Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Need Cash Limited made an announcement today to the New Zealand's Exchange (NZX) of a major expansion project costing $5,000,000, which they plan to

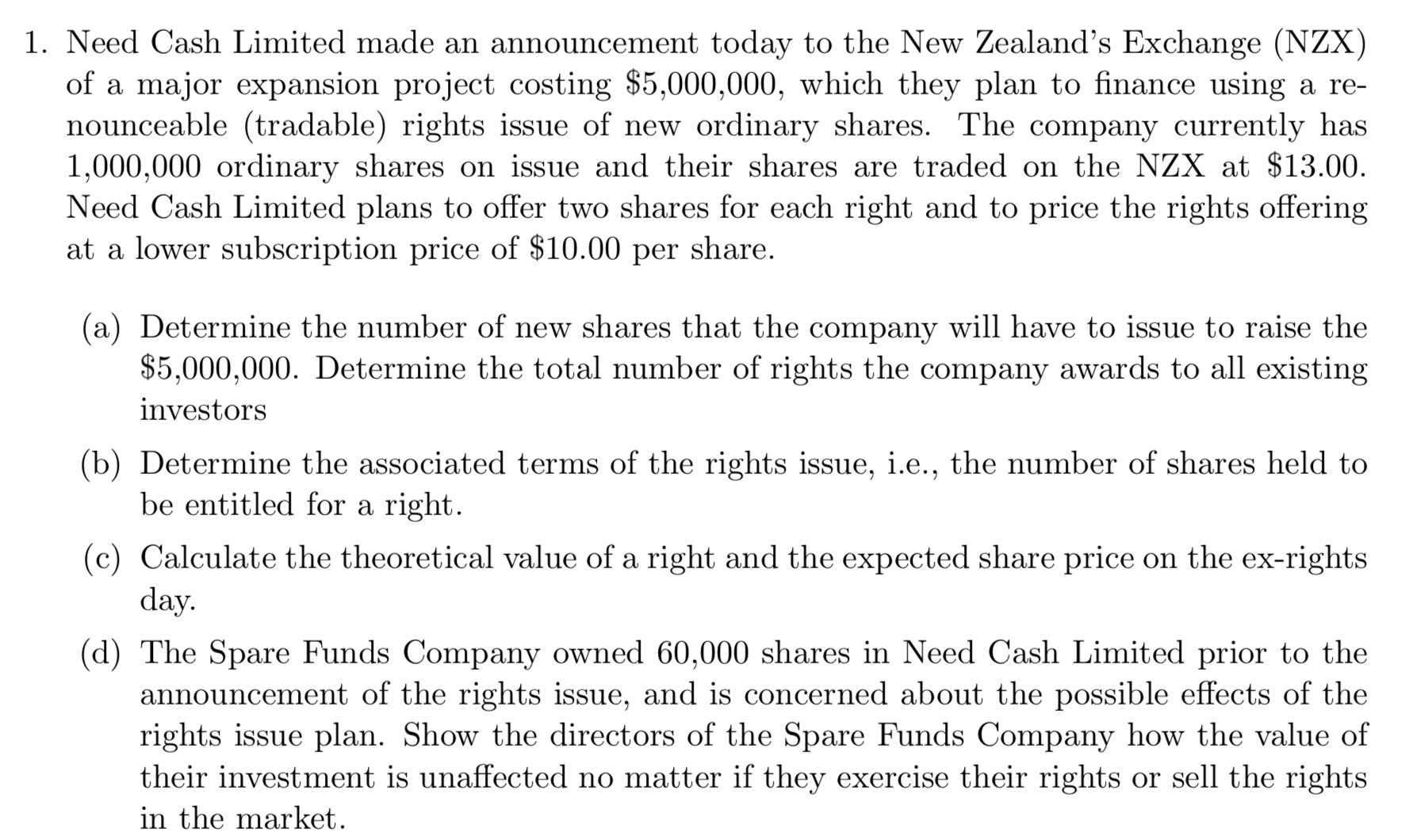

1. Need Cash Limited made an announcement today to the New Zealand's Exchange (NZX) of a major expansion project costing $5,000,000, which they plan to finance using a renounceable (tradable) rights issue of new ordinary shares. The company currently has 1,000,000 ordinary shares on issue and their shares are traded on the NZX at $13.00. Need Cash Limited plans to offer two shares for each right and to price the rights offering at a lower subscription price of $10.00 per share. (a) Determine the number of new shares that the company will have to issue to raise the $5,000,000. Determine the total number of rights the company awards to all existing investors (b) Determine the associated terms of the rights issue, i.e., the number of shares held to be entitled for a right. (c) Calculate the theoretical value of a right and the expected share price on the ex-rights day. (d) The Spare Funds Company owned 60,000 shares in Need Cash Limited prior to the announcement of the rights issue, and is concerned about the possible effects of the rights issue plan. Show the directors of the Spare Funds Company how the value of their investment is unaffected no matter if they exercise their rights or sell the rights

1. Need Cash Limited made an announcement today to the New Zealand's Exchange (NZX) of a major expansion project costing $5,000,000, which they plan to finance using a renounceable (tradable) rights issue of new ordinary shares. The company currently has 1,000,000 ordinary shares on issue and their shares are traded on the NZX at $13.00. Need Cash Limited plans to offer two shares for each right and to price the rights offering at a lower subscription price of $10.00 per share. (a) Determine the number of new shares that the company will have to issue to raise the $5,000,000. Determine the total number of rights the company awards to all existing investors (b) Determine the associated terms of the rights issue, i.e., the number of shares held to be entitled for a right. (c) Calculate the theoretical value of a right and the expected share price on the ex-rights day. (d) The Spare Funds Company owned 60,000 shares in Need Cash Limited prior to the announcement of the rights issue, and is concerned about the possible effects of the rights issue plan. Show the directors of the Spare Funds Company how the value of their investment is unaffected no matter if they exercise their rights or sell the rights Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started