Question: 1. Ms. Jones now asks Rosa to look at the ratio analysis of Readers' Publishing's balance sheet for the last quarter and interpret the

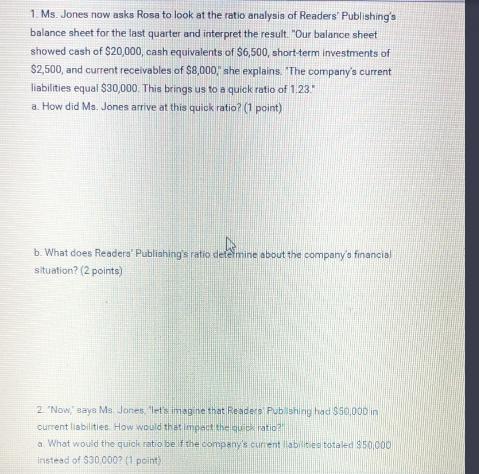

1. Ms. Jones now asks Rosa to look at the ratio analysis of Readers' Publishing's balance sheet for the last quarter and interpret the result. "Our balance sheet showed cash of $20,000, cash equivalents of $6,500, short-term investments of $2,500, and current receivables of $8,000," she explains. The company's current liabilities equal $30,000. This brings us to a quick ratio of 1.23." a. How did Ms. Jones arrive at this quick ratio? (1 point) DE b. What does Readers' Publishing's ratio determine about the company's financial situation? (2 points) 2 Now, says Ms Jones, let's imagine that Readers Publishing had $50,000 in current liabilities. How would that impact the quick ratic?" a What would the quick ratio be if the company's current liabilities totaled $50,000 instead of $30,000? (1 point)

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

1 a Ms Jones arrived at the quick ratio by adding up the cash cash equivalents shortterm investments ... View full answer

Get step-by-step solutions from verified subject matter experts