Question

(1) Nanfang Daily Chemicals Company is holding a meeting to discuss related issues such as product development and its capital expenditure budget. Founded in 1990,

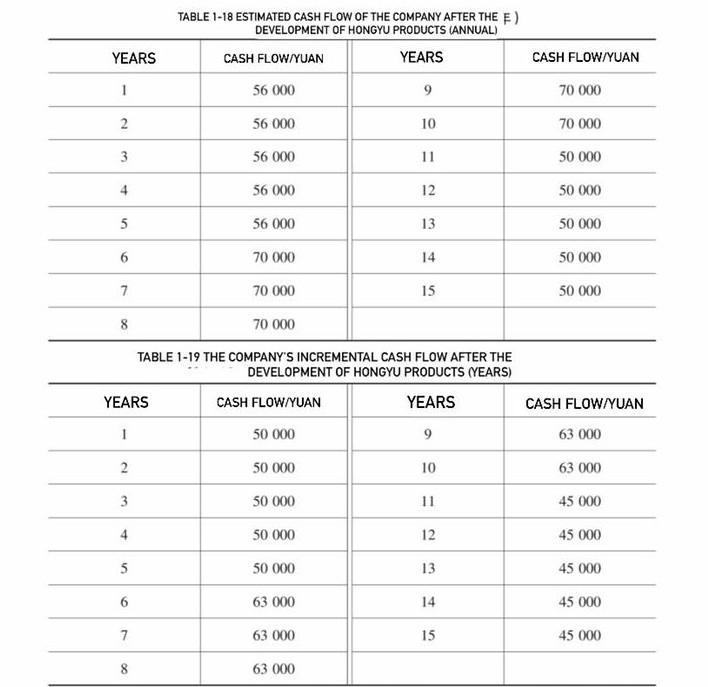

(1) Nanfang Daily Chemicals Company is holding a meeting to discuss related issues such as product development and its capital expenditure budget. Founded in 1990, Southern Company is a professional company producing detergents. At present, the company is producing "Caixia" and "Lvbo" series of detergents. Both products have a large share in the sales market in Northeast China. In recent years, the sales revenue of these two detergents has increased greatly. Its sales market has extended from the Northeast to all parts of the country. In the face of increasingly fierce commercial competition and endless technological innovation, Southern Company invested a lot of money in the research and development of new products. After two years of unremitting efforts, it finally successfully trial-produced a new type of highly concentrated liquid detergent-"Red Rain". "Brand liquid detergent. This product adopts the latest international technology and is made with a biosolvable formula. Compared with traditional powdered detergents, it has three advantages: 1)Low dosage. Use the Red Rain brand detergent to rinse the same weight of clothing, and the amount is only equivalent to 1/6 or 1/8 of the powder detergent. 2) has a strong detergency. For particularly dirty clothes, areas with a large amount of laundry or hard water, such as North China and Northeast China, the best washing effect can be achieved, and there is no need to soak beforehand. This is incomparable to powdered detergents. 3)Using light-weight plastic packaging, it is convenient to use and easy to keep. The companys chairman, general manager, research and development manager, finance manager and other relevant personnel attended the meeting. At the meeting, the manager of the R&D department first introduced the characteristics and functions of the new product, research and development costs, and the cash flow of the development project. The manager of the R&D department pointed out that the original investment in the production of Hongyu liquid detergent was 500,000 yuan, including 100,000 yuan for new product market research and 400,000 yuan for purchasing special equipment, packaging supplies and equipment. It is estimated that the service life of the equipment is 15 years, and there is no salvage value after the expiry date. Calculating the cash flow of new products based on 15 years is consistent with the company's consistent business policy. From the company's perspective, the cash flow after 15 years has great uncertainty. It is better not to predict than the error of the forecast. The manager of the R&D department listed the company's cash flow statement after the Red Rain brand detergent was put into production (see Table 1-18), and explained that the new product will impact the sales of the original two products after it is put into production. Therefore, the red rain detergent will increase after the start of production. The amount of cash flow will be as shown in Table 1-19.

After the introduction by the manager of the R&D department, the meeting started a discussion. Based on the analysis of market conditions, investment opportunities and the development level of the same industry, the company determined that the opportunity cost of investment was 10%. The manager of the companys finance department first raised the question Why did the capital expenditure budget of the Hongyu detergent development project not include plant and other equipment expenditures? The R&D manager explained: At present, the utilization rate of the production equipment of the Caixia series detergent is only Because these equipments are completely suitable for the production of Hongyu brand liquid detergents, there is no need to add other equipment except for special equipment and equipment used for processing packaging supplies. It is expected that after the Hongyu detergent production line is fully started, only need 10% of factory production capacity." The general manager of the company asked: "Should liquidity be considered after the development of new products?" The manager of the R&D department said firmly: "After the new products are put into production, an additional liquidity of 40,000 yuan is required each year. This fund is borrowed at the beginning of each year and paid at the end , Has been retained in the company, so there is no need to include this expense in the projects cash flow. Then, the chairman of the company asked: The production of new products occupies the companys remaining production capacity. If this part of the remaining capacity is rented out, the company will Will get a rental income of 20,000 yuan. Therefore, the investment income of new products should be compared with the rental income." But he also pointed out that Southern Company has always pursued a strict equipment management policy, that is, it is not allowed to lease fixed assets such as plant and equipment. According to this policy, the company may accept new projects, which is different from the normal investment project decision-making method. The discussion is still going on, and the main question is: how to analyze the impact of strict equipment management policies on the return of investment projects? How to analyze the impact of new product market research fees and additional liquidity on the project? According to the following circumstances, answer the following questions: 1)If you are the manager of the finance department, do you think that the new product market research fee belongs to the cash flow of the project? 2 )Regarding the additional working capital for the production of new products, should it be counted as the cash flow of the project? 3)Whether the company's remaining production capacity should be paid for the production of new products? why? 4)Whether the cash flow of the investment project should reflect the income lost due to the reduction of the market share of the old product due to the launch of the new product 5)If the capital required for the investment project is borrowed by the bank, should the interest expenses related to this be invested? 6)Is it reflected in the cash flow of the project? What are the criteria for evaluating the net present value, internal rate of return and investment payback period indicators for evaluating the feasibility of investment projects? If the calculation result of the net present value of this plan is - 120,000 yuan, whether the plan is feasible; if the calculation result of the internal rate of return is 6%, whether the plan is feasible; if the calculation result of the investment payback period is 10 years, whether the plan is feasible. Based on the judgment results of various indicators, make your final choice: whether to accept the project or abandon the project?

TABLE 1-18 ESTIMATED CASH FLOW OF THE COMPANY AFTER THE F) DEVELOPMENT OF HONGYU PRODUCTS (ANNUAL) CASH FLOW/YUAN YEARS YEARS CASH FLOW/YUAN 1 56 000 9 70 000 2 56 000 10 70 000 50 000 3 56 000 11 4 56 000 12 50 000 50 000 5 56 000 13 6 70 000 14 50 000 7 70 000 15 50 000 8 70 000 TABLE 1-19 THE COMPANY'S INCREMENTAL CASH FLOW AFTER THE DEVELOPMENT OF HONGYU PRODUCTS (YEARS) YEARS CASH FLOW/YUAN YEARS CASH FLOW/YUAN 1 50 000 9 63 000 2 10 50 000 50 000 63 000 45 000 3 4 50 000 12 45 000 5 50 000 13 45 000 6 63 000 14 45 000 7 63 000 15 45 000 8 63 000 TABLE 1-18 ESTIMATED CASH FLOW OF THE COMPANY AFTER THE F) DEVELOPMENT OF HONGYU PRODUCTS (ANNUAL) CASH FLOW/YUAN YEARS YEARS CASH FLOW/YUAN 1 56 000 9 70 000 2 56 000 10 70 000 50 000 3 56 000 11 4 56 000 12 50 000 50 000 5 56 000 13 6 70 000 14 50 000 7 70 000 15 50 000 8 70 000 TABLE 1-19 THE COMPANY'S INCREMENTAL CASH FLOW AFTER THE DEVELOPMENT OF HONGYU PRODUCTS (YEARS) YEARS CASH FLOW/YUAN YEARS CASH FLOW/YUAN 1 50 000 9 63 000 2 10 50 000 50 000 63 000 45 000 3 4 50 000 12 45 000 5 50 000 13 45 000 6 63 000 14 45 000 7 63 000 15 45 000 8 63 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started