispanic or Latino Not Hispanic or Latino Prefer not to answer Additional comments Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen If wo do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U. S.C. 301 . We are asking for this information to assist us in contacting you relative to your interest andior participation in the IRS volunteer income tax preparation and cutreach programs. The information you provide may bo furnished to others who coordinate activities and staffing at volunieer return preparation sites or outreach activities. The information may also be usod to establish effective controls, send correspondence and recognize volunteors. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545 -1964. Also, if you have amy comments regarding the time estimates associated with this study or suggestion on making thils process simpler. please write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224 Check appropriate box for each question in each section Forms W-2 \& W-2G Forms 1099-R \& 1098-E Daycare Statement \& Voided CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started