Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Nash Inc. uses LIFO inventory costing. At January 1, 2020, inventory was $211,147 at both cost and market value. At December 31, 2020, the

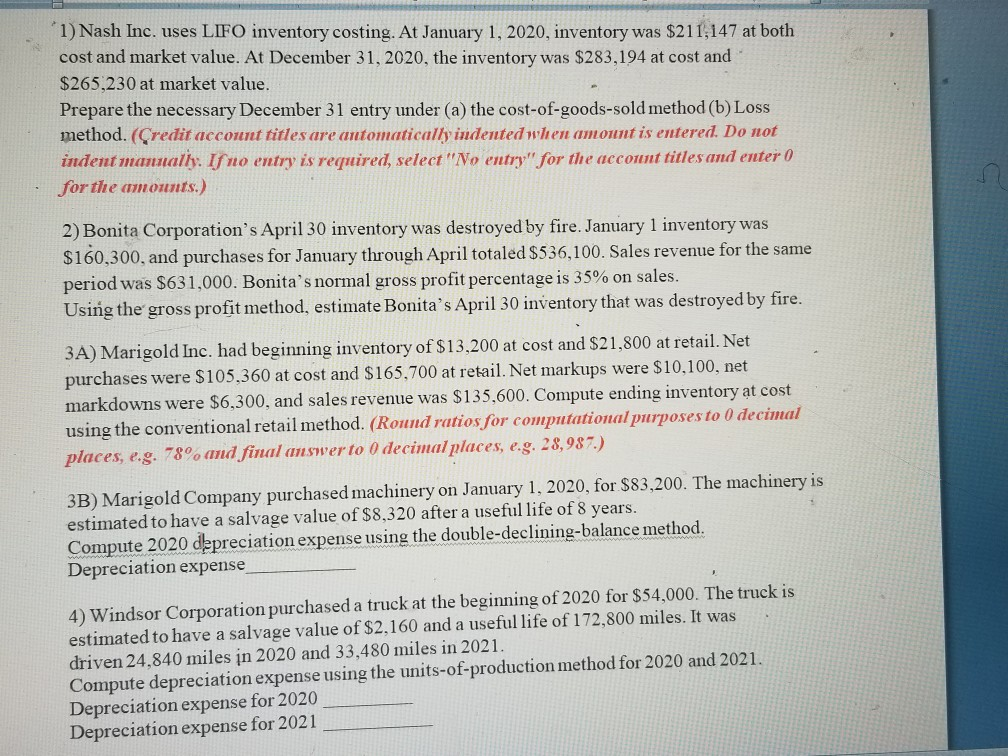

1) Nash Inc. uses LIFO inventory costing. At January 1, 2020, inventory was $211,147 at both cost and market value. At December 31, 2020, the inventory was $283,194 at cost and $265,230 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method (b) Loss method. (Credit account titles are antomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) 2) Bonita Corporation's April 30 inventory was destroyed by fire. January 1 inventory was $160,300, and purchases for January through April totaled $536,100. Sales revenue for the same period was $631,000. Bonita's normal gross profit percentage is 35% on sales. Using the gross profit method, estimate Bonita's April 30 inventory that was destroyed by fire. 3A) Marigold Inc. had beginning inventory of $13,200 at cost and $21,800 at retail. Net purchases were $105.360 at cost and $165,700 at retail. Net markups were $10,100, net markdowns were $6,300, and sales revenue was $135,600. Compute ending inventory at cost using the conventional retail method. (Round ratios for computational purposes to 0 decimal places, e.g. 78% and final answer to 0 decimal places, e.g. 28,987) 3B) Marigold Company purchased machinery on January 1, 2020, for $83,200. The machinery is estimated to have a salvage value of $8,320 after a useful life of 8 years. Compute 2020 depreciation expense using the double-declining-balance method. Depreciation expense 4) Windsor Corporation purchased a truck at the beginning of 2020 for $54,000. The truck is estimated to have a salvage value of $2.160 and a useful life of 172,800 miles. It was driven 24,840 miles in 2020 and 33.480 miles in 2021. Compute depreciation expense using the units-of-production method for 2020 and 2021. Depreciation expense for 2020 Depreciation expense for 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started