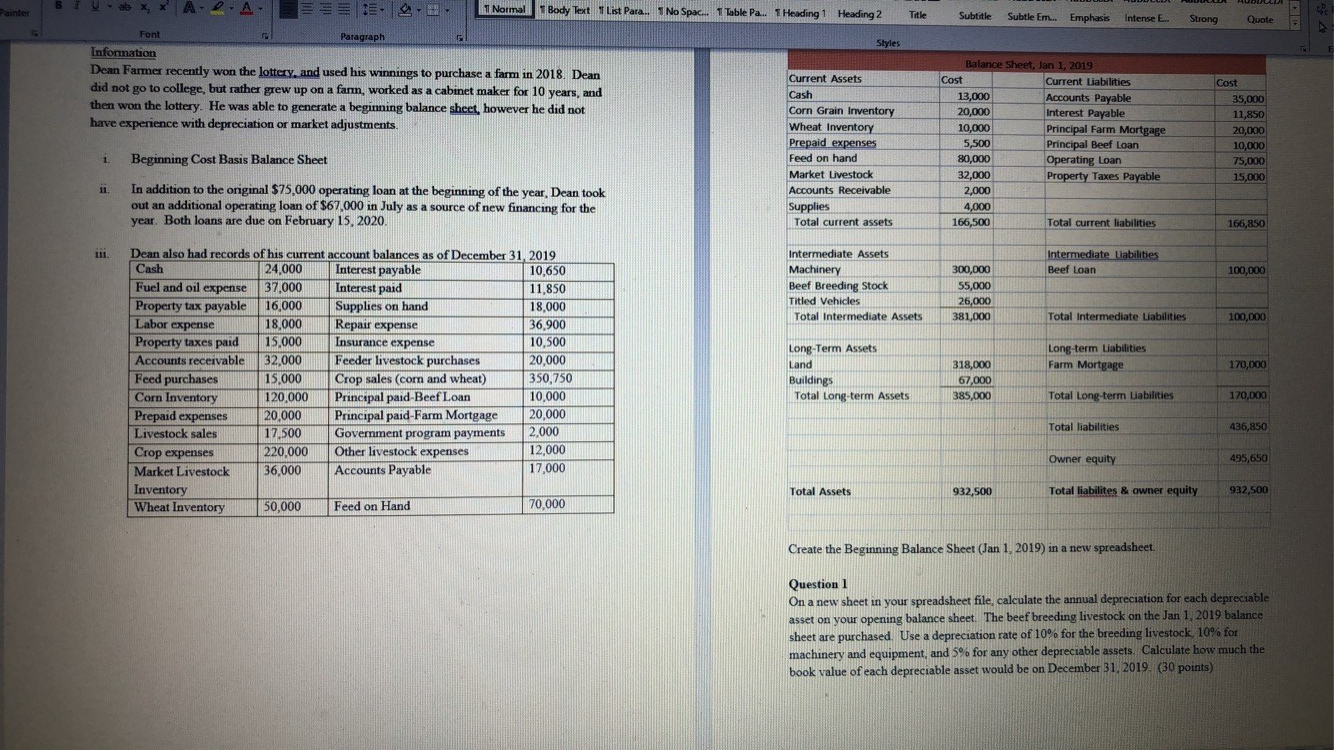

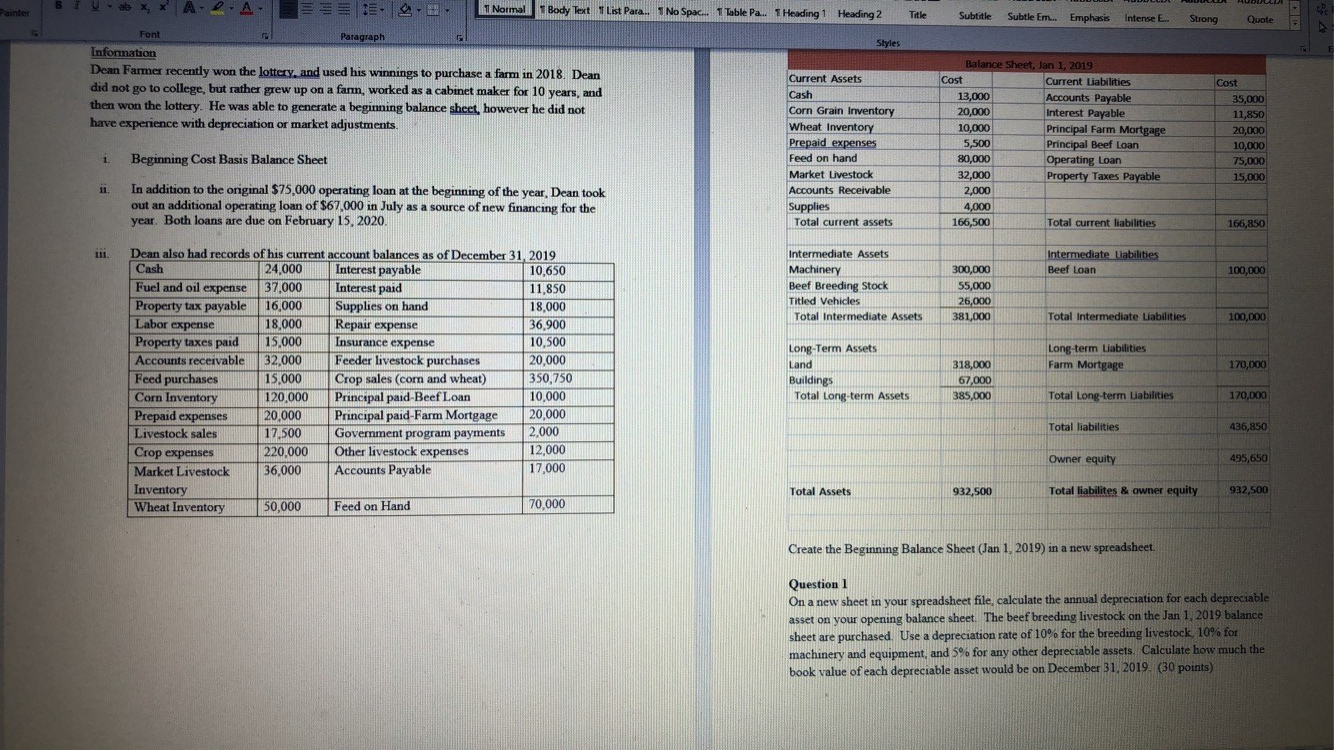

1 Normal Body Text List Para... 1 No Spac... 1 Table Pa.. 1 Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis intense L. Strong Quote Styles Font Paragraph Information Dean Farmer recently won the lottery, and used his winnings to purchase a farm in 2018. Dean did not go to college, but rather grew up on a farm, worked as a cabinet maker for 10 years, and then won the lottery. He was able to generate a beginning balance sheet, however he did not have experience with depreciation or market adjustments. Balance Sheet, Jan 1, 2019 Cost Current Liabilities 13,000 Accounts Payable 20,000 Interest Payable 10,000 Principal Farm Mortgage 5,500 Principal Beef Loan 80,000 Operating Loan 32,000 Property Taxes Payable 2,000 4,000 166,500 Total current liabilities Current Assets Cash Corn Grain Inventory Wheat Inventory Prepaid expenses Feed on hand Market Livestock Accounts Receivable Supplies Total current assets Cost 35,000 11,850 20,000 10,000 75,000 15,000 i 11. Beginning Cost Basis Balance Sheet In addition to the original $75,000 operating loan at the beginning of the year, Dean took out an additional operating loan of $67,000 in July as a source of new financing for the year. Both loans are due on February 15, 2020. 166,850 Intermediate Liabilities Beef Loan 10,650 100,000 Intermediate Assets Machinery Beef Breeding Stock Titled Vehicles Total Intermediate Assets 300,000 55,000 26,000 381,000 Total Intermediate Liabilities 100,000 Long-Term Assets Long-term Liabilities Farm Mortgage 318,000 170,000 Dean also had records of his current account balances as of December 31, 2019 Cash 24,000 Interest payable Fuel and oil expense 37.000 Interest paid 11,850 Property tax payable 16,000 Supplies on hand 18,000 Labor expense 18,000 Repair expense 36,900 Property taxes paid 15,000 Insurance expense 10,500 Accounts receivable 32,000 Feeder livestock purchases 20,000 Feed purchases 15.000 Crop sales (corn and wheat) 350.750 Corn Inventory 120,000 Principal paid-Beef Loan 10,000 Prepaid expenses 20,000 Principal paid-Farm Mortgage 20,000 Livestock sales 17.500 Government program payments 2,000 Crop expenses 220,000 Other livestock expenses 12,000 Market Livestock 36,000 Accounts Payable 17,000 Inventory Wheat Inventory 50,000 Feed on Hand 70,000 67,000 Buildings Total Long-term Assets 385,000 Total Long-term Liabilities 170,000 Total liabilities 436,850 Owner equity 495,650 Total Assets 932,500 Total liabilites & owner equity 932,500 Create the Beginning Balance Sheet (Jan 1, 2019) in a new spreadsheet. Question 1 On a new sheet in your spreadsheet file, calculate the annual depreciation for each depreciable asset on your opening balance sheet. The beef breeding livestock on the Jan 1, 2019 balance sheet are purchased. Use a depreciation rate of 10% for the breeding livestock, 10% for machinery and equipment, and 5% for any other depreciable assets. Calculate how much the book value of each depreciable asset would be on December 31, 2019. (30 points) 1 Normal Body Text List Para... 1 No Spac... 1 Table Pa.. 1 Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis intense L. Strong Quote Styles Font Paragraph Information Dean Farmer recently won the lottery, and used his winnings to purchase a farm in 2018. Dean did not go to college, but rather grew up on a farm, worked as a cabinet maker for 10 years, and then won the lottery. He was able to generate a beginning balance sheet, however he did not have experience with depreciation or market adjustments. Balance Sheet, Jan 1, 2019 Cost Current Liabilities 13,000 Accounts Payable 20,000 Interest Payable 10,000 Principal Farm Mortgage 5,500 Principal Beef Loan 80,000 Operating Loan 32,000 Property Taxes Payable 2,000 4,000 166,500 Total current liabilities Current Assets Cash Corn Grain Inventory Wheat Inventory Prepaid expenses Feed on hand Market Livestock Accounts Receivable Supplies Total current assets Cost 35,000 11,850 20,000 10,000 75,000 15,000 i 11. Beginning Cost Basis Balance Sheet In addition to the original $75,000 operating loan at the beginning of the year, Dean took out an additional operating loan of $67,000 in July as a source of new financing for the year. Both loans are due on February 15, 2020. 166,850 Intermediate Liabilities Beef Loan 10,650 100,000 Intermediate Assets Machinery Beef Breeding Stock Titled Vehicles Total Intermediate Assets 300,000 55,000 26,000 381,000 Total Intermediate Liabilities 100,000 Long-Term Assets Long-term Liabilities Farm Mortgage 318,000 170,000 Dean also had records of his current account balances as of December 31, 2019 Cash 24,000 Interest payable Fuel and oil expense 37.000 Interest paid 11,850 Property tax payable 16,000 Supplies on hand 18,000 Labor expense 18,000 Repair expense 36,900 Property taxes paid 15,000 Insurance expense 10,500 Accounts receivable 32,000 Feeder livestock purchases 20,000 Feed purchases 15.000 Crop sales (corn and wheat) 350.750 Corn Inventory 120,000 Principal paid-Beef Loan 10,000 Prepaid expenses 20,000 Principal paid-Farm Mortgage 20,000 Livestock sales 17.500 Government program payments 2,000 Crop expenses 220,000 Other livestock expenses 12,000 Market Livestock 36,000 Accounts Payable 17,000 Inventory Wheat Inventory 50,000 Feed on Hand 70,000 67,000 Buildings Total Long-term Assets 385,000 Total Long-term Liabilities 170,000 Total liabilities 436,850 Owner equity 495,650 Total Assets 932,500 Total liabilites & owner equity 932,500 Create the Beginning Balance Sheet (Jan 1, 2019) in a new spreadsheet. Question 1 On a new sheet in your spreadsheet file, calculate the annual depreciation for each depreciable asset on your opening balance sheet. The beef breeding livestock on the Jan 1, 2019 balance sheet are purchased. Use a depreciation rate of 10% for the breeding livestock, 10% for machinery and equipment, and 5% for any other depreciable assets. Calculate how much the book value of each depreciable asset would be on December 31, 2019. (30 points)