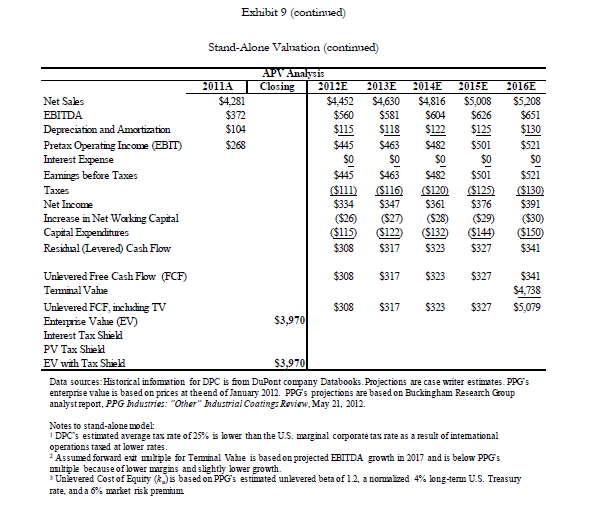

estimate the dollar increase in DPC's value if a PE fund can obtain: A. 5% revenue growth per annum (versus 4% growth) in each of

estimate the dollar increase in DPC's value if a PE fund can obtain:

A. 5% revenue growth per annum (versus 4% growth) in each of the next five years and improve the operating margin to 12% (versus 10%).

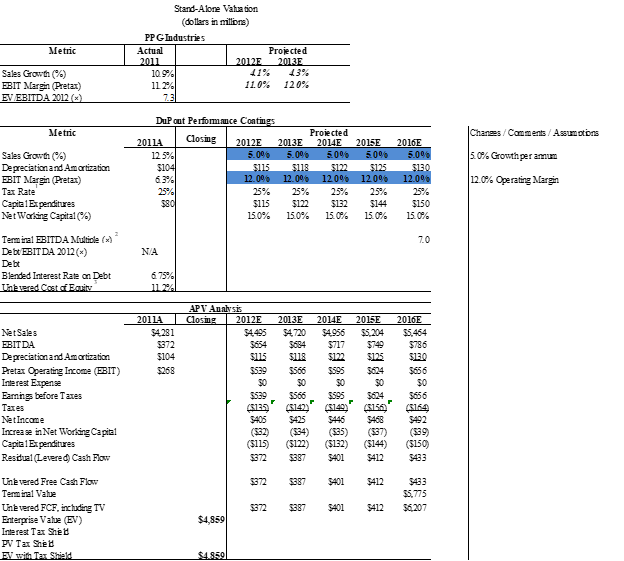

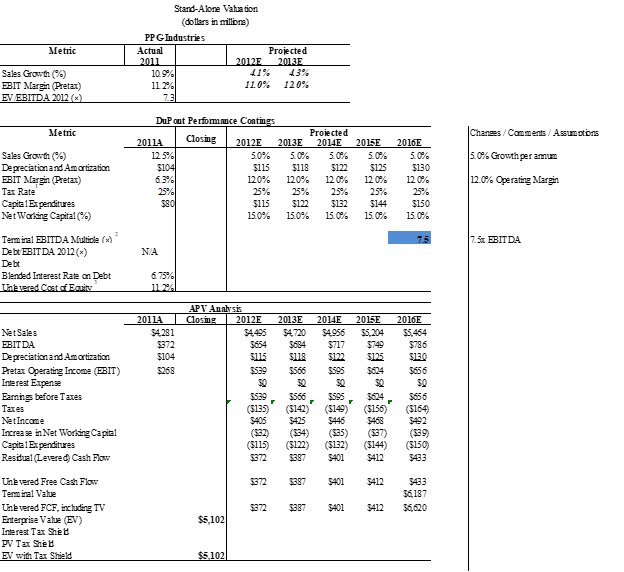

B. Assume part a and that the division can be sold at 7.5x EBITDA in five years.

C. Assume part a and part b and that debt financing equal to 6.0x forward EBITDA can be obtained. Assume that all cash available to pay debt each year (i.e., residual cash flow) is used to pay down the LBO debt and that, after five years, the firm will revert to an all-equity firm.

4. If a PE sponsor has a target return of 20% on its funds (equity contribution), what is the maximum enterprise value it can offer for DPC under parts b and c above? What minimum bid should Ellen Kullman set if she chooses to sell DPC?

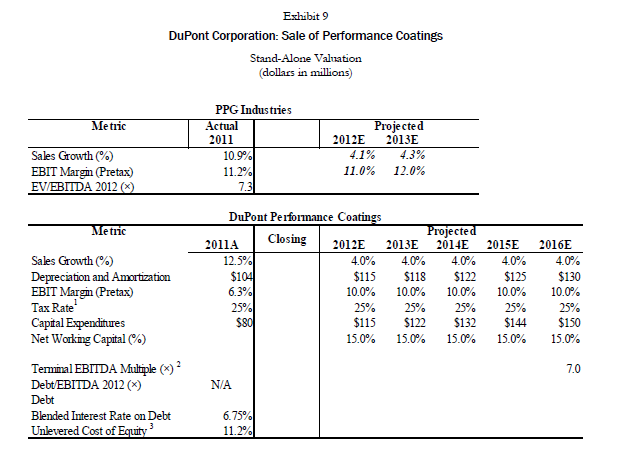

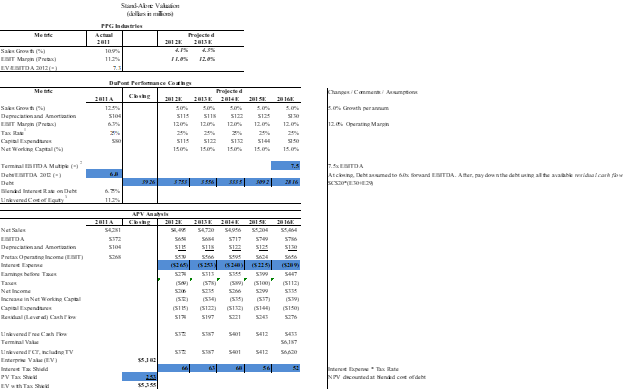

Exhibit 9 DuPont Corporation: Sale of Performance Coatings Stand-Alone Valuation (dollars in millions) PPG Industries Metric Actual 2011 Sales Growth (%) 10.9% EBIT Margin (Pretax) EV/EBITDA 2012 (x) 11.2% 7.3 2012E Projected 2013E 4.1% 4.3% 11.0% 12.0% DuPont Performance Coatings Metric Projected 2011A Closing 2012E 2013E 2014E 2015E 2016E Sales Growth (%) 12.5% 4.0% 4.0% 4.0% 4.0% 4.0% Depreciation and Amortization $104 $115 $118 $122 $125 $130 EBIT Margin (Pretax) 6.3% 10.0% 10.0% 10.0% 10.0% 10.0% Tax Rate 25% 25% 25% 25% 25% 25% Capital Expenditures $80 $115 $122 $132 $144 $150 Net Working Capital (%) 15.0% 15.0% 15.0% 15.0% 15.0% Terminal EBITDA Multiple (*) 2 7.0 Debt/EBITDA 2012 (*) N/A Debt Blended Interest Rate on Debt 6.75% Unlevered Cost of Equity 11.2%

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A To estimate the dollar increase in DPCs value with a 5 revenue growth per annum versus 4 growth an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started