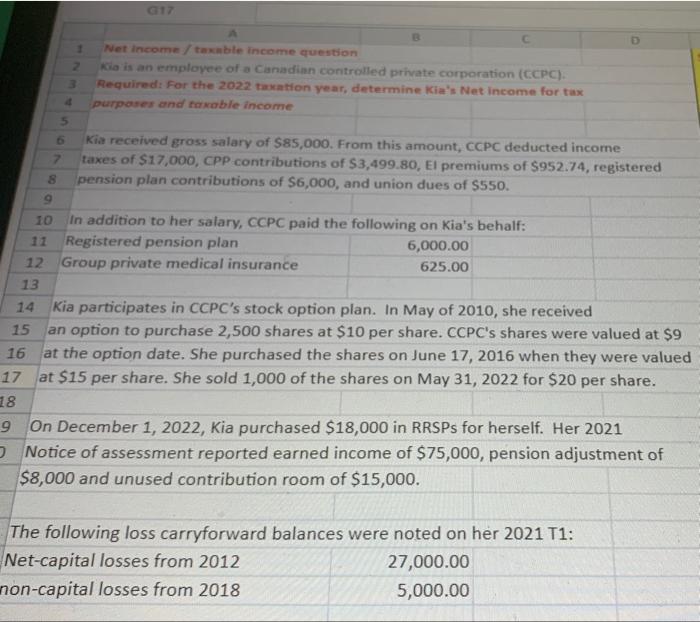

1. Net income/taxible income question 2 Kia is an employee of a Canadian controlled private corporation (CCPC). 3. Required: For the 2022 taxation year, determine Kia's Net income for tax 4 purpares and raxable income 5 6 Kia received gross salary of $85,000. From this amount, CCPC deducted income 7 taxes of $17,000, CPP contributions of $3,499.80, El premiums of $952.74, registered 8 pension plan contributions of $6,000, and union dues of $550. 10 In addition to her salary, CCPC paid the following on Kia's behalf: 14 Kia participates in CCPC's stock option plan. In May of 2010, she received 15 an option to purchase 2,500 shares at \$10 per share. CCPC's shares were valued at \$9 16 at the option date. She purchased the shares on June 17,2016 when they were valued 17 at $15 per share. She sold 1,000 of the shares on May 31,2022 for $20 per share. 18 9 On December 1, 2022, Kia purchased $18,000 in RRSPs for herself. Her 2021 Notice of assessment reported earned income of $75,000, pension adjustment of $8,000 and unused contribution room of $15,000. The following loss carryforward balances were noted on her 2021 T1: Net-capital losses from 2012 27,000.005,000.00 non-capitallossesfrom2018 1. Net income/taxible income question 2 Kia is an employee of a Canadian controlled private corporation (CCPC). 3. Required: For the 2022 taxation year, determine Kia's Net income for tax 4 purpares and raxable income 5 6 Kia received gross salary of $85,000. From this amount, CCPC deducted income 7 taxes of $17,000, CPP contributions of $3,499.80, El premiums of $952.74, registered 8 pension plan contributions of $6,000, and union dues of $550. 10 In addition to her salary, CCPC paid the following on Kia's behalf: 14 Kia participates in CCPC's stock option plan. In May of 2010, she received 15 an option to purchase 2,500 shares at \$10 per share. CCPC's shares were valued at \$9 16 at the option date. She purchased the shares on June 17,2016 when they were valued 17 at $15 per share. She sold 1,000 of the shares on May 31,2022 for $20 per share. 18 9 On December 1, 2022, Kia purchased $18,000 in RRSPs for herself. Her 2021 Notice of assessment reported earned income of $75,000, pension adjustment of $8,000 and unused contribution room of $15,000. The following loss carryforward balances were noted on her 2021 T1: Net-capital losses from 2012 27,000.005,000.00 non-capitallossesfrom2018