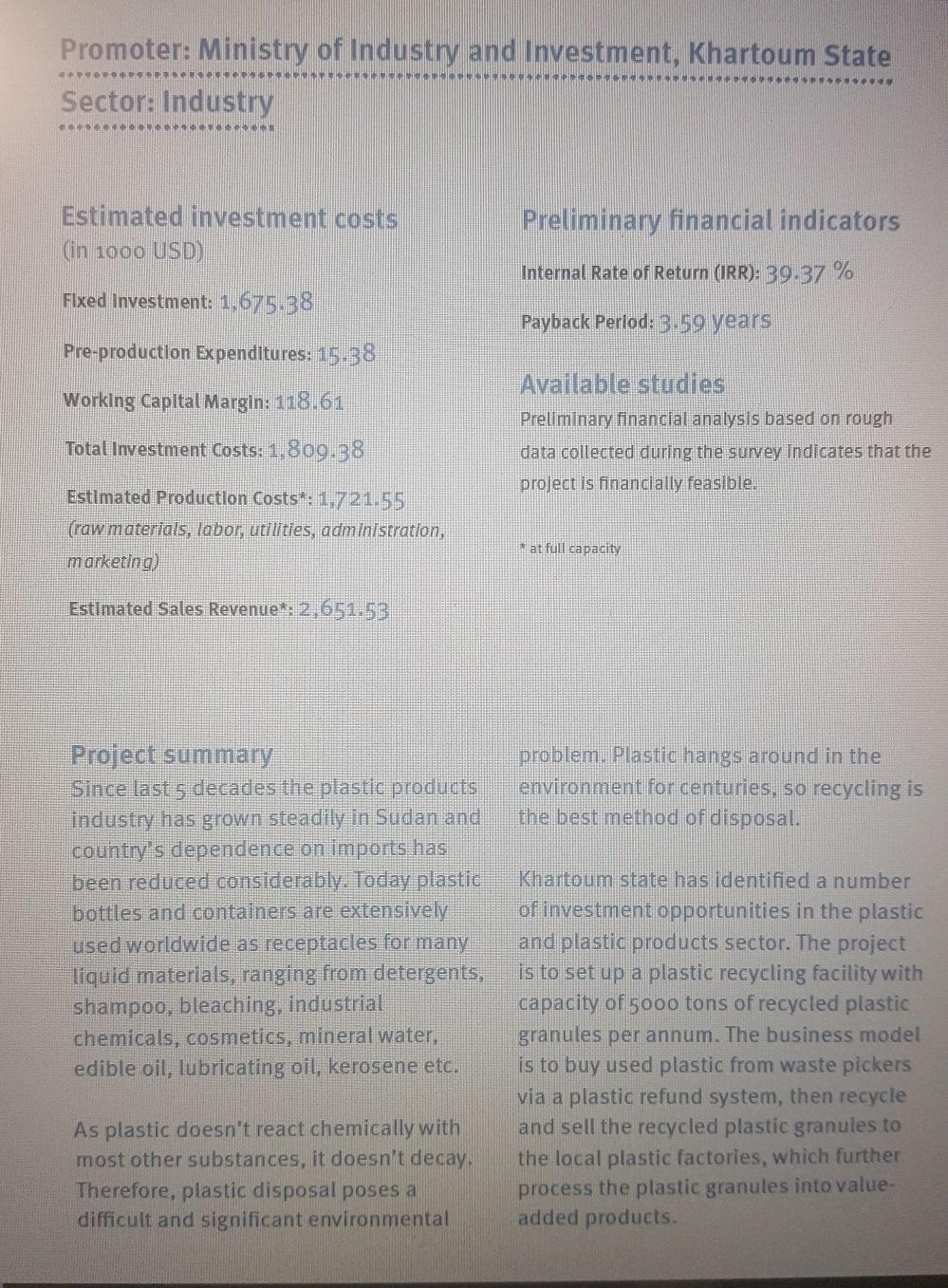

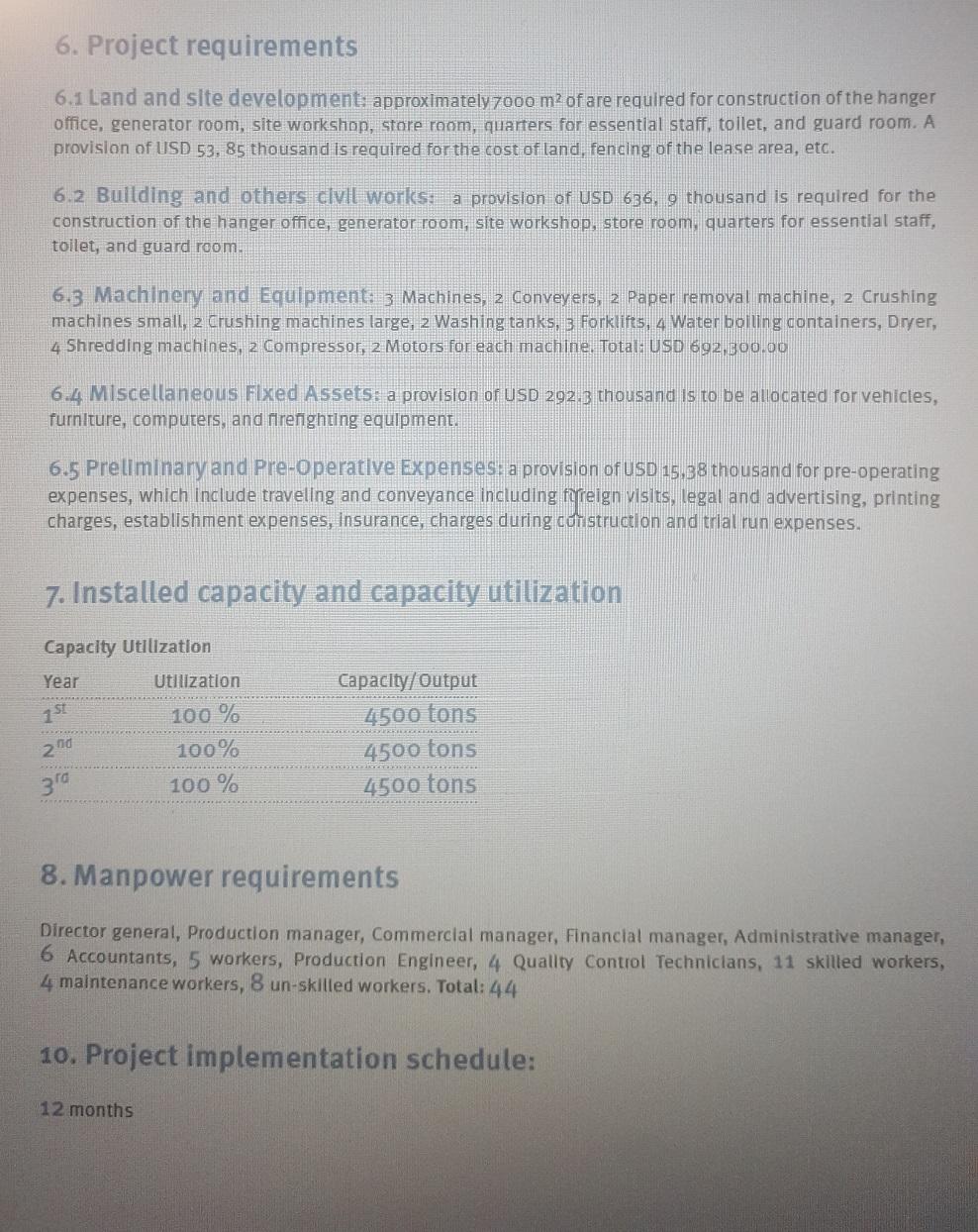

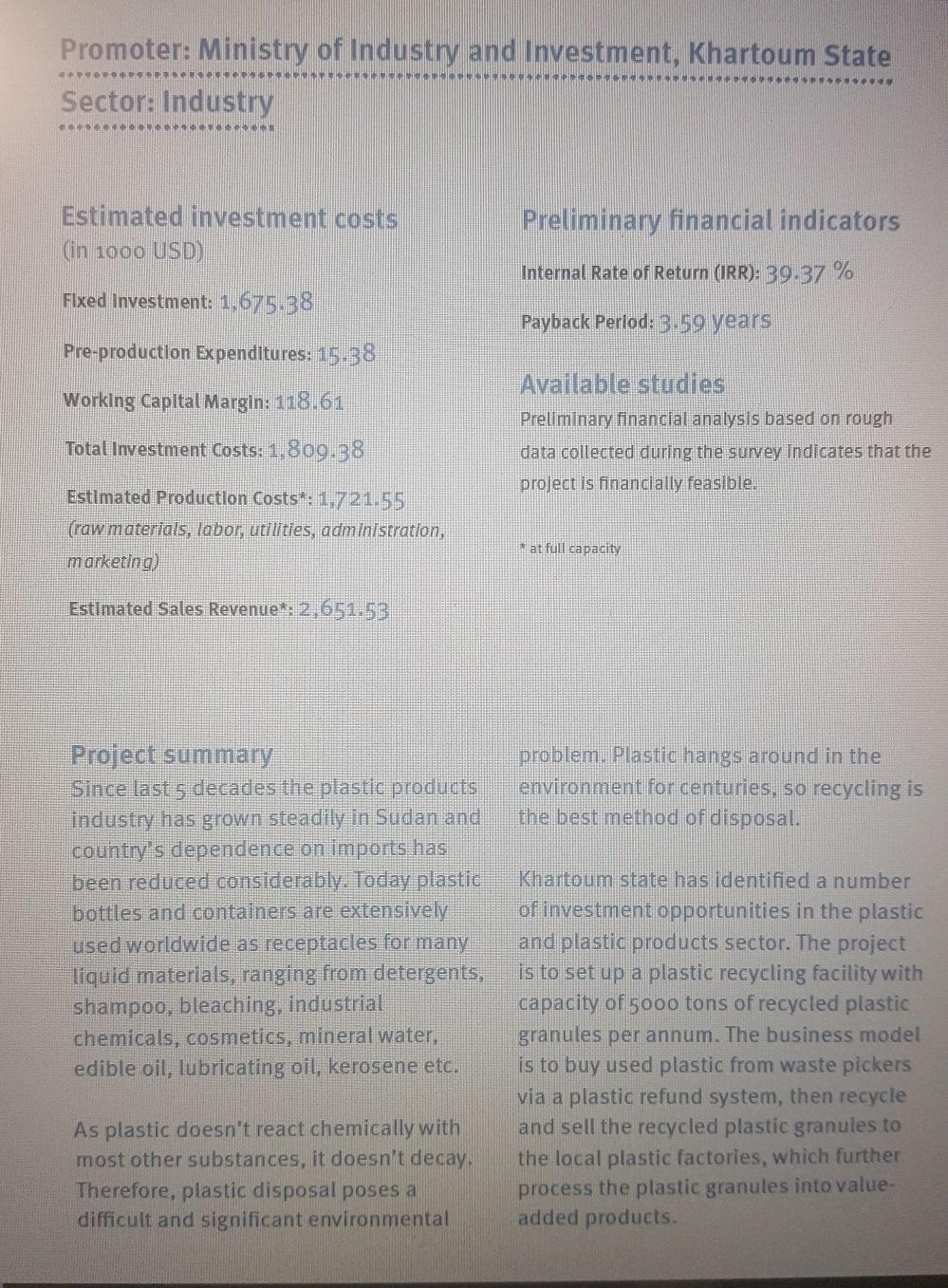

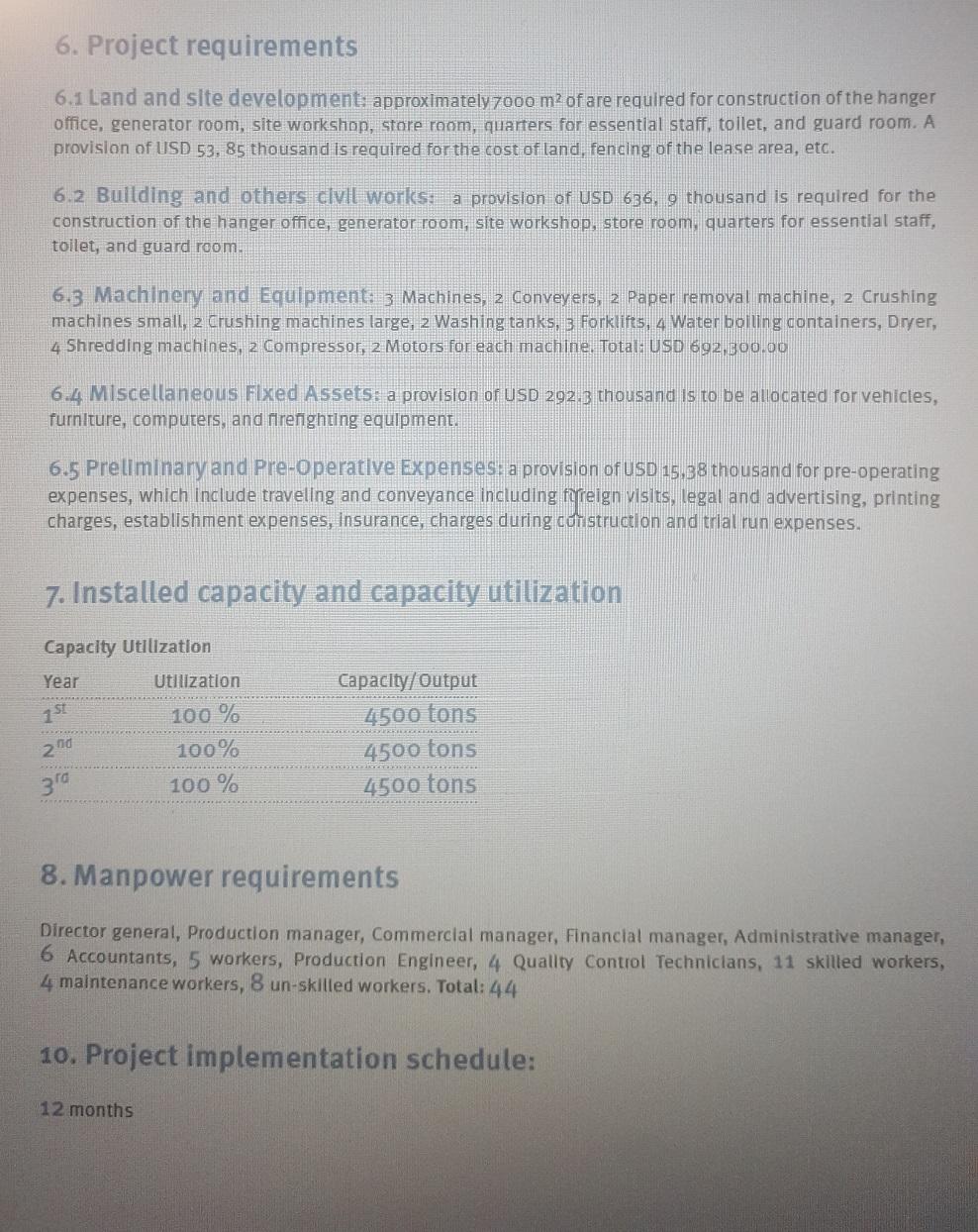

1. (Monte Carlo) Review the attached UNIDO report which describes technical and financial parameters for a plastics recycling project in Sudan. (a) (5 points) Construct a spreadsheet tab listing assumptions outlined in the report that would affect the financial evaluation of the project. Include only assumptions in your tab-do not include any outputs. (b) (10 points) Construct a spreadsheet tab that lays out cash inflows and outflows for the project in the first 15 years, making sure to account for any guidelines on implementation timelines, and using information provided in the report. (c) (5 points) Assume that after 15 years, the terminal value of the project is zero. Com- pute the NPV of the project, using discount rates of 20%, 30% and 40%. Are the NPV calculations consistent with the IRR of 39.37% listed in the report? (d) (10 points) The report assumes that annual revenue will amount to $2,651,530. Assume that annual revenue is normally distributed with a mean of $2,700,000 and a standard deviation $600,000. Assume that revenue cannot be negative. Assume that all other financial parameters are as above. Assume in particular that costs do not change. Using 10,000 trials, compute the expected NPV of the project at a discount rate of 30%. It may be helpful for you to construct a separate tab in which you compute project NPV for a single trial on a single row of the spreadsheet. (e) (5 points) What is the 90% confidence interval for project NPV at a discount rate of 30%? Be sure to use the confidence interval implied by your trials in part (d) and not the confidence interval suggested by a normally distributed NPV. (f) (5 points) Now assume that annual revenue is normally distributed with a mean of $2,400,000 and a standard deviation $900,000. Assume that revenue cannot be negative. Assume that all other financial parameters are as above. Assume in particular that costs do not change. Using 10,000 trials, compute the expected NPV of the project at a discount rate of 30% Does expected NPV go down or up relative to part (d)? Can you provide an explanation for the change in expected NPV relative to part (d)? Total Points Promoter: Ministry of Industry and Investment, Khartoum State Sector: Industry COM Estimated investment costs (in 1000 USD) Preliminary financial indicators Internal Rate of Return (IRR): 39.37 % Fixed Investment: 1,675.38 Payback Perlod: 3.59 years Pre-production Expenditures: 15.38 Working Capital Margin: 118.61 Available studies Preliminary financial analysis based on rough data collected during the survey indicates that the project is financially feasible. Total Investment Costs: 1,809.38 Estimated Production Costs : 1,7 21.55 (raw materials, labor, utilities, administration, marketing) * at full capacity Estimated Sales Revenue*: 2,651.53 problem. Plastic hangs around in the environment for centuries, so recycling is the best method of disposal. Project summary Since last 5 decades the plastic products industry has grown steadily in Sudan and country's dependence on imports has been reduced considerably. Today plastic bottles and containers are extensively used worldwide as receptacles for many liquid materials, ranging from detergents, shampoo, bleaching, industrial chemicals, cosmetics, mineral water, edible oil, lubricating oil, kerosene etc. Khartoum state has identified a number of investment opportunities in the plastic and plastic products sector. The project is to set up a plastic recycling facility with capacity of 5ooo tons of recycled plastic granules per annum. The business model is to buy used plastic from waste pickers via a plastic refund system, then recycle and sell the recycled plastic granules to the local plastic factories, which further process the plastic granules into value- added products. As plastic doesn't react chemically with most other substances, it doesn't decay. Therefore, plastic disposal poses a difficult and significant environmental 6. Project requirements 6.1 Land and site development: approximately 7000 m2 of are required for construction of the hanger office, generator room, site workshop, store room, quarters for essential staff, toilet, and guard room. A provision of USD 53, 85 thousand is required for the cost of land, fencing of the lease area, etc. 6.2 Bullding and others clvll worksa provision of USD 636, 9 thousand is required for the construction of the hanger office, generator room, site workshop, store room quarters for essential staff, toilet, and guard room. 6.3 Machinery and Equipment: 3 Machines, 2 Conveyers, 2 Paper removal machine, 2 Crushing machines small, 2 Crushing machines large, 2 Washing tanks, 3 Forklifts, 4 Water boiling containers, Dryer, 4 Shredding machines, 2 Compressor 2 Motors for each machine. Total: USD 692,300.00 6.4 Miscellaneous Fixed Assets: a provision of USD 292.3 thousand is to be allocated for vehicles, furniture, computers, and firenghting equlpment. 6.5 Preliminary and Pre-Operative Expenses: a provision of USD 15,38 thousand for pre-operating expenses, which include traveling and conveyance including fyreign visits, legal and advertising, printing charges, establishment expenses, Insurance, charges during construction and trial run expenses. 7. Installed capacity and capacity utilization Capacity Utilization Year Utilization 15 2nd 3rd 100 % 100% 100 % Capacity/Output 4500 tons 4500 tons 4500 tons 8. Manpower requirements Director general, Production manager, Commercial manager, Financial manager, Administrative manager, 6 Accountants, 5 workers, Production Engineer, 4 Quality Control Technicians, 11 skilled workers, 4 maintenance workers, 8 un-skilled workers. Total: 44 10. Project implementation schedule: 12 months 1. (Monte Carlo) Review the attached UNIDO report which describes technical and financial parameters for a plastics recycling project in Sudan. (a) (5 points) Construct a spreadsheet tab listing assumptions outlined in the report that would affect the financial evaluation of the project. Include only assumptions in your tab-do not include any outputs. (b) (10 points) Construct a spreadsheet tab that lays out cash inflows and outflows for the project in the first 15 years, making sure to account for any guidelines on implementation timelines, and using information provided in the report. (c) (5 points) Assume that after 15 years, the terminal value of the project is zero. Com- pute the NPV of the project, using discount rates of 20%, 30% and 40%. Are the NPV calculations consistent with the IRR of 39.37% listed in the report? (d) (10 points) The report assumes that annual revenue will amount to $2,651,530. Assume that annual revenue is normally distributed with a mean of $2,700,000 and a standard deviation $600,000. Assume that revenue cannot be negative. Assume that all other financial parameters are as above. Assume in particular that costs do not change. Using 10,000 trials, compute the expected NPV of the project at a discount rate of 30%. It may be helpful for you to construct a separate tab in which you compute project NPV for a single trial on a single row of the spreadsheet. (e) (5 points) What is the 90% confidence interval for project NPV at a discount rate of 30%? Be sure to use the confidence interval implied by your trials in part (d) and not the confidence interval suggested by a normally distributed NPV. (f) (5 points) Now assume that annual revenue is normally distributed with a mean of $2,400,000 and a standard deviation $900,000. Assume that revenue cannot be negative. Assume that all other financial parameters are as above. Assume in particular that costs do not change. Using 10,000 trials, compute the expected NPV of the project at a discount rate of 30% Does expected NPV go down or up relative to part (d)? Can you provide an explanation for the change in expected NPV relative to part (d)? Total Points Promoter: Ministry of Industry and Investment, Khartoum State Sector: Industry COM Estimated investment costs (in 1000 USD) Preliminary financial indicators Internal Rate of Return (IRR): 39.37 % Fixed Investment: 1,675.38 Payback Perlod: 3.59 years Pre-production Expenditures: 15.38 Working Capital Margin: 118.61 Available studies Preliminary financial analysis based on rough data collected during the survey indicates that the project is financially feasible. Total Investment Costs: 1,809.38 Estimated Production Costs : 1,7 21.55 (raw materials, labor, utilities, administration, marketing) * at full capacity Estimated Sales Revenue*: 2,651.53 problem. Plastic hangs around in the environment for centuries, so recycling is the best method of disposal. Project summary Since last 5 decades the plastic products industry has grown steadily in Sudan and country's dependence on imports has been reduced considerably. Today plastic bottles and containers are extensively used worldwide as receptacles for many liquid materials, ranging from detergents, shampoo, bleaching, industrial chemicals, cosmetics, mineral water, edible oil, lubricating oil, kerosene etc. Khartoum state has identified a number of investment opportunities in the plastic and plastic products sector. The project is to set up a plastic recycling facility with capacity of 5ooo tons of recycled plastic granules per annum. The business model is to buy used plastic from waste pickers via a plastic refund system, then recycle and sell the recycled plastic granules to the local plastic factories, which further process the plastic granules into value- added products. As plastic doesn't react chemically with most other substances, it doesn't decay. Therefore, plastic disposal poses a difficult and significant environmental 6. Project requirements 6.1 Land and site development: approximately 7000 m2 of are required for construction of the hanger office, generator room, site workshop, store room, quarters for essential staff, toilet, and guard room. A provision of USD 53, 85 thousand is required for the cost of land, fencing of the lease area, etc. 6.2 Bullding and others clvll worksa provision of USD 636, 9 thousand is required for the construction of the hanger office, generator room, site workshop, store room quarters for essential staff, toilet, and guard room. 6.3 Machinery and Equipment: 3 Machines, 2 Conveyers, 2 Paper removal machine, 2 Crushing machines small, 2 Crushing machines large, 2 Washing tanks, 3 Forklifts, 4 Water boiling containers, Dryer, 4 Shredding machines, 2 Compressor 2 Motors for each machine. Total: USD 692,300.00 6.4 Miscellaneous Fixed Assets: a provision of USD 292.3 thousand is to be allocated for vehicles, furniture, computers, and firenghting equlpment. 6.5 Preliminary and Pre-Operative Expenses: a provision of USD 15,38 thousand for pre-operating expenses, which include traveling and conveyance including fyreign visits, legal and advertising, printing charges, establishment expenses, Insurance, charges during construction and trial run expenses. 7. Installed capacity and capacity utilization Capacity Utilization Year Utilization 15 2nd 3rd 100 % 100% 100 % Capacity/Output 4500 tons 4500 tons 4500 tons 8. Manpower requirements Director general, Production manager, Commercial manager, Financial manager, Administrative manager, 6 Accountants, 5 workers, Production Engineer, 4 Quality Control Technicians, 11 skilled workers, 4 maintenance workers, 8 un-skilled workers. Total: 44 10. Project implementation schedule: 12 months