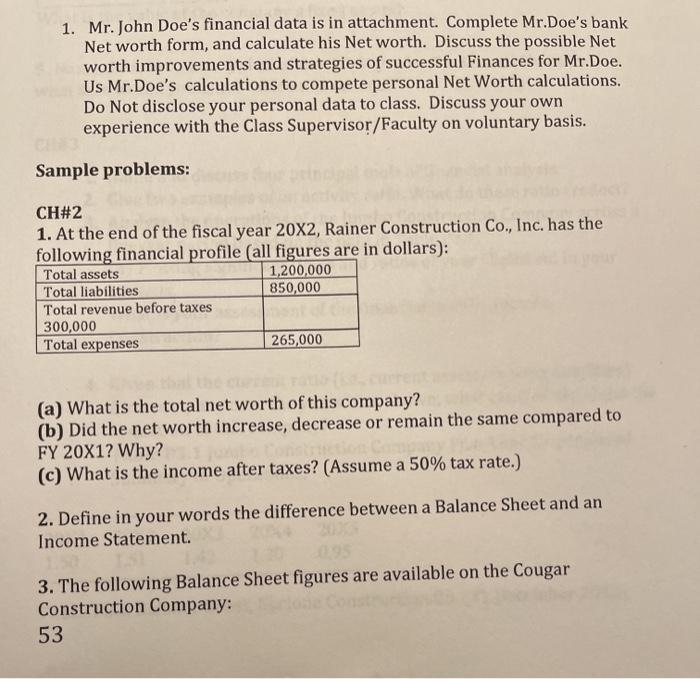

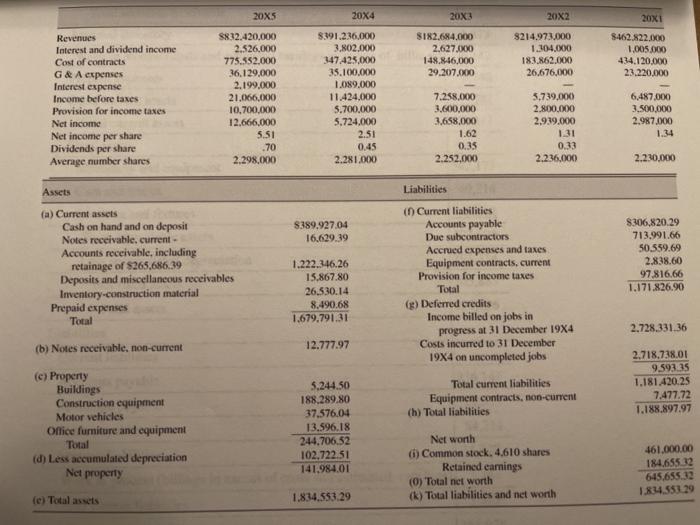

1. Mr. John Doe's financial data is in attachment. Complete Mr.Doe's bank Net worth form, and calculate his Net worth. Discuss the possible Net worth improvements and strategies of successful Finances for Mr.Doe. Us Mr.Doe's calculations to compete personal Net Worth calculations, Do Not disclose your personal data to class. Discuss your own experience with the Class Supervisor/Faculty on voluntary basis. Sample problems: CH#2 1. At the end of the fiscal year 20X2, Rainer Construction Co., Inc. has the following financial profile (all figures are in dollars): Total assets 1,200,000 Total liabilities 850,000 Total revenue before taxes 300,000 Total expenses 265,000 (a) What is the total net worth of this company? (b) Did the net worth increase, decrease or remain the same compared to FY 20X1? Why? (c) What is the income after taxes? (Assume a 50% tax rate.) 2. Define in your words the difference between a Balance Sheet and an Income Statement 3. The following Balance Sheet figures are available on the Cougar Construction Company: 53 20X5 20X4 20x3 20x2 S182.684.000 2.627.000 148.846,000 29.207.000 8214.973.000 1.104.000 183.862.000 26,676,000 20x1 3-462.822.00 1.005.000 434.120.000 23.220.000 Revenues Interest and dividend income Cost of contracts G&A expenses Interest expense Income before taxes Provision for income taxes Net income Net income per share Dividends per share Average number shares 8832.420,000 2.526,000 775.552.000 36.129,000 2.199,000 21.066.000 10.700.000 12.666,000 5.SI .70 2.298.000 8391.236,000 3,802.1XOXO 347.425,000 35.100.000 1,089,000 11.424,000 5.700.000 5.724,000 2.51 0.45 2.281.000 7.258.000 3.600.000 3,658,000 1.62 0.35 2.252.000 5.739.000 2.800.000 2.939.000 1.31 0.33 2.236,000 6,487.000 3.500.000 2.987.000 1.34 2.230.000 Assets Liabilities 8389.927.04 16.629.39 (a) Current assets Cash on hand and on deposit Notes receivable, current Accounts receivable, including retainage of $265,686.39 Deposits and miscellaneous receivables Inventory-construction material Prepaid expenses Total in Current liabilities Accounts payable Due subcontractors Accrued expenses and taxes Equipment contracts, current Provision for income taxes Total (g) Deferred credits Income billed on jobs in progress at 31 December 1984 Costs incurred to 31 December 1984 on uncompleted jobs 8306,820.29 713.991.66 50.559.69 2.838.60 97,816,66 1.171.826.90 1.222.346.26 15,867.80 26.530.14 8.490.68 1.679.791.31 2.728.331.36 (b) Notes receivable, non-current 12.777.97 Total current liabilities Equipment contracts, non-current (h) Total liabilities 2.718.738.01 9.593.35 1.181420.25 7.477.72 1.188.897.97 (e) Property Buildings Construction equipment Motor vehicles Office furniture and equipment Total (d) Less accumulated depreciation Net property 5.244.50 188.289.80 37.576.04 13.596.18 244,706.52 102.722.51 141.984.01 Net worth d) Common stock. 4.610 shares Retained earnings (0) Total net worth (k) Total liabilities and net worth 461.000.00 184.655.32 645.655.32 1.834.55129 (e) Total assets 1.834.553.29