Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Normal 1 No Spa Ay A. Styles . Paragraph ont 40 Marks Question 1 Your company has appointment you to estimate the value of

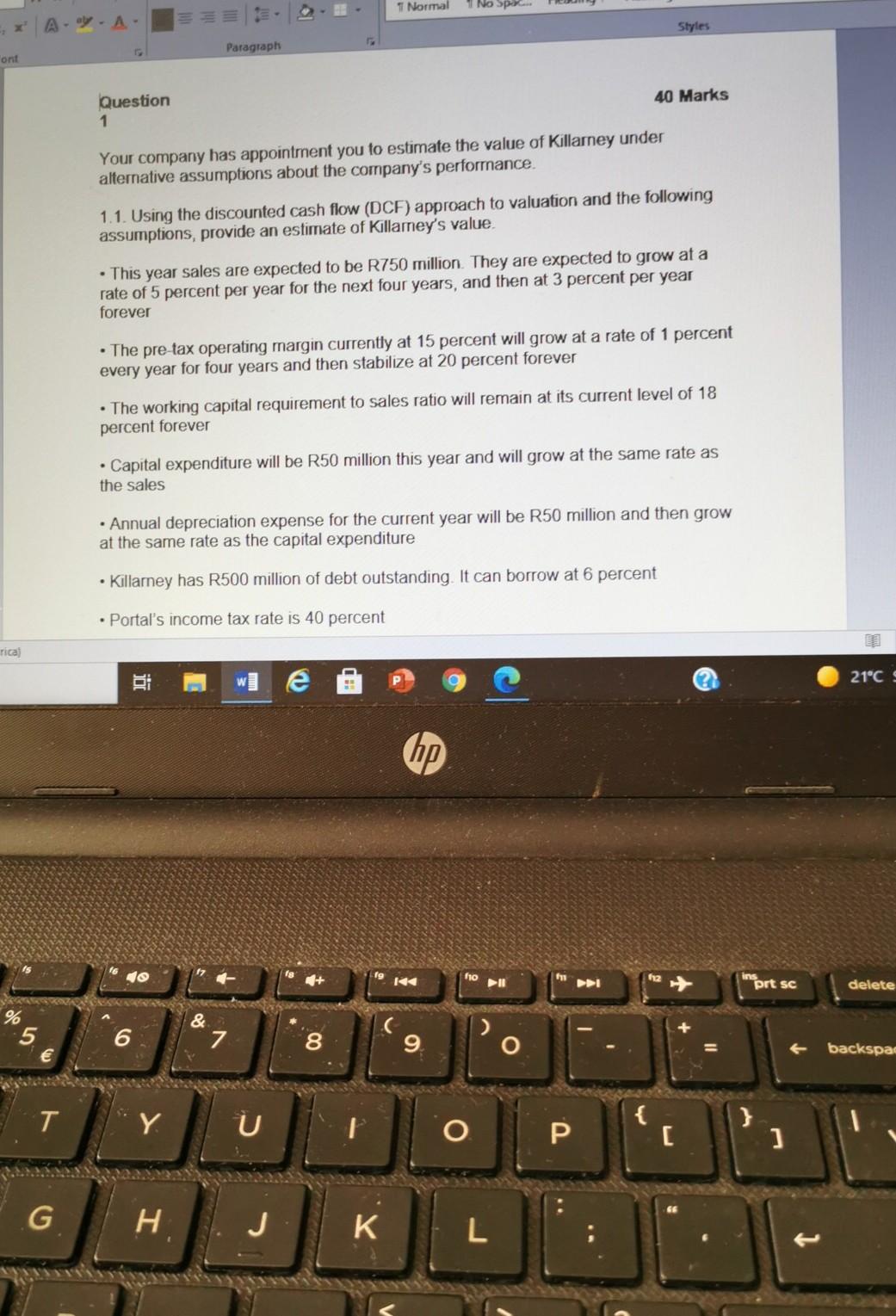

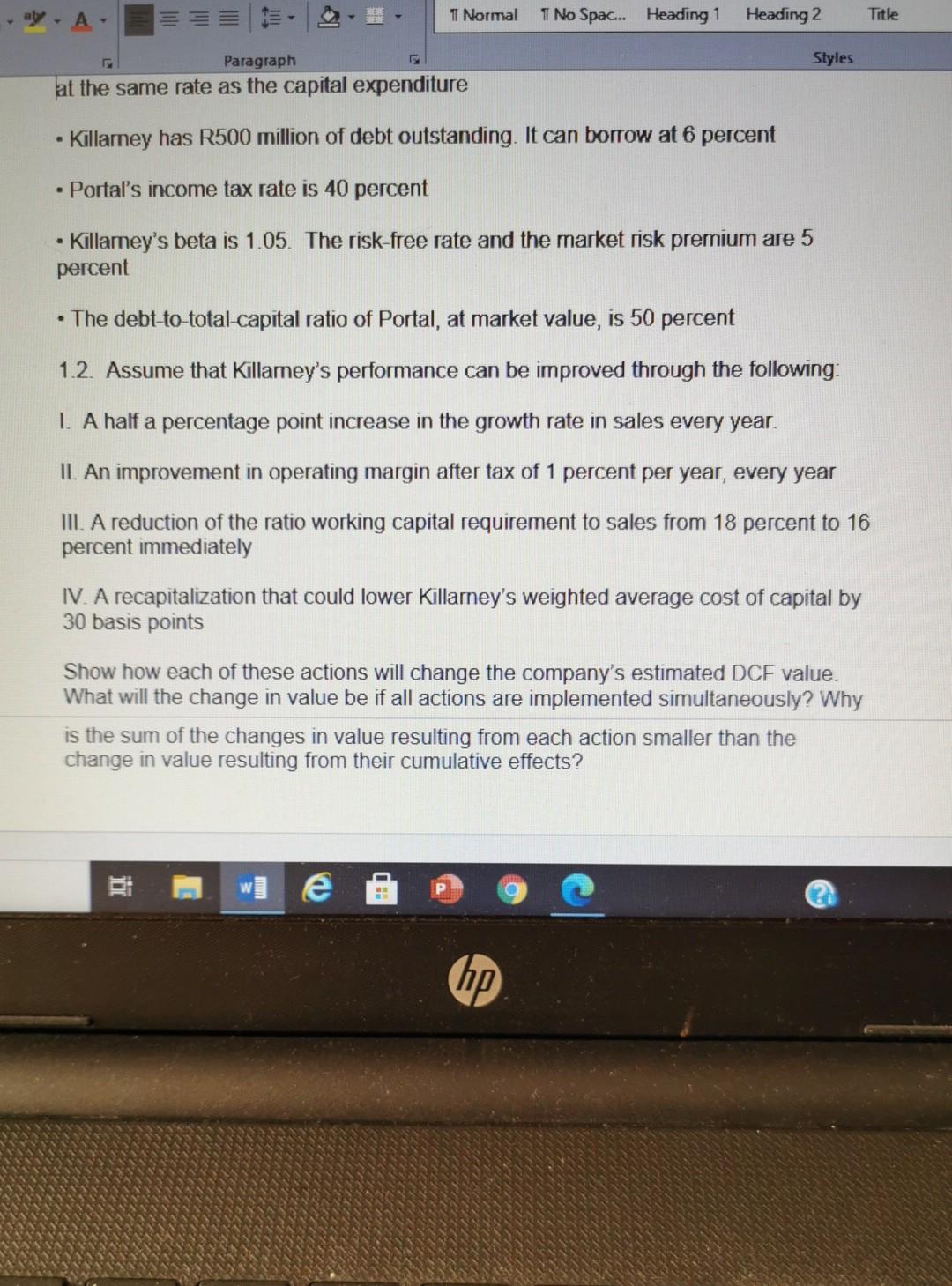

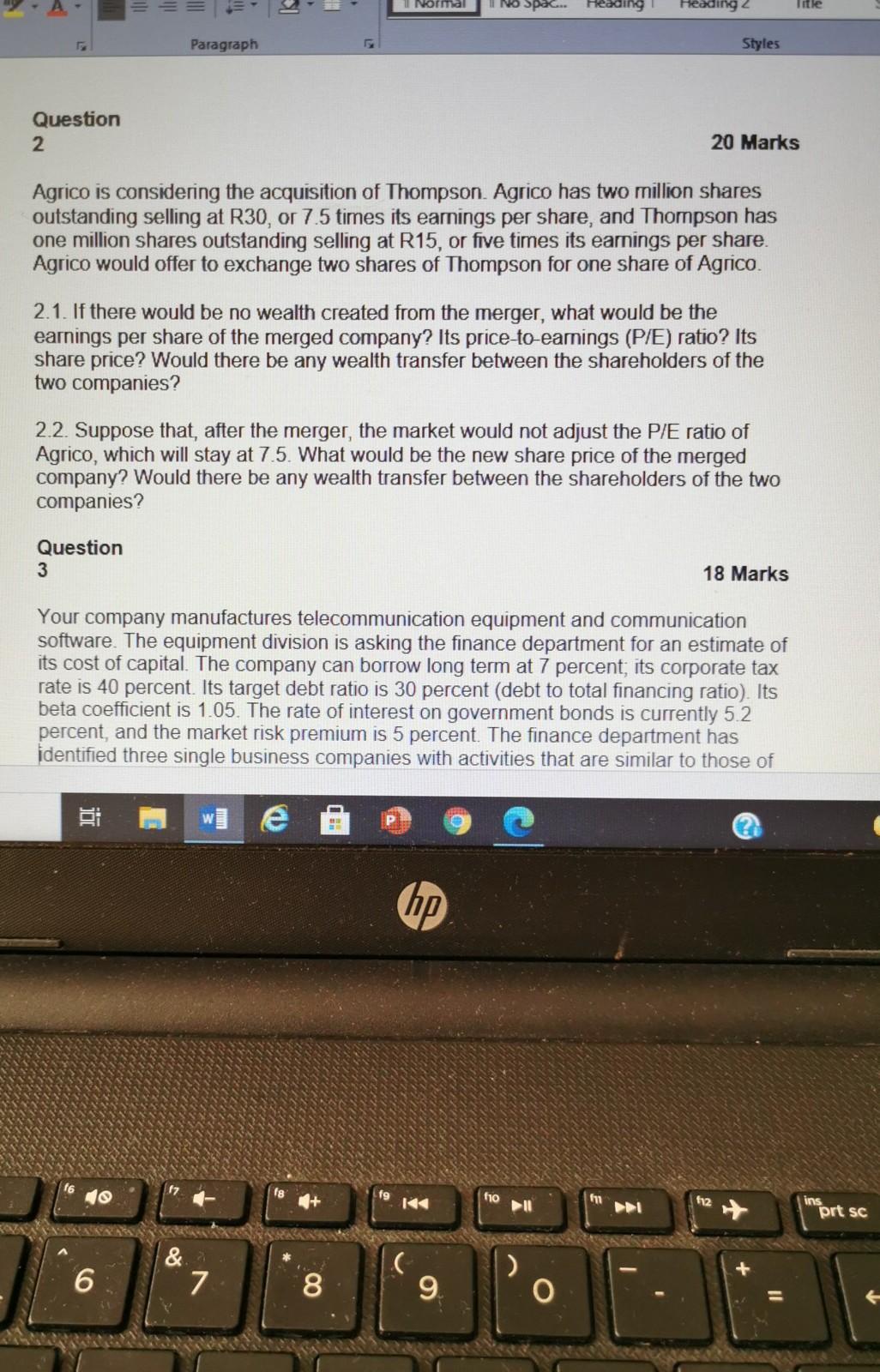

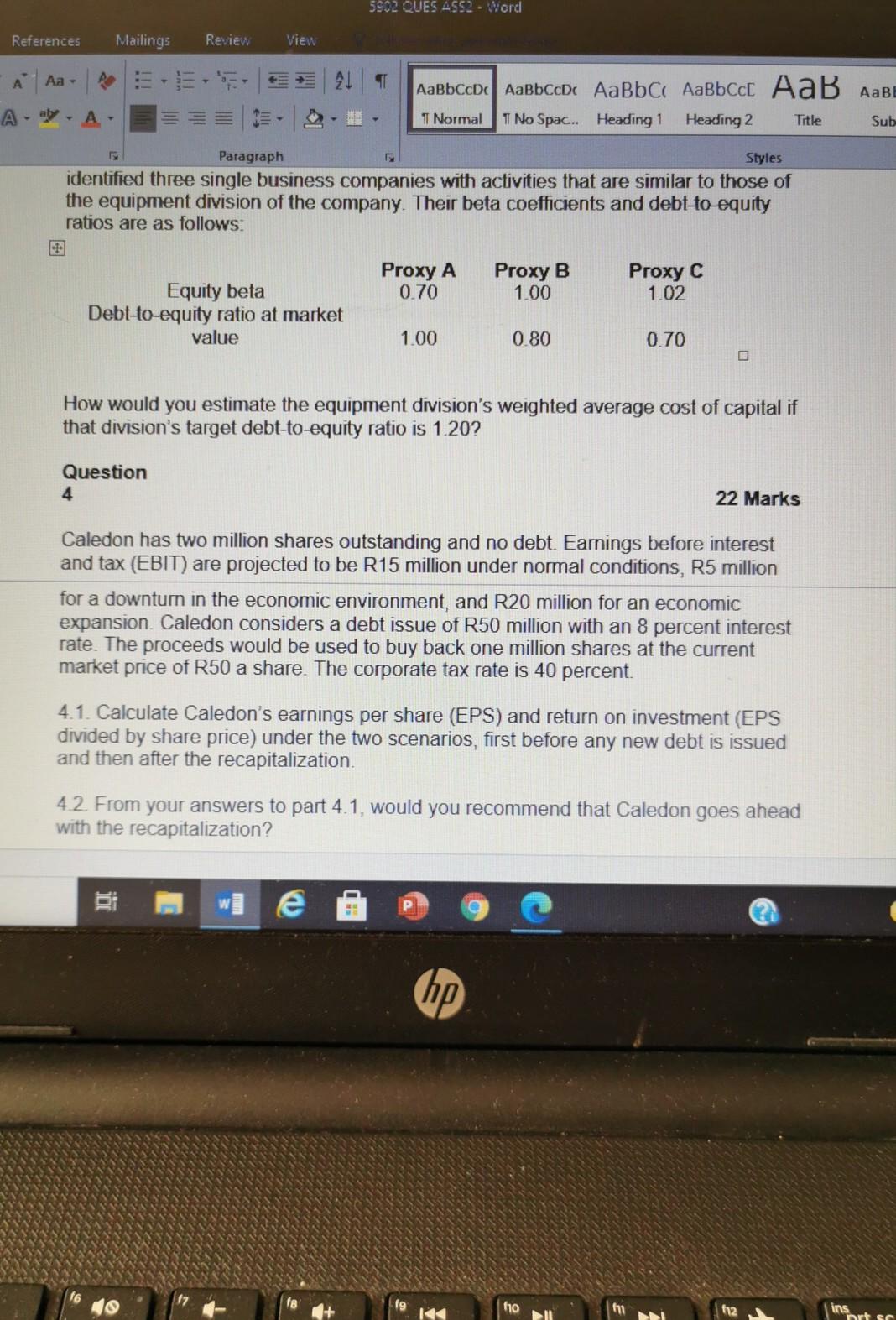

1 Normal 1 No Spa Ay A. Styles . Paragraph ont 40 Marks Question 1 Your company has appointment you to estimate the value of Killarney under alternative assumptions about the company's performance 1.1. Using the discounted cash flow (DCF) approach to valuation and the following assumptions, provide an estimate of Killarney's value This year sales are expected to be R750 million. They are expected to grow at a rate of 5 percent per year for the next four years, and then at 3 percent per year forever The pre tax operating margin currently at 15 percent will grow at a rate of 1 percent every year for four years and then stabilize at 20 percent forever The working capital requirement to sales ratio will remain at its current level of 18 percent forever Capital expenditure will be R50 million this year and will grow at the same rate as the sales Annual depreciation expense for the current year will be R50 million and then grow at the same rate as the capital expenditure Killarney has R500 million of debt outstanding. It can borrow at 6 percent Portal's income tax rate is 40 percent ricaj DI e 21C S hp + 110 II insort sc delete % ( 5 & 7 6 8 9 backspac T Y U { O ] G H J K L aby 1 Normal 11 No Spac... Heading 1 Heading 2 Title Styles Paragraph at the same rate as the capital expenditure Killamey has R500 million of debt outstanding. It can borrow at 6 percent Portal's income tax rate is 40 percent Killarey's beta is 1.05. The risk-free rate and the market risk premium are 5 percent The debt-to-total-capital ratio of Portal, at market value, is 50 percent 12. Assume that Killamey's performance can be improved through the following: 1. A half a percentage point increase in the growth rate in sales every year. II. An improvement in operating margin after tax of 1 percent per year, every year III. A reduction of the ratio working capital requirement to sales from 18 percent to 16 percent immediately IV. A recapitalization that could lower Killarney's weighted average cost of capital by 30 basis points Show how each of these actions will change the company's estimated DCF value. What will the change in value be if all actions are implemented simultaneously? Why is the sum of the changes in value resulting from each action smaller than the change in value resulting from their cumulative effects? e hp Normal No Spec. Reading Heading 2 Title Paragraph Styles Question 2 20 Marks Agrico is considering the acquisition of Thompson. Agrico has two million shares outstanding selling at R30, or 7.5 times its earnings per share, and Thompson has one million shares outstanding selling at R15, or five times its earnings per share. Agrico would offer to exchange two shares of Thompson for one share of Agrico. 2.1. If there would be no wealth created from the merger, what would be the earnings per share of the merged company? Its price-to-earnings (P/E) ratio? Its share price? Would there be any wealth transfer between the shareholders of the two companies? 2.2. Suppose that, after the merger, the market would not adjust the P/E ratio of Agrico, which will stay at 7.5. What would be the new share price of the merged company? Would there be any wealth transfer between the shareholders of the two companies? Question 3 18 Marks Your company manufactures telecommunication equipment and communication software. The equipment division is asking the finance department for an estimate of its cost of capital. The company can borrow long term at 7 percent; its corporate tax rate is 40 percent. Its target debt ratio is 30 percent (debt to total financing ratio). Its beta coefficient is 1.05. The rate of interest on government bonds is currently 5.2 percent, and the market risk premium is 5 percent. The finance department has identified three single business companies with activities that are similar to those of e hp 10 + 110 11 112 ins prt sc 6 & 7 00 9 0 5902 QUES ASS2 - Word References Mailings Review View A - bC AaBbccc 11 No Spac... Heading 1 Heading 2 A-ay. A T Normal Title Sub Paragraph Styles identified three single business companies with activities that are similar to those of the equipment division of the company. Their beta coefficients and debt-to-equity ratios are as follows: Proxy A 0.70 Proxy B 1.00 Proxy C 1.02 Equity beta Debt-to-equity ratio at market value 1.00 0.80 0.70 How would you estimate the equipment division's weighted average cost of capital if that division's target debt-to-equity ratio is 1.20? Question 4 22 Marks Caledon has two million shares outstanding and no debt. Earnings before interest and tax (EBIT) are projected to be R15 million under normal conditions, R5 million for a downturn in the economic environment, and R20 million for an economic expansion. Caledon considers a debt issue of R50 million with an 8 percent interest rate. The proceeds would be used to buy back one million shares at the current market price of R50 a share. The corporate tax rate is 40 percent. 4.1. Calculate Caledon's earnings per share (EPS) and return on investment (EPS divided by share price) under the two scenarios, first before any new debt is issued and then after the recapitalization. 42 From your answers to part 4.1, would you recommend that Caledon goes ahead with the recapitalization? BI e hp 16 10 K fo 12 ins prt s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started