Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Mr. Darcy is managing director of the Pemberley Trading Co Ltd. He is paid an annual salary of 36000 and also bonuses based

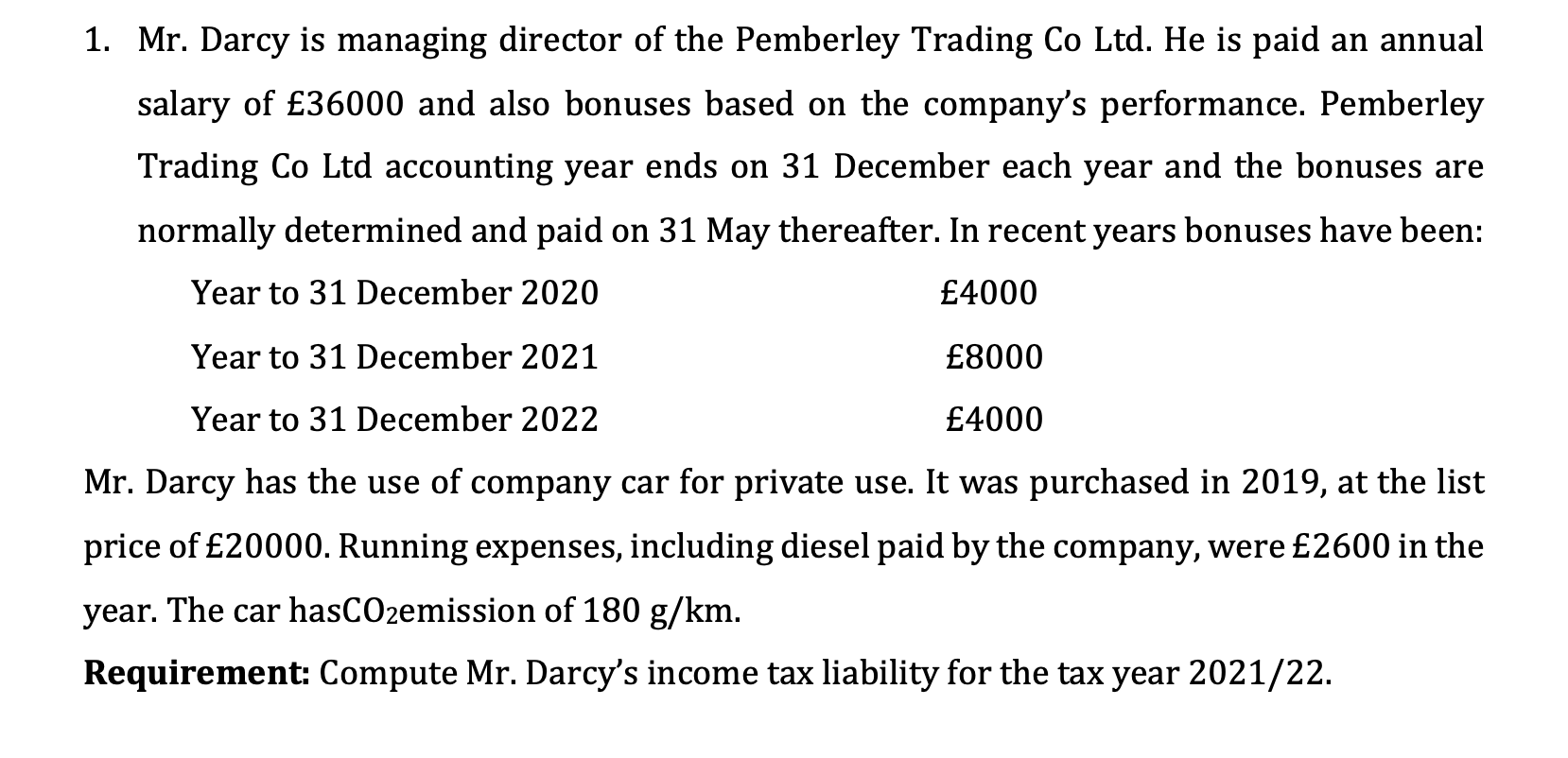

1. Mr. Darcy is managing director of the Pemberley Trading Co Ltd. He is paid an annual salary of 36000 and also bonuses based on the company's performance. Pemberley Trading Co Ltd accounting year ends on 31 December each year and the bonuses are normally determined and paid on 31 May thereafter. In recent years bonuses have been: Year to 31 December 2020 Year to 31 December 2021 Year to 31 December 2022 4000 8000 4000 Mr. Darcy has the use of company car for private use. It was purchased in 2019, at the list price of 20000. Running expenses, including diesel paid by the company, were 2600 in the year. The car hasCO2emission of 180 g/km. Requirement: Compute Mr. Darcy's income tax liability for the tax year 2021/22.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To compute Mr Darcys income tax liability for the tax year 202122 we need to calculate his total tax...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started