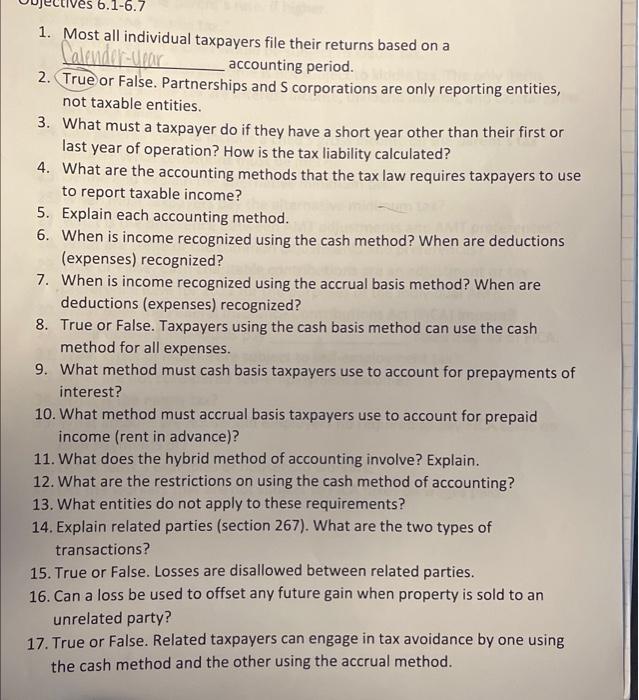

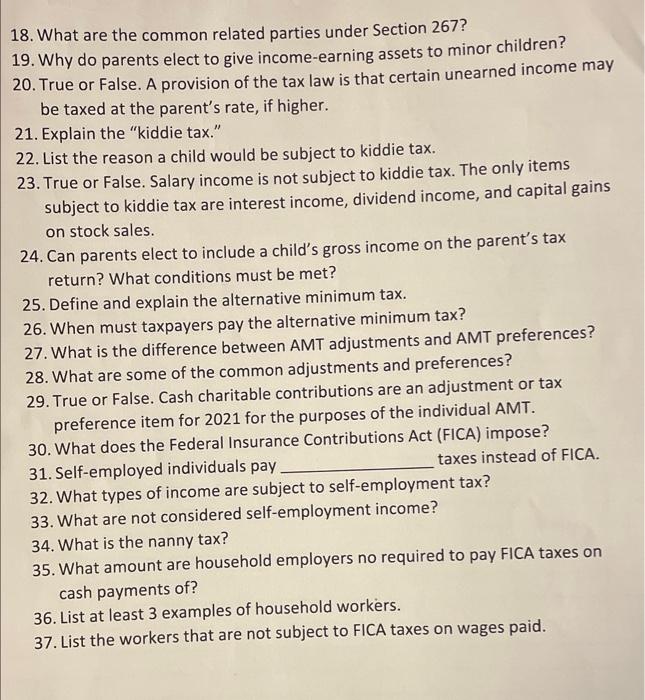

1. Most all individual taxpayers file their returns based on a accounting period. 2. True or False. Partnerships and S corporations are only reporting entities, not taxable entities. 3. What must a taxpayer do if they have a short year other than their first or last year of operation? How is the tax liability calculated? 4. What are the accounting methods that the tax law requires taxpayers to use to report taxable income? 5. Explain each accounting method. 6. When is income recognized using the cash method? When are deductions (expenses) recognized? 7. When is income recognized using the accrual basis method? When are deductions (expenses) recognized? 8. True or False. Taxpayers using the cash basis method can use the cash method for all expenses. 9. What method must cash basis taxpayers use to account for prepayments of interest? 10. What method must accrual basis taxpayers use to account for prepaid income (rent in advance)? 11. What does the hybrid method of accounting involve? Explain. 12. What are the restrictions on using the cash method of accounting? 13. What entities do not apply to these requirements? 14. Explain related parties (section 267). What are the two types of transactions? 15. True or False. Losses are disallowed between related parties. 16. Can a loss be used to offset any future gain when property is sold to an unrelated party? 17. True or False. Related taxpayers can engage in tax avoidance by one using the cash method and the other using the accrual method. 18. What are the common related parties under Section 267 ? 19. Why do parents elect to give income-earning assets to minor children? 20. True or False. A provision of the tax law is that certain unearned income may be taxed at the parent's rate, if higher. 21. Explain the "kiddie tax." 22. List the reason a child would be subject to kiddie tax. 23. True or False. Salary income is not subject to kiddie tax. The only items subject to kiddie tax are interest income, dividend income, and capital gains on stock sales. 24. Can parents elect to include a child's gross income on the parent's tax return? What conditions must be met? 25. Define and explain the alternative minimum tax. 26. When must taxpayers pay the alternative minimum tax? 27. What is the difference between AMT adjustments and AMT preferences? 28. What are some of the common adjustments and preferences? 29. True or False. Cash charitable contributions are an adjustment or tax preference item for 2021 for the purposes of the individual AMT. 30. What does the Federal Insurance Contributions Act (FICA) impose? 31. Self-employed individuals pay taxes instead of FICA. 32. What types of income are subject to self-employment tax? 33. What are not considered self-employment income? 34. What is the nanny tax? 35. What amount are household employers no required to pay FICA taxes on cash payments of? 36 . List at least 3 examples of household workers. 37. List the workers that are not subject to FICA taxes on wages paid