Answered step by step

Verified Expert Solution

Question

1 Approved Answer

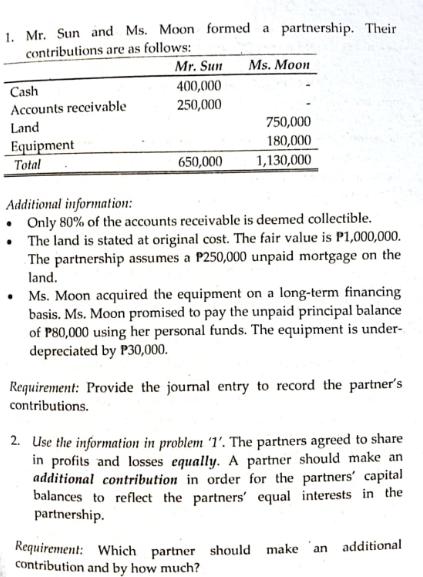

1. Mr. Sun and Ms. Moon formed a partnership. Their contributions are as follows: Cash Accounts receivable Land Equipment Total Mr. Sun 400,000 250,000

1. Mr. Sun and Ms. Moon formed a partnership. Their contributions are as follows: Cash Accounts receivable Land Equipment Total Mr. Sun 400,000 250,000 650,000 Ms. Moon 750,000 180,000 1,130,000 Additional information: Only 80% of the accounts receivable is deemed collectible. The land is stated at original cost. The fair value is P1,000,000. The partnership assumes a P250,000 unpaid mortgage on the land. . Ms. Moon acquired the equipment on a long-term financing basis. Ms. Moon promised to pay the unpaid principal balance of P80,000 using her personal funds. The equipment is under- depreciated by P30,000. Requirement: Provide the journal entry to record the partner's contributions. 2. Use the information in problem '1'. The partners agreed to share in profits and losses equally. A partner should make an additional contribution in order for the partners' capital balances to reflect the partners' equal interests in the partnership. Requirement: Which partner should make an contribution and by how much? additional

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entry to Record the Partners Contributions To record Mr Suns contribution Cash 250000 Mr S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started