Answered step by step

Verified Expert Solution

Question

1 Approved Answer

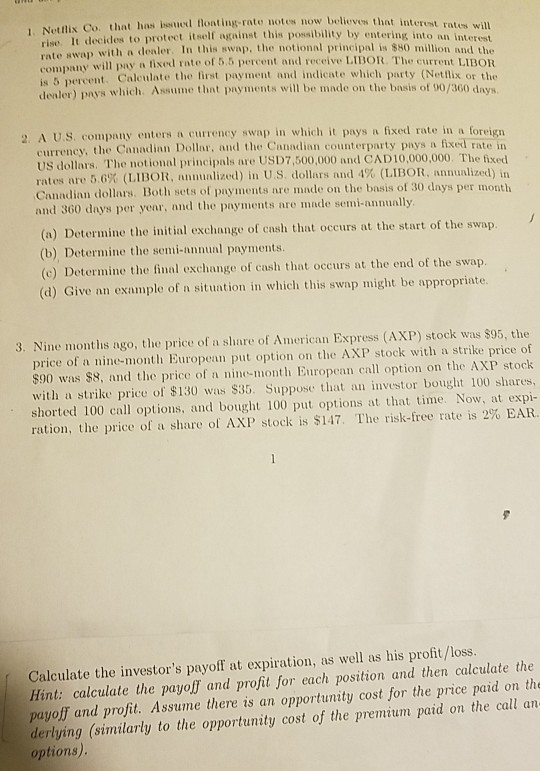

1 Netflix Co. that has been floating rate notes now believes that interese rise I decides to protect itself nainst this possibility by entering into

1 Netflix Co. that has been floating rate notes now believes that interese rise I decides to protect itself nainst this possibility by entering into an in rate swap with a dealer. In this swap, the notional principal is $80 million and the company will pay a fixed rate of 5.5 percent and receive LIBOR. The current LIROU is 5 percent. Calculate the first payment and indicate which party (Netflix or the dealer) prys which Assume that payments will be made on the basis of 90/360 dnym 2 AUS company enters a currency swap in which it pays fixed rate in foreign currency, the Canadian Dollar, and the Canadian counterparty pays n fixed rate in US dollars. The notional principals are USD7,500,000 and CAD10,000,000. The fixed rates are 5.6% (LIBOR, annualized) in US dollars and 4% (LIBOR, annualized) in Conndian dollars. Both sets of payments are made on the basis of 30 dnys per month and 360 dnys per yone, and the payments are made semi-annually (a) Determine the initial exchange of cash that occurs at the start of the swap. (b) Determine the semi-annunl payments. (c) Determine the final exchange of cash that occurs at the end of the swap. (d) Give an example of n situntion in which this swap might be appropriate 3. Nine months ago, the price of a share of American Express (AXP) stock was $95, the price of a nine-month European put option on the AXP stock with a strike price of $90 was $8, and the price of a nine-month European call option on the AXP stock with a strike price of $130 was $35. Suppose that an investor bought 100 shares, shorted 100 call options, and bought 100 put options at that time. Now, at expi- ration, the price of a share of AXP stock is $147. The risk-free rate is 2% EAR. Calculate the investor's payoff at expiration, as well as his profit/loss. Hint: calculate the payoff and profit for each position and then calculate the payoff and profit. Assume there is an opportunity cost for the price paid on the derlying (similarly to the opportunity cost of the premium paid on the call an options)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started