Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Nadine Chelesvig has patented her invention. She is offering a patent manufacturer two contracts for the exclusive right to manufacture and market her product.

1. Nadine Chelesvig has patented her invention. She is offering a patent manufacturer two contracts for the exclusive right to manufacture and market her product. Plan A calls for an immediate single lump payment to her of $30,000. Plan B calls for an annual payment of $1,050 plus a royalty of $0.60 per unit sold. The remaining life of the patent is 10 years. Nadine uses a MARR of 7 %/year. a. What must be the uniform annual sales volume of the product for Nadine to be indifferent between the contracts, based on a present worth analysis?

2.

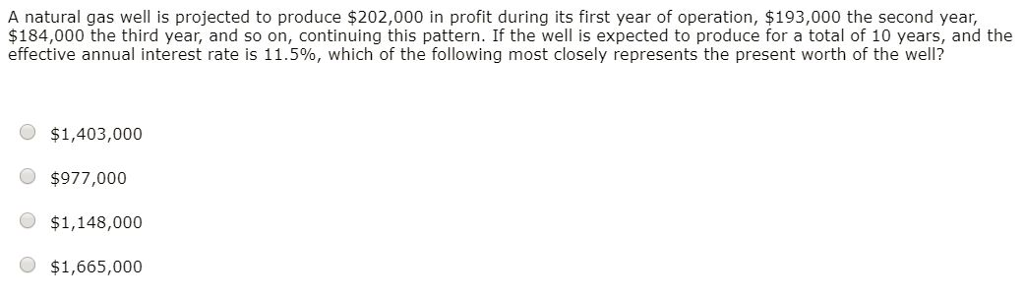

A natural gas well is projected to produce $202,000 in profit during its first year of operation, $193,000 the second year, $184,000 the third year, and so on, continuing this pattern. If the well is expected to produce for a total of 10 years, and the effective annual interest rate is 11.5%, which of the following most closely represents the present worth of the well? O $1,403,000 $977,000 $1,148,000 $1,665,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started