Answered step by step

Verified Expert Solution

Question

1 Approved Answer

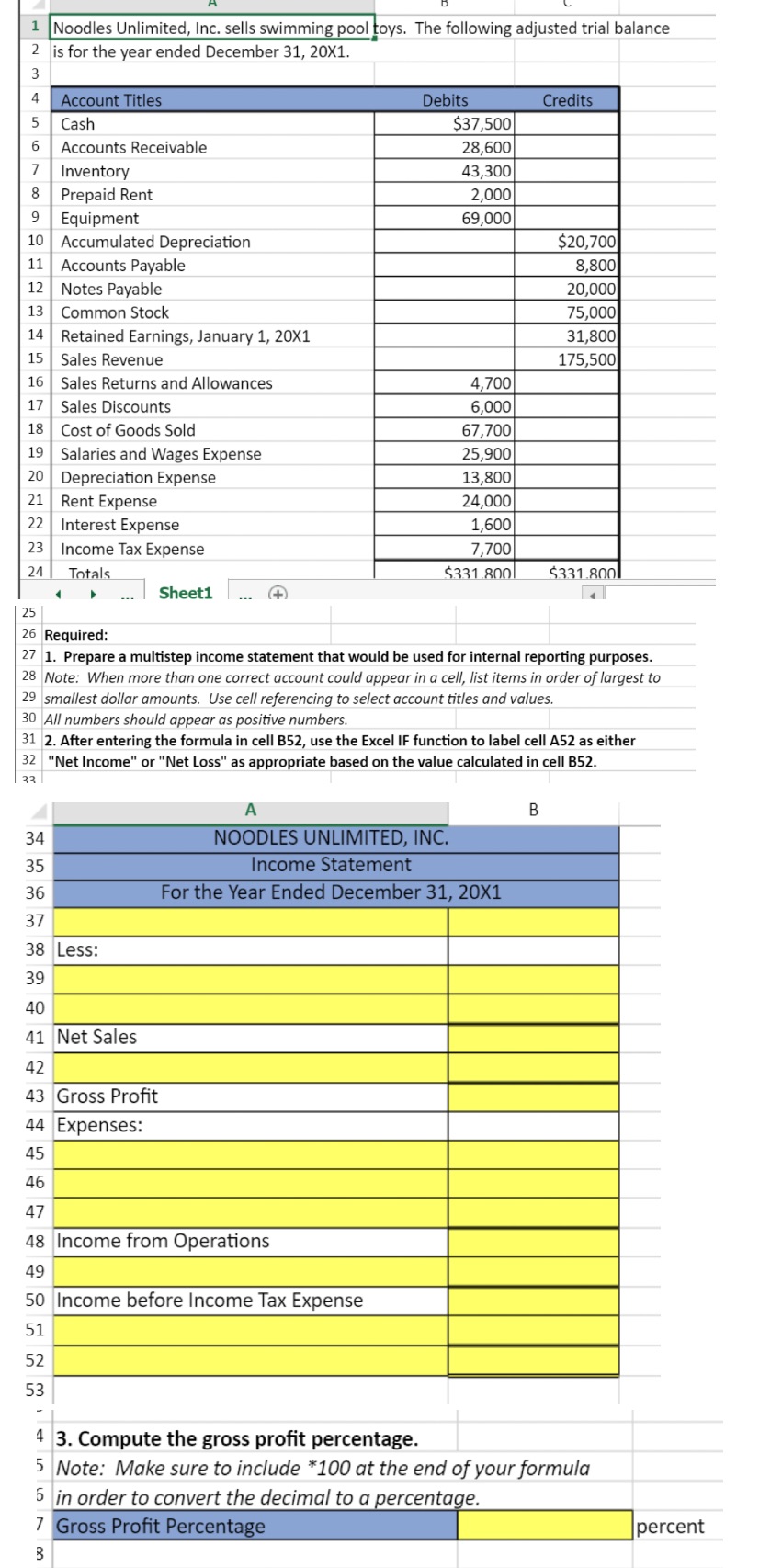

1 Noodles Unlimited, Inc. sells swimming pool toys. The following adjusted trial balance 2 is for the year ended December 31, 20X1. 3 4

1 Noodles Unlimited, Inc. sells swimming pool toys. The following adjusted trial balance 2 is for the year ended December 31, 20X1. 3 4 Account Titles Debits Credits 5 Cash $37,500 6 Accounts Receivable 28,600 7 Inventory 43,300 8 Prepaid Rent 2,000 9 Equipment 69,000 10 Accumulated Depreciation $20,700 11 Accounts Payable 8,800 12 Notes Payable 20,000 13 Common Stock 75,000 14 Retained Earnings, January 1, 20X1 31,800 15 Sales Revenue 175,500 16 Sales Returns and Allowances 4,700 17 Sales Discounts 6,000 18 Cost of Goods Sold 67,700 19 Salaries and Wages Expense 25,900 20 Depreciation Expense 13,800 21 Rent Expense 24,000 22 Interest Expense 1,600 23 Income Tax Expense 7,700 24 Totals $331.800 $331.800 Sheet1 + 25 26 Required: 27 1. Prepare a multistep income statement that would be used for internal reporting purposes. 28 Note: When more than one correct account could appear in a cell, list items in order of largest to 29 smallest dollar amounts. Use cell referencing to select account titles and values. 30 All numbers should appear as positive numbers. 31 2. After entering the formula in cell B52, use the Excel IF function to label cell A52 as either 32 "Net Income" or "Net Loss" as appropriate based on the value calculated in cell B52. 33 34 35 36 37 38 Less: 39 40 41 Net Sales 42 43 Gross Profit 44 Expenses: 45 46 47 NOODLES UNLIMITED, INC. Income Statement For the Year Ended December 31, 20X1 48 Income from Operations 49 50 Income before Income Tax Expense 51 52 53 B 4 3. Compute the gross profit percentage. 5 Note: Make sure to include *100 at the end of your formula 5 in order to convert the decimal to a percentage. 7 Gross Profit Percentage B percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started