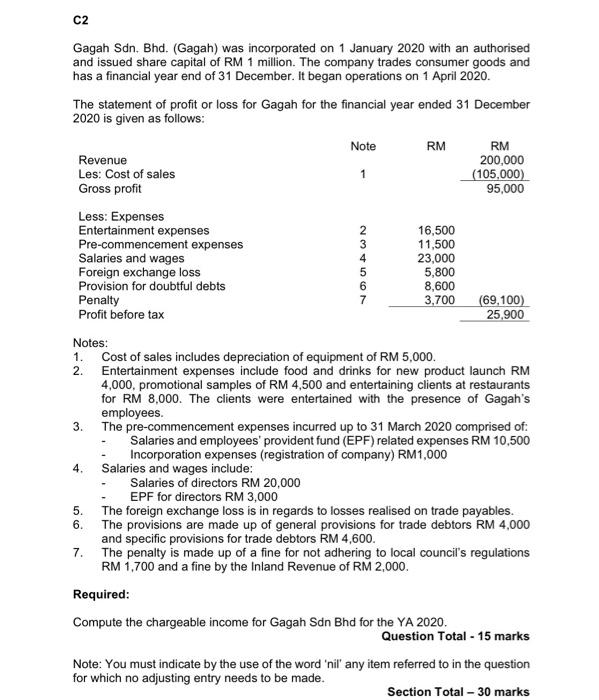

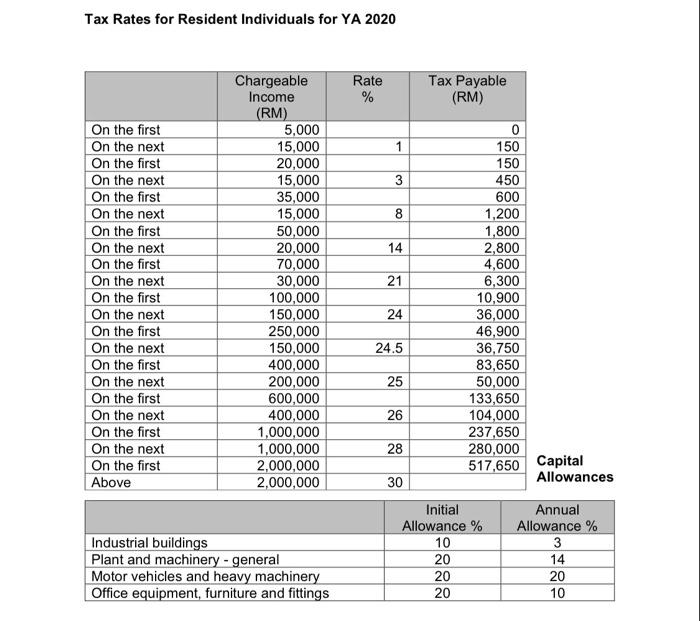

1 No N C2 Gagah Sdn. Bhd. (Gagah) was incorporated on 1 January 2020 with an authorised and issued share capital of RM 1 million. The company trades consumer goods and has a financial year end of 31 December. It began operations on 1 April 2020. The statement of profit or loss for Gagah for the financial year ended 31 December 2020 is given as follows: Note RM RM Revenue 200,000 Les: Cost of sales (105,000) Gross profit 95,000 Less: Expenses Entertainment expenses 16,500 Pre-commencement expenses 11,500 Salaries and wages 23,000 Foreign exchange loss 5,800 Provision for doubtful debts 8,600 Penalty 7 3,700 (69.100) Profit before tax 25,900 Notes: 1. Cost of sales includes depreciation of equipment of RM 5,000. 2. Entertainment expenses include food and drinks for new product launch RM 4,000, promotional samples of RM 4,500 and entertaining clients at restaurants for RM 8.000. The clients were entertained with the presence of Gagah's employees. 3. The pre-commencement expenses incurred up to 31 March 2020 comprised of: Salaries and employees' provident fund (EPF) related expenses RM 10,500 Incorporation expenses (registration of company) RM1,000 Salaries and wages include: Salaries of directors RM 20,000 EPF for directors RM 3,000 5. The foreign exchange loss is in regards to losses realised on trade payables. 6. The provisions are made up of general provisions for trade debtors RM 4,000 and specific provisions for trade debtors RM 4,600. 7. The penalty is made up of a fine for not adhering to local council's regulations RM 1,700 and a fine by the Inland Revenue of RM 2,000. Required: Compute the chargeable income for Gagah Sdn Bhd for the YA 2020. Question Total - 15 marks Note: You must indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made. Section Total - 30 marks 4. Tax Rates for Resident Individuals for YA 2020 Rate % Tax Payable (RM) 1 3 8 14 Chargeable Income (RM) 5,000 15,000 20,000 15,000 35,000 15,000 50,000 20,000 70,000 30,000 100,000 150,000 250,000 150,000 400,000 200,000 600,000 400,000 1,000,000 1,000,000 2,000,000 2,000,000 On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first Above 21 0 150 150 450 600 1,200 1,800 2,800 4,600 6,300 10,900 36,000 46,900 36,750 83,650 50,000 133,650 104,000 237,650 280,000 517,650 24 24.5 25 26 28 Capital Allowances 30 Industrial buildings Plant and machinery - general Motor vehicles and heavy machinery Office equipment, furniture and fittings Initial Allowance % 10 20 20 20 Annual Allowance % 3 14 20 10