Answered step by step

Verified Expert Solution

Question

1 Approved Answer

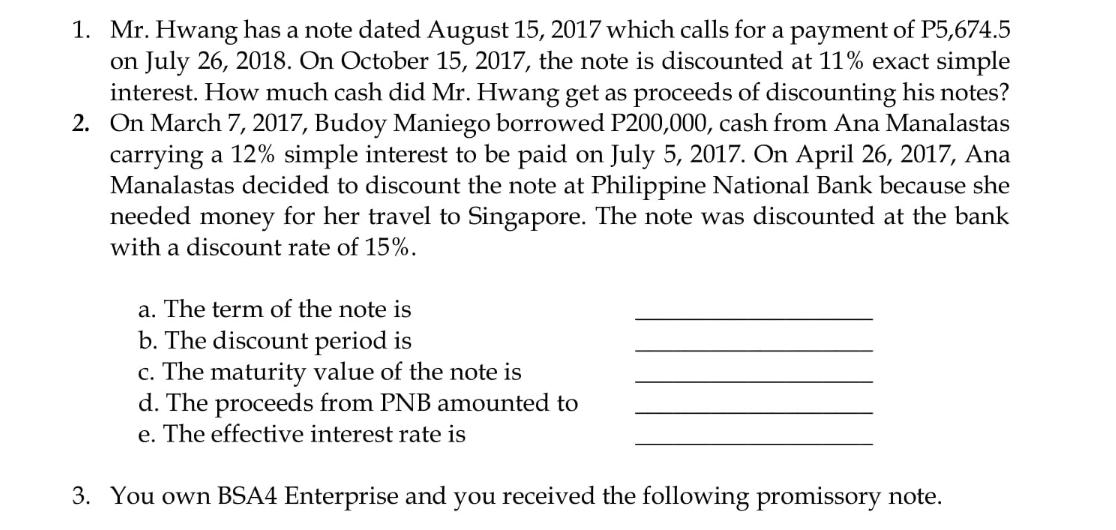

1. Mr. Hwang has a note dated August 15, 2017 which calls for a payment of P5,674.5 on July 26, 2018. On October 15,

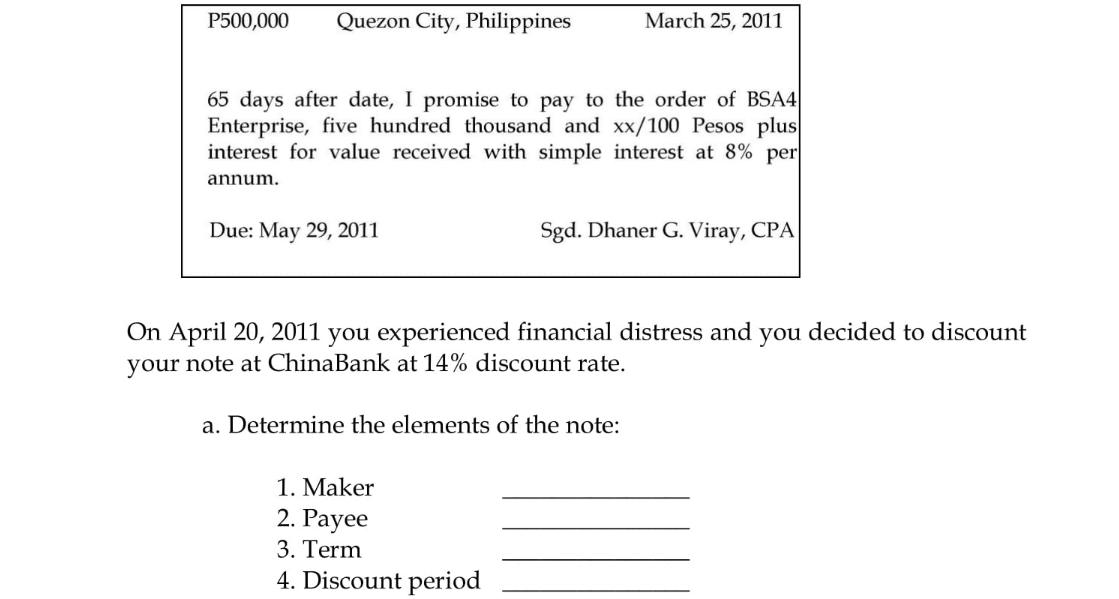

1. Mr. Hwang has a note dated August 15, 2017 which calls for a payment of P5,674.5 on July 26, 2018. On October 15, 2017, the note is discounted at 11% exact simple interest. How much cash did Mr. Hwang get as proceeds of discounting his notes? 2. On March 7, 2017, Budoy Maniego borrowed P200,000, cash from Ana Manalastas carrying a 12% simple interest to be paid on July 5, 2017. On April 26, 2017, Ana Manalastas decided to discount the note at Philippine National Bank because she needed money for her travel to Singapore. The note was discounted at the bank with a discount rate of 15%. a. The term of the note is b. The discount period is c. The maturity value of the note is d. The proceeds from PNB amounted to e. The effective interest rate is 3. You own BSA4 Enterprise and you received the following promissory note. P500,000 Quezon City, Philippines 65 days after date, I promise to pay to the order of BSA4 Enterprise, five hundred thousand and xx/100 Pesos plus interest for value received with simple interest at 8% per annum. Due: May 29, 2011 March 25, 2011 Sgd. Dhaner G. Viray, CPA On April 20, 2011 you experienced financial distress and you decided to discount your note at ChinaBank at 14% discount rate. a. Determine the elements of the note: 1. Maker 2. Payee 3. Term 4. Discount period b. Solve for the bank discount. c. How much would you be taking home as proceeds from discounting the note?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the cash proceeds from discounting the note we need to determine the discount and subtract it from the face value of the note The note is discounted on October 15 2017 and the payment d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started