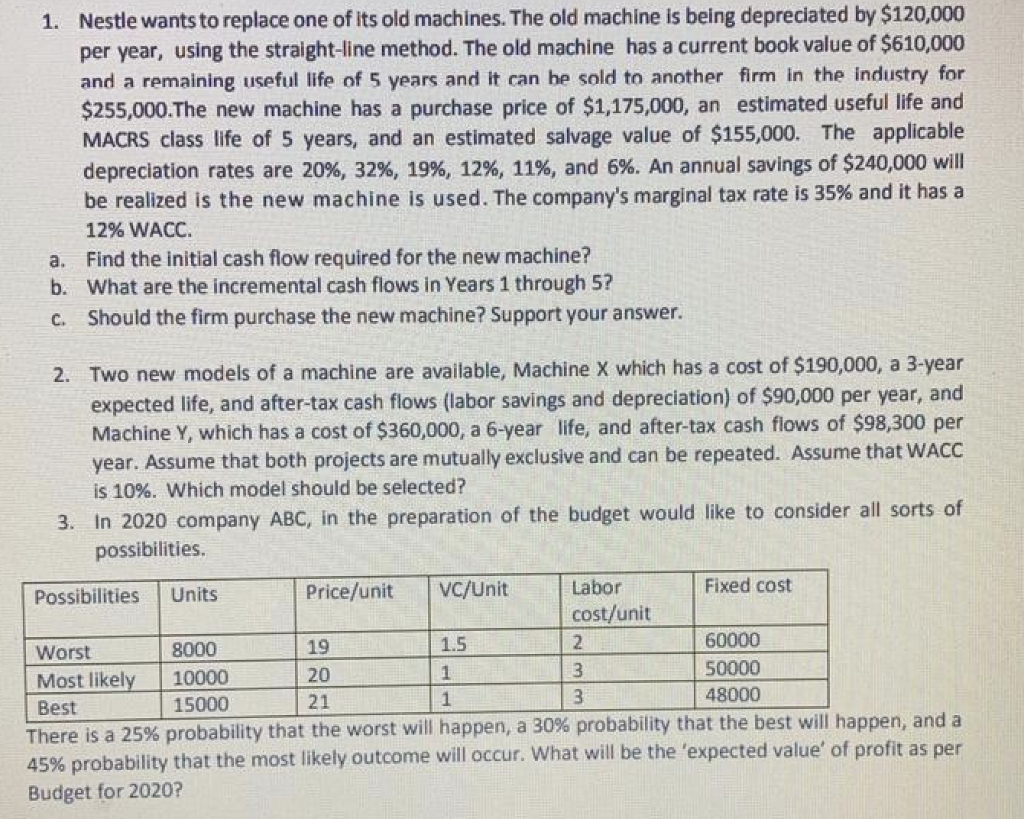

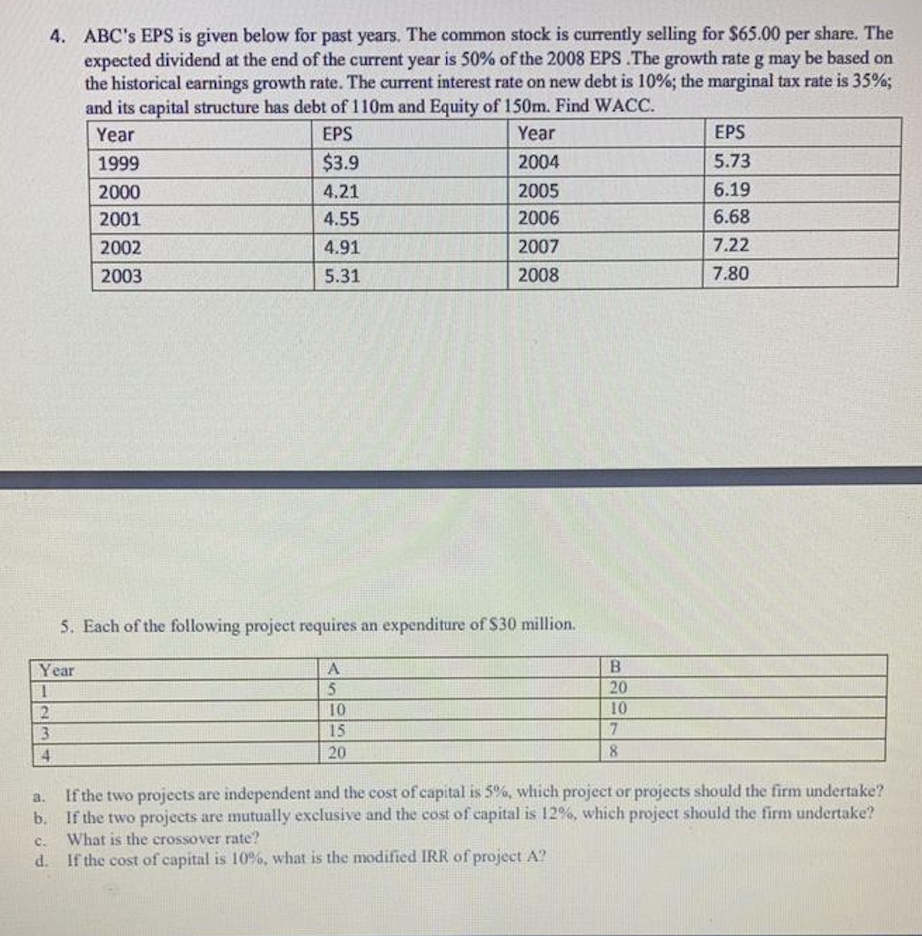

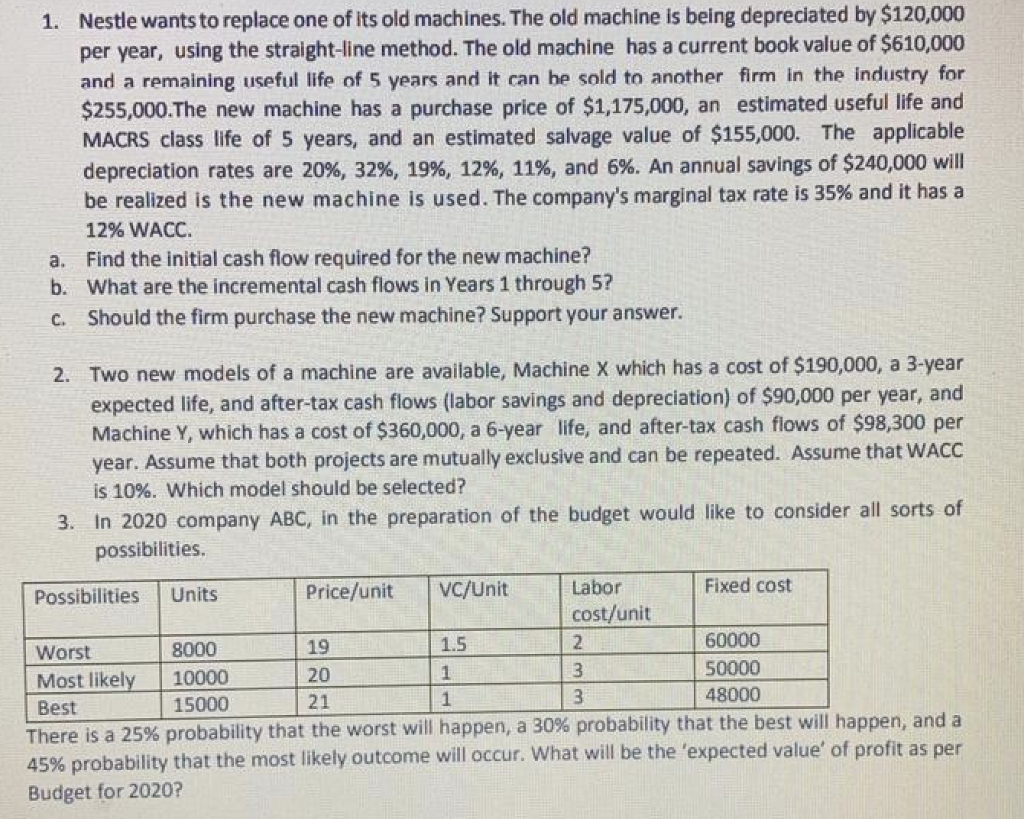

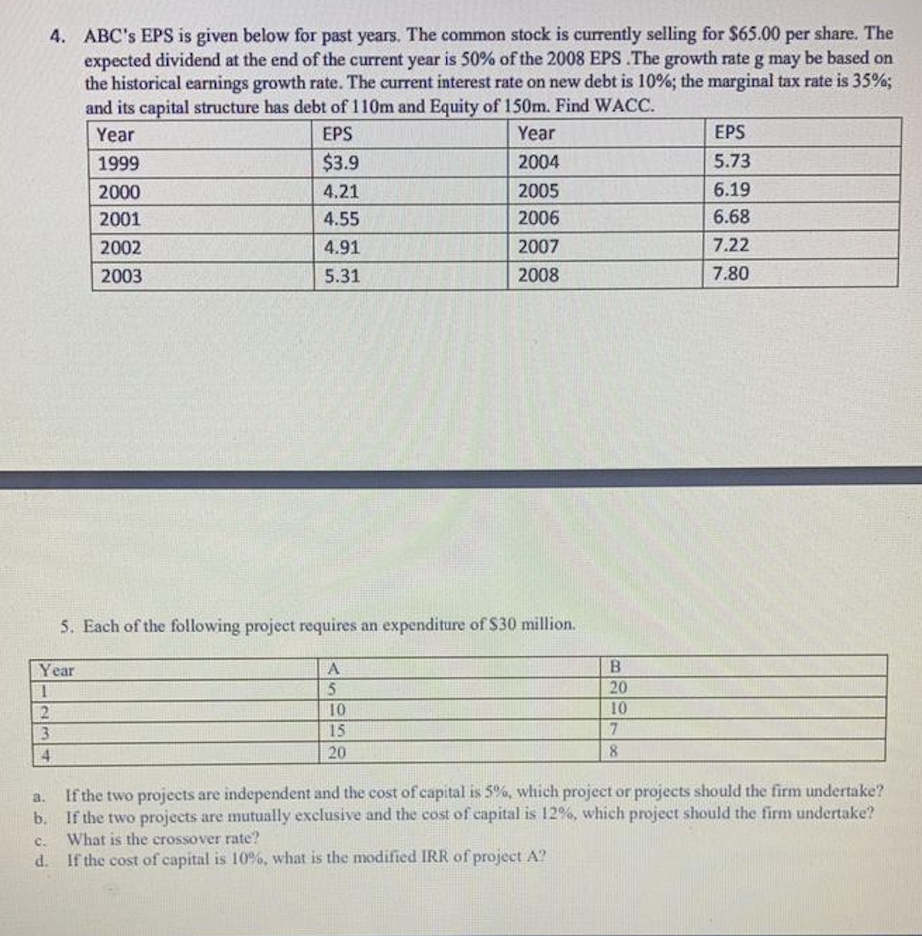

1. Nestle wants to replace one of its old machines. The old machine is being depreciated by $120,000 per year, using the straight-line method. The old machine has a current book value of $610,000 and a remaining useful life of 5 years and it can be sold to another firm in the industry for $255,000. The new machine has a purchase price of $1,175,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $155,000. The applicable depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. An annual savings of $240,000 will be realized is the new machine is used. The company's marginal tax rate is 35% and it has a 12% WACC. a. Find the initial cash flow required for the new machine? b. What are the incremental cash flows in Years 1 through 5? C. Should the firm purchase the new machine? Support your answer. 2. Two new models of a machine are available, Machine X which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $90,000 per year, and Machine Y, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Assume that both projects are mutually exclusive and can be repeated. Assume that WACC is 10%. Which model should be selected? 3. In 2020 company ABC, in the preparation of the budget would like to consider all sorts of possibilities. Possibilities Units Price/unit VC/Unit Labor Fixed cost cost/unit Worst 8000 19 1.5 2 60000 Most likely 10000 20 1 3 50000 Best 15000 21 3 48000 There is a 25% probability that the worst will happen, a 30% probability that the best will happen, and a 45% probability that the most likely outcome will occur. What will be the 'expected value of profit as per Budget for 2020? 1 4. ABC's EPS is given below for past years. The common stock is currently selling for $65.00 per share. The expected dividend at the end of the current year is 50% of the 2008 EPS The growth rate g may be based on the historical earnings growth rate. The current interest rate on new debt is 10%; the marginal tax rate is 35%; and its capital structure has debt of 110m and Equity of 150m. Find WACC. Year EPS Year EPS 1999 $3.9 2004 5.73 2000 4.21 2005 6.19 2001 4.55 2006 6.68 2002 4.91 2007 7.22 2003 5.31 2008 7.80 5. Each of the following project requires an expenditure of S30 million Year 1 2. 3 4 A 5 10 15 20 B 20 10 7 8 a. If the two projects are independent and the cost of capital is 5%, which project or projects should the firm undertake? b. If the two projects are mutually exclusive and the cost of capital is 12%, which project should the firm undertake? What is the crossover rate? d. If the cost of capital is 10%, what is the modified IRR of project A