Question

1 )Note 4 Inventories of the Consolidated Financial Statements, includes a 2nd table of information underneath the breakdown of raw materials, work in process and

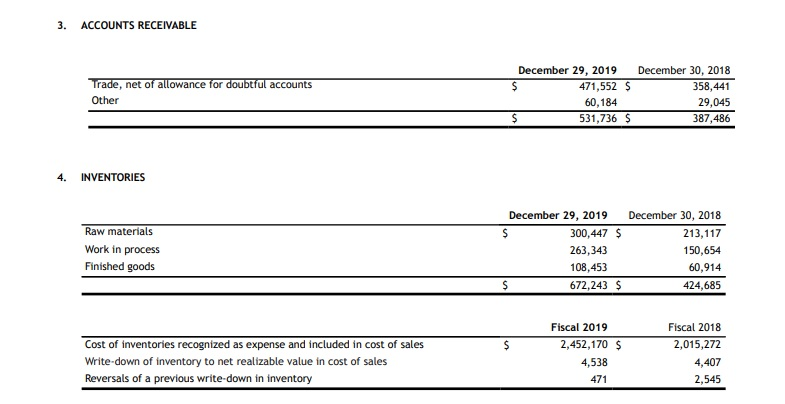

1 )Note 4 Inventories of the Consolidated Financial Statements, includes a 2nd table of information underneath the breakdown of raw materials, work in process and finished goods. Using this information:

A) For each of fiscal 2019 and 2018, determine the % of write-downs of inventory compared to the Cost of inventories recognized as expense and included in cost of sales. Are the %s similar? Are inventory write-downs a significant problem for NFI Group?

B) NFI Group starts to manufacture buses and motor coaches only when they have a signed contract from a customer. The contract specifies a fixed price the customer will pay. NFI Group does not manufacture buses and motor coaches without a customer order, and then hope to find a customer at some point in the future. How does this business model impact the possibility of NFI needing to record inventory write-downs? [Hint: Think about comparing NFIs situation to a standard car manufacturer such as Ford, or to a retailer such as Dollarama. Would you expect those companies to have a higher or lower rate of inventory write-downs?]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started