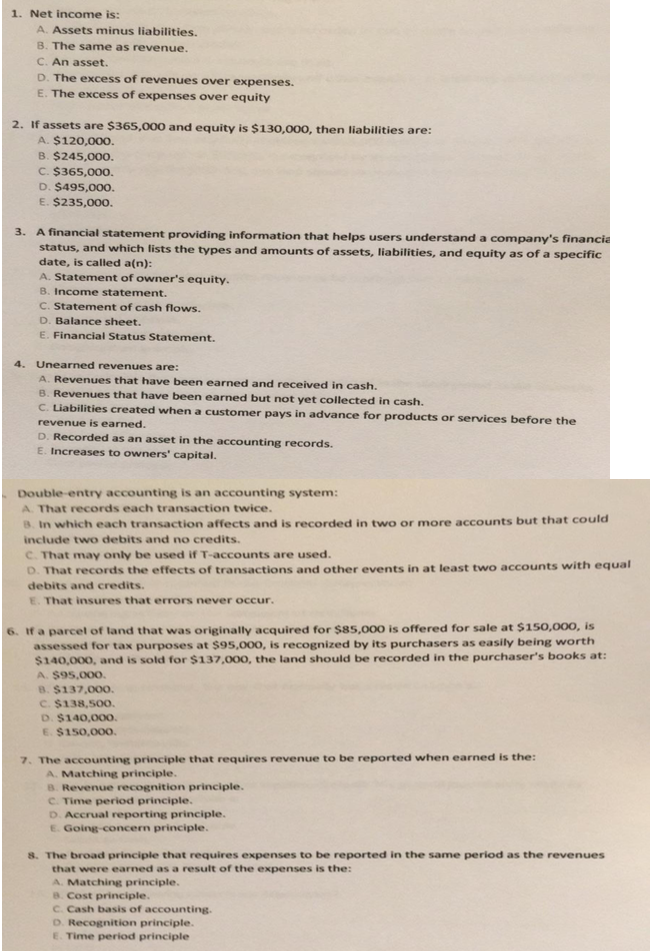

1. Net income is: A. Assets minus liabilities. B. The same as revenue. C. An asset. D. The excess of revenues over expenses. E. The excess of expenses over equity $365,000 and equity is $130,000, then liabilities are: 2. If assets are A. $120,000. B. $245,000. C. $365,000. D. $495,000. E. $235,000. 3. A financial statement providing information that helps users understand a company's financia status, and which lists the types and amounts of assets, liabilities, and equity as of a specific date, is called a(n): A. Statement of owner's equity. B. Income statement. C. Statement of cash flows. D. Balance sheet. E. Financial Status Statement. 4. Unearned revenues are: A. Revenues that have been earned and received in cash. B. Revenues that have been earned but not yet collected in cash. c. Liabilities created when a customer pays in advance for products or services before the revenue is earned. D. Recorded as an asset in the accounting records E. Increases to owners' capital. Double-entry accounting is an accounting system: A That records each transaction twice. 8. In which each transaction affects and is recorded in two or more accounts but that could include two debits and no credits c. That may only be used if T-accounts are used. D. That records the effects of transactions and other events in at least two accounts with equal debits and credits. E. That insures that errors never occur. 6. If a parcel of land that was originally acquired for $85,000 is offered for sale at $ 150,000, is assessed for tax purposes at $95,000, is recognized by its purchasers as easily being worth $140,000, and is sold for $137,000, the land should be recorded in the purchaser's books at: A. $95,000. 8. $137,000. c. $138,500. D. $140,000. E. $150,000. 7. The accounting principle that requires revenue A. Matching principle. 8. Revenue recognition principle. c. Time period principle. D. Accrual reporting principle. Going-concern principle. to be reported when earned is the: 8. The broad principle that requires expenses to be reported in the same period as the revenue es that were earned as a result of the expenses is the: A. Matching principle. 8. Cost principle. c Cash basis of accounting o Recognition principle. E. Time period principle